Berkshire Hathaway 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

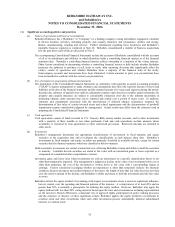

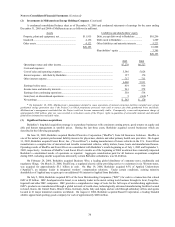

(11) Derivatives (Continued)

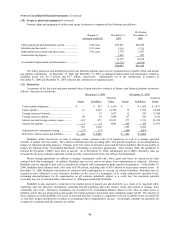

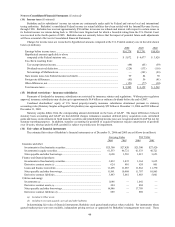

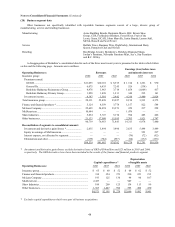

Fair values and gross notional values of open derivative contracts of utilities and energy businesses as of December 31, 2006

follow (in millions).

Notional

Assets Liabilities Value

Energy derivatives..................................................................................... $ 467 $ 740 *

Interest rate and foreign currency swaps ................................................... 17 149 $2,123

$ 484 $ 889

* Notional values associated with commodity and weather-related derivatives are not presented due to the unique units of

measure pertinent to such contracts. Notional values for commodity and weather contracts are not stated in terms of dollars.

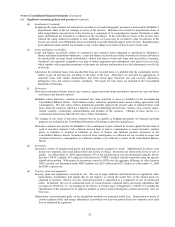

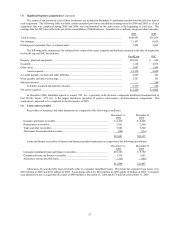

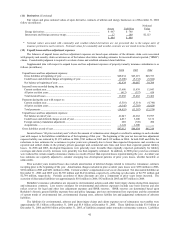

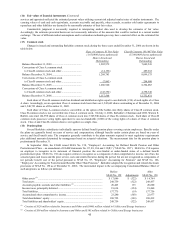

(12) Unpaid losses and loss adjustment expenses

The balances of unpaid losses and loss adjustment expenses are based upon estimates of the ultimate claim costs associated

with property and casualty claim occurrences as of the balance sheet dates including estimates for incurred but not reported (“IBNR”)

claims. Considerable judgment is required to evaluate claims and establish estimated claim liabilities.

Supplemental data with respect to unpaid losses and loss adjustment expenses of property/casualty insurance subsidiaries is as

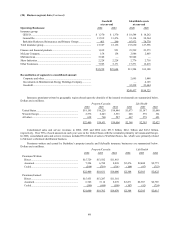

follows (in millions).

2006 2005 2004

Unpaid losses and loss adjustment expenses:

Gross liabilities at beginning of year.............................................................................. $48,034 $45,219 $45,393

Ceded losses and deferred charges at beginning of year ................................................ (5,200) (5,132) (5,684)

Net balance at beginning of year .................................................................................... 42,834 40,087 39,709

Incurred losses recorded during the year:

Current accident year...................................................................................................... 13,680 15,839 13,043

All prior accident years................................................................................................... (612) (357) 419

Total incurred losses....................................................................................................... 13,068 15,482 13,462

Payments during the year with respect to:

Current accident year...................................................................................................... (5,510) (5,514) (4,746)

All prior accident years................................................................................................... (9,345) (7,793) (8,828)

Total payments ............................................................................................................... (14,855) (13,307) (13,574)

Unpaid losses and loss adjustment expenses:

Net balance at end of year .............................................................................................. 41,047 42,262 39,597

Ceded losses and deferred charges at end of year .......................................................... 4,833 5,200 5,132

Foreign currency translation adjustment ........................................................................ 608 (728) 490

Acquisitions.................................................................................................................... 1,124 1,300 —

Gross liabilities at end of year ........................................................................................... $47,612 $48,034 $45,219

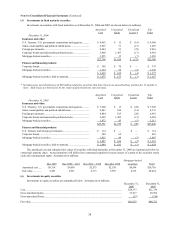

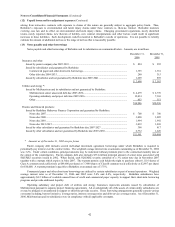

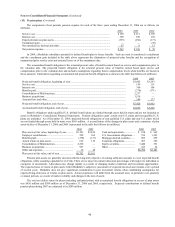

Incurred losses “all prior accident years” reflects the amount of estimation error charged or credited to earnings in each calendar

year with respect to the liabilities established as of the beginning of that year. The beginning of the year net loss and loss adjustment

expense liability was reduced by $1,071 million in 2006, $743 million in 2005 and $119 million in 2004. In both 2005 and 2006, the

reductions in loss estimates for occurrences in prior years were primarily due to lower than expected frequencies and severities on

reported and settled claims in the primary private passenger and commercial auto lines and lower than expected general liability

losses. In 2006 and 2005, developed frequencies were generally more favorable than originally expected, particularly for liability

coverages and claim severity increases were generally less than originally estimated. In addition, in 2006 prior years loss estimates

were reduced for certain casualty reinsurance claims as a result of lower than expected losses reported during the year. Accident year

loss estimates are regularly adjusted to consider emerging loss development patterns of prior years losses, whether favorable or

unfavorable.

Prior accident years incurred losses also include amortization of deferred charges related to retroactive reinsurance contracts

incepting prior to the beginning of the year. Amortization charges included in prior accident years losses were $358 million in 2006,

$294 million in 2005 and $451 million in 2004. Certain workers’ compensation reserves are discounted. Net discounted liabilities at

December 31, 2006 and 2005 were $2,705 million and $2,434 million, respectively, reflecting net discounts of $2,793 million and

$2,798 million, respectively. Periodic accretions of these discounts are also a component of prior years losses incurred. The

accretion of discounted liabilities was approximately $101 million in 2006, $92 million in 2005 and $87 million in 2004.

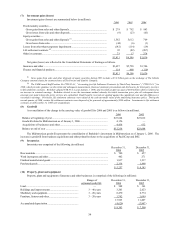

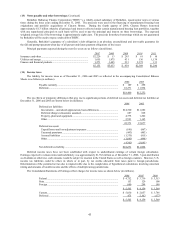

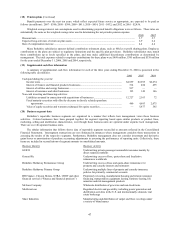

Berkshire’ s insurance subsidiaries are exposed to environmental, asbestos and other latent injury claims arising from insurance

and reinsurance contracts. Loss reserve estimates for environmental and asbestos exposures include case basis reserves and also

reflect reserves for legal and other loss adjustment expenses and IBNR reserves. IBNR reserves are determined based upon

Berkshire’ s historic general liability exposure base and policy language, previous environmental loss experience and the assessment

of current trends of environmental law, environmental cleanup costs, asbestos liability law and judgmental settlements of asbestos

liabilities.

The liabilities for environmental, asbestos and latent injury claims and claims expenses net of reinsurance recoverables were

approximately $5.1 billion at December 31, 2006 and $5.4 billion at December 31, 2005. These liabilities include $3.8 billion at

December 31, 2006 and $4.0 billion at December 31, 2005, of liabilities assumed under retroactive reinsurance contracts. Liabilities