Berkshire Hathaway 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Insurance — Underwriting (Continued)

Berkshire Hathaway Reinsurance Group

The Berkshire Hathaway Reinsurance Group (“BHRG”) underwrites excess-of-loss reinsurance and quota share

coverages for insurers and reinsurers worldwide. BHRG’s business includes catastrophe excess-of-loss reinsurance and excess

direct and facultative reinsurance for large or otherwise unusual discrete property risks referred to as individual risk. Retroactive

reinsurance policies provide indemnification of losses and loss adjustment expenses with respect to past loss events. Other

multi-line refers to other business written on both a quota-share and excess basis, participations in and contracts with Lloyd’s

syndicates, as well as aviation business and workers’ compensation programs. The timing and amount of catastrophe losses can

produce extraordinary volatility in the periodic underwriting results of the BHRG, and, in particular, in the catastrophe and

individual risk business. The pre-tax probable maximum loss from a single event is currently estimated to be approximately

$6 billion. BHRG’s pre-tax underwriting results are summarized below. Amounts are in millions.

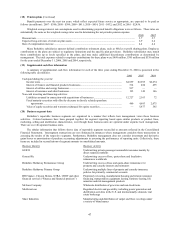

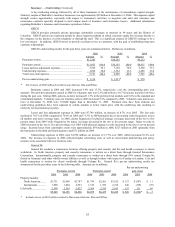

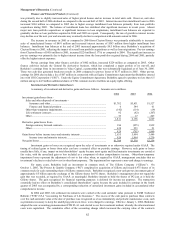

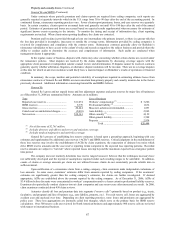

Premiums earned Pre-tax underwriting gain (loss)

2006 2005 2004 2006 2005 2004

Catastrophe and individual risk.............................. $2,196 $1,663 $1,462 $1,588 $(1,178) $ 385

Retroactive reinsurance .......................................... 146 10 188 (173) (214) (412)

Other multi-line...................................................... 2,634 2,290 2,064 243 323 444

$4,976 $3,963 $3,714 $1,658 $(1,069)* $ 417

* Includes losses of $2.5 billion from Hurricanes Katrina, Rita and Wilma.

Catastrophe and individual risk contracts may provide exceptionally large limits of indemnification, often several

hundred million dollars and occasionally in excess of $1 billion, and cover catastrophe risks (such as hurricanes, earthquakes or

other natural disasters) or other property risks (such as aviation and aerospace, commercial multi-peril or terrorism). Catastrophe

and individual risk premiums written were approximately $2.4 billion in 2006, $1.8 billion in 2005 and $1.5 billion in 2004. The

increase in volume in 2006 was principally attributable to improved rates in the U.S. and limited industry capacity for

catastrophe reinsurance which led to more opportunities to write new business. The level of business written in future periods

may vary significantly based upon market conditions and management’s assessment of the adequacy of premium rates.

Pre-tax underwriting results in 2006 reflect no significant losses from catastrophe events and incurred losses of

approximately $200 million attributable to prior years’ events, primarily Hurricane Wilma which occurred in the fourth quarter

of 2005. Underwriting results from catastrophe and individual risk business in 2005 included estimated losses of approximately

$2.4 billion from Hurricanes Katrina, Rita and Wilma. In 2004, underwriting results from catastrophe and individual risk

business included estimated catastrophe losses of $790 million from four hurricanes that struck the U.S. and Caribbean during

the third quarter. The timing and magnitude of losses produce extraordinary volatility in periodic underwriting results of

BHRG’s catastrophe and individual risk business. BHRG generally does not cede catastrophe and individual risks to mitigate the

volatility. Management accepts such potential volatility provided that the long-term prospect of achieving underwriting profits is

reasonable.

Retroactive policies normally provide very large, but limited, indemnification of unpaid losses and loss adjustment

expenses with respect to past loss events that are expected to be paid over long periods of time. The underwriting losses from

retroactive reinsurance are primarily attributed to the amortization of deferred charges established on retroactive reinsurance

contracts written in previous years. The deferred charges, which represent the difference between the premium and the estimated

ultimate claim reserves, are amortized over the expected claim payment period using the interest method. The amortization

charges are recorded as losses incurred and, therefore, generate underwriting losses. The level of amortization in a given period

is based upon estimates of the timing and amount of future loss payments. To the extent there are changes in these estimates,

deferred charge balances are adjusted on a retrospective basis via a cumulative adjustment.

Underwriting losses from retroactive reinsurance in 2006 are net of gains of approximately $145 million which

primarily derived from contracts that were commuted or amended during the last half of 2006. Underwriting losses in 2005 from

retroactive reinsurance are net of a gain of approximately $46 million related to the final settlement of remaining unpaid losses

under a retroactive reinsurance agreement. In addition, estimates of unpaid losses were reviewed during the fourth quarter of

2005 which resulted in a net reduction of $75 million in loss reserves and the rates of deferred charge amortization on certain

other contracts were decreased due to slower than expected loss payments. During 2004 the estimated timing of future loss

payments with respect to one large contract was accelerated which produced an incremental amortization charge of

approximately $100 million. Unamortized deferred charges at December 31, 2006 were approximately $1.74 billion compared

to $2.13 billion at December 31, 2005. Management believes that these charges are reasonable with respect to the large amounts

of float related to these policies. Float was approximately $6.5 billion at December 31, 2006.

Premiums earned from other multi-line reinsurance increased in 2006 as compared to 2005 due to the continued growth

in workers’ compensation programs. Increased premiums were earned in 2005 as compared to 2004 from new workers’

compensation and ongoing aviation programs and were partially offset by declines in quota-share contracts. Underwriting

results from other multi-line reinsurance in 2006 reflected favorable comparative underwriting results from property contracts

which benefited from low catastrophe losses. These favorable comparative results were somewhat offset by a deterioration in

underwriting results from aviation business. Underwriting results in 2005 included estimated losses of approximately $100

million from Hurricanes Katrina, Rita and Wilma, while results in 2004 included losses of approximately $175 million arising

from the third quarter hurricanes affecting the U.S. and Caribbean. However, underwriting gains from aviation coverages and

approximately $160 million in gains from the commutations of several reinsurance contracts during 2004 more than offset the

losses arising from catastrophes.