Berkshire Hathaway 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

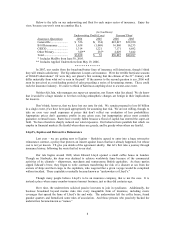

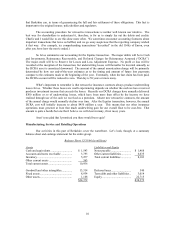

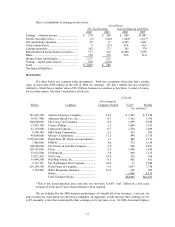

Here’ s a breakdown of earnings in this sector: (in millions)

Pre-Tax Earnings Interest-Bearing Liabilities

2006 2005 2006 2005

Trading – ordinary income ............................ $ 274 $ 200 $ 600 $1,061

Gen Re Securities (loss) ................................. (5) (104) 1,204* 2,617*

Life and annuity operation ............................. 29 11 2,459 2,461

Value Capital (loss) ....................................... 6 (33) N/A N/A

Leasing operations ......................................... 182 173 261 370

Manufactured-housing finance (Clayton)....... 513 416 10,498 9,299

Other............................................................... 158 159 N/A N/A

Income before capital gains............................ 1,157 822

Trading – capital gains (losses) ..................... 938 (234)

Total .............................................................. $ 2,095 $ 588

*Includes all liabilities

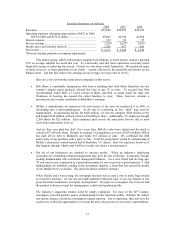

Investments

We show below our common stock investments. With two exceptions, those that had a market

value of more than $700 million at the end of 2006 are itemized. We don’ t itemize the two securities

referred to, which have a market value of $1.9 billion, because we continue to buy them. I could, of course,

tell you their names. But then I would have to kill you.

12/31/06

Percentage of

Shares Company Company Owned Cost* Market

(in millions)

151,610,700 American Express Company ................... 12.6 $ 1,287 $ 9,198

36,417,400 Anheuser-Busch Cos., Inc. ...................... 4.7 1,761 1,792

200,000,000 The Coca-Cola Company ........................ 8.6 1,299 9,650

17,938,100 Conoco Phillips ....................................... 1.1 1,066 1,291

21,334,900 Johnson & Johnson.................................. 0.7 1,250 1,409

6,708,760 M&T Bank Corporation .......................... 6.1 103 820

48,000,000 Moody’ s Corporation .............................. 17.2 499 3,315

2,338,961,000 PetroChina “H” shares (or equivalents)... 1.3 488 3,313

3,486,006 POSCO.................................................... 4.0 572 1,158

100,000,000 The Procter & Gamble Company ............ 3.2 940 6,427

229,707,000 Tesco ....................................................... 2.9 1,340 1,820

31,033,800 US Bancorp ............................................. 1.8 969 1,123

17,072,192 USG Corp ................................................ 19.0 536 936

19,944,300 Wal-Mart Stores, Inc. .............................. 0.5 942 921

1,727,765 The Washington Post Company .............. 18.0 11 1,288

218,169,300 Wells Fargo & Company......................... 6.5 3,697 7,758

1,724,200 White Mountains Insurance..................... 16.0 369 999

Others ......................................................

5,866 8,315

Total Common Stocks ............................. $22,995 $61,533

*This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases

because of write-ups or write-downs that have been required.

We are delighted by the 2006 business performance of virtually all of our investees. Last year, we

told you that our expectation was that these companies, in aggregate, would increase their earnings by 6%

to 8% annually, a rate that would double their earnings every ten years or so. In 2006 American Express,

15