Berkshire Hathaway 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

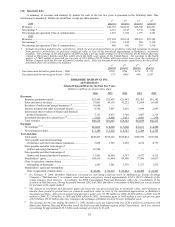

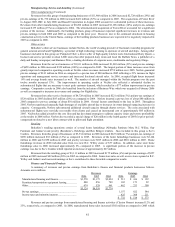

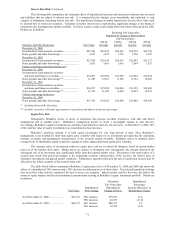

Investment and Derivative Gains/Losses (Continued)

owned as of the adoption date was recorded, net of applicable income tax, as an increase to retained earnings of $180 million. In

2006, Berkshire disposed of most of the life settlement contracts. The excess of the proceeds over the carrying value of the

contracts disposed of represents most of the gain from these contracts in 2006.

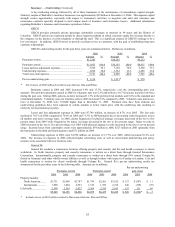

Derivative gains and losses from foreign currency forward contracts arise as the value of the U.S. dollar changes

against certain foreign currencies. Small changes in certain foreign currency exchange rates produce material changes in the fair

value of these contracts and consequently can produce volatility in reported earnings. The notional values of open foreign

currency forward contracts were approximately $1 billion and $14 billion as of December 31, 2006 and 2005, respectively.

During 2005, the value of most foreign currencies decreased relative to the U.S. dollar and these contracts produced losses.

Conversely, the value of many foreign currencies rose relative to the U.S. dollar in 2004, and Berkshire’s contract positions

produced significant gains.

Over the past three years, Berkshire has also entered into several other derivative contracts pertaining to credit default

risks of other entities as well as equity price risk associated with major equity indices. Such contracts are carried at estimated

fair value and the change in estimated fair value is included in earnings in the period of the change. Other derivative contract

gains in 2006 derived primarily from credit default contracts. Management attributes the gains to tightening of interest rate

spreads and market perceptions that the creditworthiness of many of the underlying credit issuers has improved.

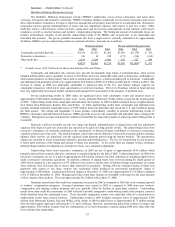

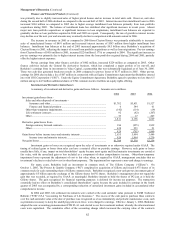

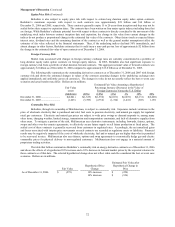

Financial Condition

Berkshire’s balance sheet continues to reflect significant liquidity and a strong capital base. Consolidated

shareholders’ equity at December 31, 2006 was $108.4 billion. Consolidated cash and invested assets, excluding assets of

finance and financial products businesses, was approximately $126.1 billion at December 31, 2006 (including cash and cash

equivalents of $38.3 billion) and $115.6 billion at December 31, 2005 (including cash and cash equivalents of $40.5 billion).

Berkshire’s invested assets are held predominantly in its insurance businesses. Berkshire believes that it currently maintains

sufficient liquidity to cover its contractual obligations and provide for contingent liquidity.

During 2006, Berkshire made several business acquisitions for aggregate cash consideration of $10.1 billion. See

Note 3 to the Consolidated Financial Statements for more information concerning these acquisitions. Berkshire maintains a large

amount of capital in its insurance subsidiaries for strategic purposes and in support of reserves for unpaid losses. In the United

States, in particular, dividend payments by insurance companies are subject to prior approval by state regulators. For the year

ending December 31, 2006, Berkshire’s insurance subsidiaries paid dividends of $7.1 billion.

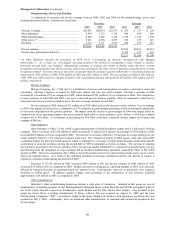

Capital expenditures of the utilities and energy businesses were $2.4 billion in 2006. Capital expenditures, construction

and other development costs for the year ending December 31, 2007 are forecasted to be approximately $3.0 billion.

MidAmerican expects to fund these capital expenditures with cash flows from operations and the issuance of debt.

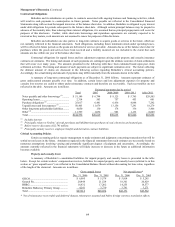

MidAmerican utilizes debt to finance the construction of long-lived regulated electric and gas utility assets, including power

plants, transmission and distribution assets and natural gas pipelines and may also issue debt to finance operations. Certain

borrowings of its regulated utility subsidiaries are secured by the assets of those subsidiaries. As of December 31, 2006,

outstanding debt of MidAmerican maturing in 2007 and 2008 was $3.6 billion, with an additional $1.7 billion due before 2012.

During 2006, Berkshire made a five year commitment to provide up to $3.5 billion of additional capital to MidAmerican to

permit the repayment of its debt obligations or to fund its regulated utility subsidiaries. Berkshire has not and does not intend to

guarantee the repayment of debt by MidAmerican or any of its subsidiaries.

Berkshire’s consolidated notes payable and other borrowings of insurance and other businesses, was $3.7 billion at

December 31, 2006 and $3.6 billion at December 31, 2005. As of December 31, 2006, outstanding borrowings include parent

company borrowings of $612 million that mature in 2007, including senior notes issued as part of the SQUARZ securities in

2002. The outstanding SQUARZ securities consist of $334 million principal amount of senior notes due in November 2007 and

outstanding warrants that expire in May 2007 to purchase 3,716 Class A equivalent shares of Berkshire common stock. A

warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a rate of 3.00%.

Each warrant provides the holder the right to purchase either 0.1116 shares of Class A or 3.348 shares of Class B stock for

$10,000. Short-term borrowings consist primarily of commercial paper and bank loans of NetJets, which are used in the ordinary

course of business. The full and timely payment of such borrowings is guaranteed by Berkshire.

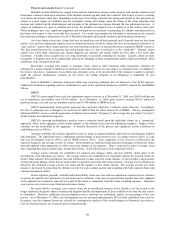

Assets of the finance and financial products businesses were $24.6 billion as of December 31, 2006 and $24.5 billion

as of December 31, 2005, consisting primarily of loans and finance receivables, fixed maturity securities and cash and cash

equivalents. Liabilities were $19.4 billion as of December 31, 2006 and $20.3 billion as of December 31, 2005 and include notes

and other borrowings of $12.0 billion at December 31, 2006 and $10.9 billion at December 31, 2005. Notes payable include

$8.85 billion par amount of medium-term notes issued by Berkshire Hathaway Finance Corporation (“BHFC”). The notes

mature at various dates beginning in 2007 ($700 million) through 2015. The proceeds from these notes were used to finance

originated and acquired loans of Clayton Homes. Full and timely payment of principal and interest on the notes issued by BHFC

is guaranteed by Berkshire. In addition, during the fourth quarter of 2006, Clayton Homes borrowed $1.3 billion under non-

public pass-through arrangements having an expected weighted average life of approximately eight years. Such borrowings are

secured by portfolios of manufactured housing loans and are not guaranteed by Berkshire. The proceeds from these borrowings

will be used to repay certain debt of BHFC.