Berkshire Hathaway 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

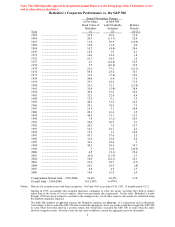

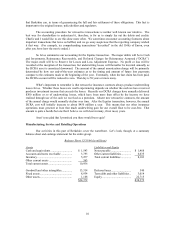

Our gain in net worth during 2006 was $16.9 billion, which increased the per-share book value of

both our Class A and Class B stock by 18.4%. Over the last 42 years (that is, since present management

took over) book value has grown from $19 to $70,281, a rate of 21.4% compounded annually.*

We believe that $16.9 billion is a record for a one-year gain in net worth – more than has ever

been booked by any American business, leaving aside boosts that have occurred because of mergers (e.g.,

AOL’ s purchase of Time Warner). Of course, Exxon Mobil and other companies earn far more than

Berkshire, but their earnings largely go to dividends and/or repurchases, rather than to building net worth.

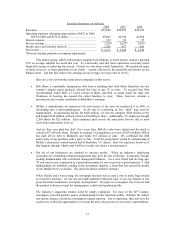

All that said, a confession about our 2006 gain is in order. Our most important business,

insurance, benefited from a large dose of luck: Mother Nature, bless her heart, went on vacation. After

hammering us with hurricanes in 2004 and 2005 – storms that caused us to lose a bundle on super-cat

insurance – she just vanished. Last year, the red ink from this activity turned black – very black.

In addition, the great majority of our 73 businesses did outstandingly well in 2006. Let me focus

for a moment on one of our largest operations, GEICO. What management accomplished there was simply

extraordinary.

As I’ ve told you before, Tony Nicely, GEICO’ s CEO, went to work at the company 45 years ago,

two months after turning 18. He became CEO in 1992, and from then on the company’ s growth exploded.

In addition, Tony has delivered staggering productivity gains in recent years. Between yearend 2003 and

yearend 2006, the number of GEICO policies increased from 5.7 million to 8.1 million, a jump of 42%.

Yet during that same period, the company’ s employees (measured on a fulltime-equivalent basis) fell 3.5%.

So productivity grew 47%. And GEICO didn’ t start fat.

That remarkable gain has allowed GEICO to maintain its all-important position as a low-cost

producer, even though it has dramatically increased advertising expenditures. Last year GEICO spent $631

million on ads, up from $238 million in 2003 (and up from $31 million in 1995, when Berkshire took

control). Today, GEICO spends far more on ads than any of its competitors, even those much larger. We

will continue to raise the bar.

Last year I told you that if you had a new son or grandson to be sure to name him Tony. But Don

Keough, a Berkshire director, recently had a better idea. After reviewing GEICO’ s performance in 2006,

he wrote me, “Forget births. Tell the shareholders to immediately change the names of their present

children to Tony or Antoinette.” Don signed his letter “Tony.”

* * * * * * * * * * * *

Charlie Munger – my partner and Berkshire’ s vice chairman – and I run what has turned out to be

a big business, one with 217,000 employees and annual revenues approaching $100 billion. We certainly

didn’ t plan it that way. Charlie began as a lawyer, and I thought of myself as a security analyst. Sitting in

those seats, we both grew skeptical about the ability of big entities of any type to function well. Size seems

to make many organizations slow-thinking, resistant to change and smug. In Churchill’ s words: “We shape

our buildings, and afterwards our buildings shape us.” Here’ s a telling fact: Of the ten non-oil companies

having the largest market capitalization in 1965 – titans such as General Motors, Sears, DuPont and

Eastman Kodak – only one made the 2006 list.

*All per-share figures used in this report apply to Berkshire’ s A shares. Figures for the B shares

are 1/30th of those shown for the A.

3