Berkshire Hathaway 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

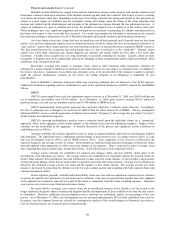

Manufacturing, Service and Retailing (Continued)

Other manufacturing (Continued)

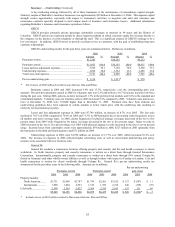

Revenues from this group of manufacturing businesses of $11,988 million in 2006 increased $2,728 million (29%) and

pre-tax earnings of $1,756 million in 2006 increased $421 million (32%) as compared to 2005. The acquisitions of Forest River

in August 2005, IMC in July 2006 and Russell Corporation in August 2006 account for a substantial portion of these increases.

Revenues from other manufacturing businesses of $9,260 million in 2005 increased $1,108 million (14%) and pre-tax earnings

increased $175 million (15%) as compared to 2004. The aforementioned acquisition of Forest River accounted for a significant

portion of the increase. Additionally, the building products group of businesses reported significant increases in revenues and

pre-tax earnings in both 2006 and 2005 as compared to the prior year. However, due to the continued slowdown in housing

construction activity in the United States, earnings of the building products businesses are expected to be negatively impacted in

2007 as compared to 2006.

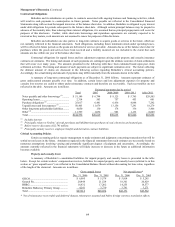

Other service

Berkshire’s other service businesses include NetJets, the world’s leading provider of fractional ownership programs for

general aviation aircraft and FlightSafety, a provider of high technology training to operators of aircraft and ships. Among other

businesses included in this group are Pampered Chef, a direct seller of high quality kitchen tools; International Dairy Queen, a

licensor and service provider to about 6,000 stores that offer prepared dairy treats and food; the Buffalo News, a publisher of a

daily and Sunday newspaper; and Business Wire, a leading distributor of corporate news, multimedia and regulatory filings.

Revenues from the service businesses of $5,811 million in 2006 increased $1,083 million (23%) and pre-tax earnings

of $658 million in 2006 increased $329 million (100%) as compared to 2005. The largest portion of these increases arose from

greatly improved comparative operating results at NetJets where revenues increased $759 million over 2005. NetJets generated

pre-tax earnings of $143 million in 2006 as compared to a pre-tax loss of $80 million in 2005 reflecting a 23% increase in flight

operations and management service revenues and increased fractional aircraft sales. In 2006, occupied flight hours increased

19% and average hourly rates increased as well. The number of aircraft managed within the NetJets program over the past

twelve months increased 13%. The improvement in operating results at NetJets also reflected a substantial decline in

subcontracted flights that are necessary to meet peak customer demand, which resulted in a $77 million improvement in pre-tax

earnings. Comparative results in 2006 also benefited from the inclusion of Business Wire which was acquired in February 2006

as well as comparative increases in revenues and earnings for FlightSafety.

Revenues from other service businesses of $4,728 million in 2005 increased $221 million (5%) and pre-tax earnings of

$329 million in 2005 declined $83 million (20%) as compared to 2004. NetJets incurred a pre-tax loss of about $80 million in

2005 compared to pre-tax earnings of about $10 million in 2004. Several factors contributed to the loss in 2005. Throughout

2005, NetJets experienced unusually high shortages of available aircraft due to increases in owner demand outpacing increases in

capacity. Consequently, NetJets subcontracted additional aircraft capacity through charter services. The costs associated with

subcontracted flights were not fully recoverable from clients and caused an incremental cost of approximately $85 million in

2005. NetJets has added aircraft to the core fleet and has developed strategies to address capacity issues and restore profitability

as the results in 2006 reflect. NetJets also recorded a special charge of $20 million in the fourth quarter of 2005 for prior periods’

compensation related to a new labor contract with its pilots and flight attendants.

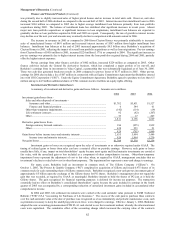

Retailing

Berkshire’s retailing operations consist of several home furnishings (Nebraska Furniture Mart, R.C. Willey, Star

Furniture and Jordan’s) and jewelry (Borsheim’s, Helzbergs and Ben Bridge) retailers. Also included in this group is See’s

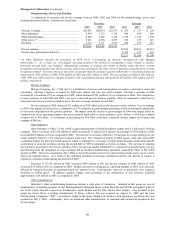

Candies. Revenues from this group of businesses of $3,334 million in 2006 increased $223 million (7%) and pre-tax earnings of

$289 million increased $32 million (12%) as compared to 2005. Revenues of the home furnishings businesses were $2,144

million in 2006 and $1,958 million in 2005 and jewelry revenues were $815 million in 2006 and $801 million in 2005. Home

furnishings revenues in 2006 included sales from two new R.C. Willey stores of $77 million. In addition, same store home

furnishings sales in 2006 increased approximately 6% compared to 2005. A significant portion of the increase in pre-tax

earnings was due to See’s Candies which reported an increase of approximately $27 million.

Revenues from the retailing group of $3,111 million in 2005 increased $175 million (6%) and pre-tax earnings of $257

million in 2005 increased $42 million (20%) in 2005 as compared to 2004. Same store sales as well as new stores opened at R.C.

Willey and Jordan’s and increased earnings at See’s contributed to these favorable comparative results.

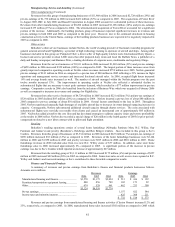

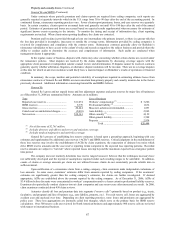

Finance and Financial Products

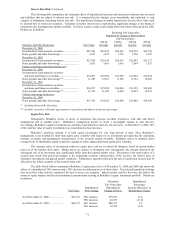

A summary of revenues and pre-tax earnings from Berkshire’s finance and financial products businesses follows.

Amounts are in millions.

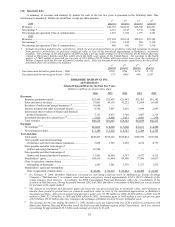

Revenues Earnings

2006 2005 2004 2006 2005 2004

Manufactured housing and finance............................. $3,570 $3,175 $2,024 $ 513 $ 416 $ 192

Furniture/transportation equipment leasing................ 880 856 789 182 173 92

Other........................................................................... 674 528 961 462 233 300

$5,124 $4,559 $3,774

Pre-tax earnings ............................................................. 1,157 822 584

Income taxes and minority interests.............................. 425 308 211

$ 732 $ 514 $ 373

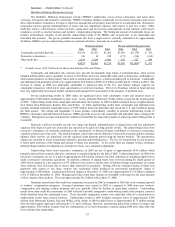

Revenues and pre-tax earnings from manufactured housing and finance activities (Clayton Homes) increased 12% and

23%, respectively, as compared to 2005. In 2006, manufactured home sales increased $302 million as compared to 2005 which