Berkshire Hathaway 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. In September, Charlie and I, along with five Berkshire associates, visited ISCAR in Israel. We –

and I mean every one of us – have never been more impressed with any operation. At ISCAR, as

throughout Israel, brains and energy are ubiquitous. Berkshire shareholders are lucky to have joined with

Eitan, Jacob, Danny and their talented associates.

* * * * * * * * * * * *

A few months later, Berkshire again became “the buyer of choice” in a deal brought to us by my

friend, John Roach, of Fort Worth. John, many of you will remember, was Chairman of Justin Industries,

which we bought in 2000. At that time John was helping John Justin, who was terminally ill, find a

permanent home for his company. John Justin died soon after we bought Justin Industries, but it has since

been run exactly as we promised him it would be.

Visiting me in November, John Roach brought along Paul Andrews, Jr., owner of about 80% of

TTI, a Fort Worth distributor of electronic components. Over a 35-year period, Paul built TTI from

$112,000 of sales to $1.3 billion. He is a remarkable entrepreneur and operator.

Paul, 64, loves running his business. But not long ago he happened to witness how disruptive the

death of a founder can be both to a private company’ s employees and the owner’ s family. What starts out

as disruptive, furthermore, often evolves into destructive. About a year ago, therefore, Paul began to think

about selling TTI. His goal was to put his business in the hands of an owner he had carefully chosen, rather

than allowing a trust officer or lawyer to conduct an auction after his death.

Paul rejected the idea of a “strategic” buyer, knowing that in the pursuit of “synergies,” an owner

of that type would be apt to dismantle what he had so carefully built, a move that would uproot hundreds of

his associates (and perhaps wound TTI’ s business in the process). He also ruled out a private equity firm,

which would very likely load the company with debt and then flip it as soon as possible.

That left Berkshire. Paul and I met on the morning of November 15th and made a deal before

lunch. Later he wrote me: “After our meeting, I am confident that Berkshire is the right owner for TTI . . .

I am proud of our past and excited about our future.” And so are Charlie and I.

* * * * * * * * * * * *

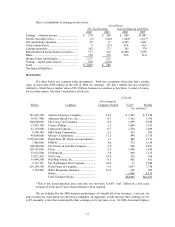

We also made some “tuck-in” acquisitions during 2006 at Fruit of the Loom (“Fruit”), MiTek,

CTB, Shaw and Clayton. Fruit made the largest purchases. First, it bought Russell Corp., a leading

producer of athletic apparel and uniforms for about $1.2 billion (including assumed debt) and in December

it agreed to buy the intimate apparel business of VF Corp. Together, these acquisitions add about $2.2

billion to Fruit’ s sales and bring with them about 23,000 employees.

Charlie and I love it when we can acquire businesses that can be placed under managers, such as

John Holland at Fruit, who have already shown their stuff at Berkshire. MiTek, for example, has made 14

acquisitions since we purchased it in 2001, and Gene Toombs has delivered results from these deals far in

excess of what he had predicted. In effect, we leverage the managerial talent already with us by these tuck-

in deals. We will make many more.

* * * * * * * * * * * *

We continue, however, to need “elephants” in order for us to use Berkshire’ s flood of incoming

cash. Charlie and I must therefore ignore the pursuit of mice and focus our acquisition efforts on much

bigger game.

Our exemplar is the older man who crashed his grocery cart into that of a much younger fellow

while both were shopping. The elderly man explained apologetically that he had lost track of his wife and

was preoccupied searching for her. His new acquaintance said that by coincidence his wife had also

wandered off and suggested that it might be more efficient if they jointly looked for the two women.

Agreeing, the older man asked his new companion what his wife looked like. “She’ s a gorgeous blonde,”

the fellow answered, “with a body that would cause a bishop to go through a stained glass window, and

she’ s wearing tight white shorts. How about yours?” The senior citizen wasted no words: “Forget her,

we’ ll look for yours.”

6