Berkshire Hathaway 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Management’s Discussion (Continued)

Contractual Obligations

Berkshire and its subsidiaries are parties to contracts associated with ongoing business and financing activities, which

will result in cash payments to counterparties in future periods. Notes payable are reflected in the Consolidated Financial

Statements along with accrued but unpaid interest as of the balance sheet date. In addition, Berkshire is obligated to pay interest

under debt obligations for periods subsequent to the balance sheet date. Although certain principal balances may be prepaid in

advance of the maturity date, thus reducing future interest obligations, it is assumed that no principal prepayments will occur for

purposes of this disclosure. Further, while short-term borrowings and repurchase agreements are currently expected to be

renewed as they mature, such amounts are not assumed to renew for purposes of this disclosure.

Berkshire and subsidiaries are also parties to long-term contracts to acquire goods or services in the future, which are

not currently reflected in the financial statements. Such obligations, including future minimum rentals under operating leases,

will be reflected in future periods as the goods are delivered or services provided. Amounts due as of the balance sheet date for

purchases where the goods and services have been received and a liability incurred are not included to the extent that such

amounts are due within one year of the balance sheet date.

Contractual obligations for unpaid losses and loss adjustment expenses arising under property and casualty insurance

contracts are estimates. The timing and amount of such payments are contingent upon the ultimate outcome of claim settlements

that will occur over many years. The amounts presented in the following table have been estimated based upon past claim

settlement activities. The timing and amount of such payments are subject to significant estimation error. The factors affecting

the ultimate amount of claims are discussed in the following section regarding Berkshire’s critical accounting policies.

Accordingly, the actual timing and amount of payments may differ materially from the amounts shown in the table.

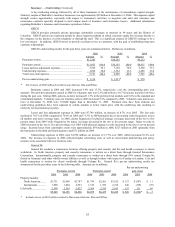

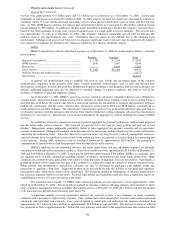

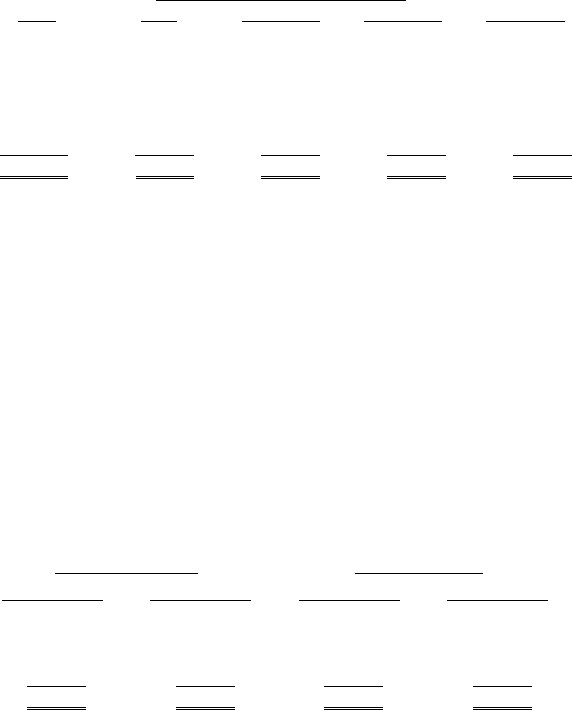

A summary of long-term contractual obligations as of December 31, 2006 follows. Amounts represent estimates of

gross undiscounted amounts payable over time. In addition, certain losses and loss adjustment expenses for property and

casualty loss reserves are ceded to others under reinsurance contracts and therefore are recoverable. Such recoverables are not

reflected in the table. Amounts are in millions.

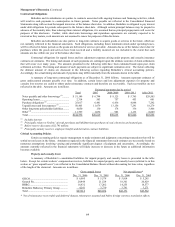

Estimated payments due by period

Total 2007 2008-2009 2010-2011 After 2011

Notes payable and other borrowings (1) .......... $ 51,189 $ 6,794 $ 9,125 $ 5,765 $29,505

Operating leases ............................................. 2,314 503 757 453 601

Purchase obligations (2) .................................. 25,017 6,441 6,436 4,848 7,292

Unpaid losses and loss expenses (3) ................ 50,405 11,679 13,156 7,291 18,279

Other long-term policyholder liabilities......... 4,050 130 178 336 3,406

Other (4) .......................................................... 11,797 1,072 983 1,133 8,609

Total............................................................... $144,772 $26,619 $30,635 $19,826 $67,692

(1) Includes interest.

(2) Principally relates to NetJets’ aircraft purchases and MidAmerican purchases of coal, electricity and natural gas.

(3) Before reserve discounts of $2,793 million.

(4) Principally annuity reserves, employee benefits and derivative contract liabilities.

Critical Accounting Policies

Certain accounting policies require management to make estimates and judgments concerning transactions that will be

settled several years in the future. Amounts recognized in the financial statements from such estimates are necessarily based on

numerous assumptions involving varying and potentially significant degrees of judgment and uncertainty. Accordingly, the

amounts currently reflected in the financial statements will likely increase or decrease in the future as additional information

becomes available.

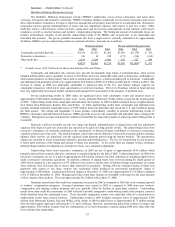

Property and casualty losses

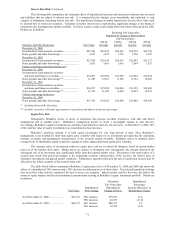

A summary of Berkshire’s consolidated liabilities for unpaid property and casualty losses is presented in the table

below. Except for certain workers’ compensation reserves, liabilities for unpaid property and casualty losses (referred to in this

section as “gross unpaid losses”) are reflected in the Consolidated Balance Sheets without discounting for time value, regardless

of the length of the claim-tail. Amounts are in millions.

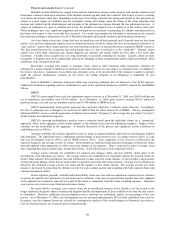

Gross unpaid losses Net unpaid losses*

Dec. 31, 2006 Dec. 31, 2005 Dec. 31, 2006 Dec. 31, 2005

GEICO.......................................................... $ 6,095 $ 5,578 $ 5,814 $ 5,285

General Re.................................................... 20,444 21,524 18,361 20,429

BHRG........................................................... 16,832 17,202 14,255 14,577

Berkshire Hathaway Primary Group ............ 4,241 3,730 3,741 3,271

Total ............................................................. $47,612 $48,034 $42,171 $43,562

* Net of reinsurance recoverable and deferred charges reinsurance assumed and before foreign currency translation effects.