Berkshire Hathaway 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

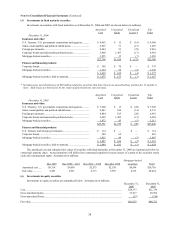

(1) Significant accounting policies and practices (Continued)

(r) Accounting pronouncements to be adopted in subsequent years

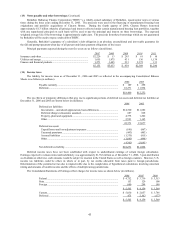

In July 2006, the FASB issued FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”).

FIN 48 prescribes a recognition threshold and measurement attribute for financial statement recognition of positions

taken or expected to be taken in income tax returns. Only tax positions meeting a “more-likely-than-not” threshold

of being sustained are recognized under FIN 48. FIN 48 also provides guidance on derecognition, classification of

interest and penalties and accounting and disclosures for annual and interim financial statements. FIN 48 is

effective for fiscal years beginning after December 15, 2006. The cumulative effect of any changes arising from the

initial application of FIN 48 is required to be reported as an adjustment to the opening balance of retained earnings

in the period of adoption.

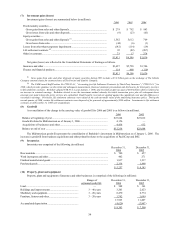

In September 2006, the FASB issued FASB Staff Position No. AUG AIR-1, “Accounting for Planned Major

Maintenance Activities” (“AUG AIR-1”). AUG AIR-1 prohibits the use of the accrue-in-advance method of

accounting for planned major maintenance activities in which such maintenance costs are ratably recognized by

accruing a liability in periods before the maintenance is performed. This pronouncement also retains three

alternative methods for accounting for planned major maintenance activities including the direct expensing method,

the built-in overhaul method and the deferral method. AUG AIR-1 is effective for fiscal years beginning after

December 15, 2006.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”). SFAS 157 defines

fair value as the price received to transfer an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date reflecting the highest and best use valuation concepts. SFAS 157

establishes a framework for measuring fair value by creating a hierarchy of fair value measurements currently

required under GAAP that distinguishes market data between observable independent market inputs and

unobservable market assumptions. SFAS 157 further expands disclosures about such fair value measurements.

SFAS 157 is effective for fiscal years beginning after November 15, 2007 and may be adopted earlier but only if the

adoption is in the first quarter of the fiscal year.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities - Including an amendment of FASB Statement No. 115” (“SFAS No. 159”). SFAS No. 159 permits

entities to elect to measure many financial instruments and certain other items at fair value. Upon adoption of SFAS

No. 159, an entity may elect the fair value option for eligible items that exist at the adoption date. Subsequent to the

initial adoption, the election of the fair value option should only be made at initial recognition of the asset or

liability or upon a remeasurement event that gives rise to new-basis accounting. SFAS No. 159 does not affect any

existing accounting literature that requires certain assets and liabilities to be carried at fair value nor does it

eliminate disclosure requirements included in other accounting standards. SFAS No. 159 is effective for fiscal years

beginning after November 15, 2007 and may be adopted earlier but only if the adoption is in the first quarter of the

fiscal year.

Berkshire is evaluating the impact that the adoption of these pronouncements will have on its consolidated financial

position and currently does not anticipate that the adoption of these accounting pronouncements will have a material

effect on its consolidated financial position.

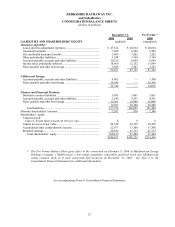

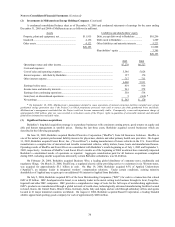

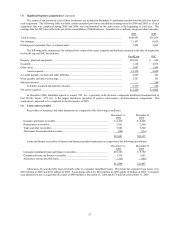

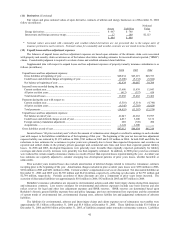

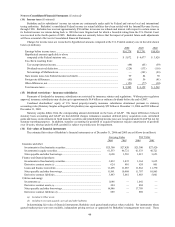

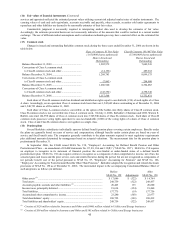

(2) Investments in MidAmerican Energy Holdings Company

MidAmerican owns a combined regulated electric and natural gas utility company in the United States (MidAmerican Energy

Company), a regulated electric utility company in the United States (PacifiCorp which was acquired March 21, 2006), two interstate

natural gas pipeline companies in the United States (Kern River and Northern Natural Gas), two electricity distribution companies in

the United Kingdom (Northern Electric and Yorkshire Electricity), a diversified portfolio of domestic and international electric power

projects and the second largest residential real estate brokerage firm in the United States (HomeServices). This group of businesses is

referred to as “MidAmerican” or the “utilities and energy businesses.”

On February 9, 2006, Berkshire converted its non-voting preferred stock to common stock and upon conversion, owned

approximately 83.4% (80.5% diluted) of the voting common stock interests. In conjunction with the acquisition of PacifiCorp,

Berkshire acquired additional common stock of MidAmerican for $3.4 billion. Berkshire’ s ownership in MidAmerican as of

December 31, 2006 was 87.8% (86.6% diluted). Accordingly, the 2006 Consolidated Financial Statements reflect the consolidation

of the accounts of MidAmerican. MidAmerican’ s debt obligations are not guaranteed by Berkshire. However, Berkshire has made a

commitment until February 28, 2011 that would allow MidAmerican to request up to $3.5 billion of capital to pay its debt obligations

or to provide funding to its regulated subsidiaries.

During 2004 and 2005, Berkshire possessed the ability to exercise significant influence on the operations of MidAmerican

through its investments in common and convertible preferred stock of MidAmerican, which together possessed 9.7% of the voting

rights and 83.4% (80.5% diluted) of the economic rights of MidAmerican. The convertible preferred stock, although generally non-

voting, was substantially an identical subordinate interest to a share of common stock and economically equivalent to common stock.

Therefore, during that period, Berkshire accounted for its investments in MidAmerican pursuant to the equity method. An unaudited

pro forma balance sheet as of December 31, 2005 is included on the face of the accompanying Consolidated Balance Sheets reflecting

the consolidation of MidAmerican. Walter Scott, Jr., a member of Berkshire’ s Board of Directors, controlled approximately 86% of

the voting interest in MidAmerican at December 31, 2005. As a result of Berkshire’ s conversion of its preferred stock to voting

common stock, at December 31, 2006, Mr. Scott’ s voting interest has been reduced to 11%.