Berkshire Hathaway 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

that Berkshire can, in terms of guaranteeing the full and fair settlement of these obligations. This fact is

important to the original insurer, policyholders and regulators.

The accounting procedure for retroactive transactions is neither well known nor intuitive. The

best way for shareholders to understand it, therefore, is for us to simply lay out the debits and credits.

Charlie and I would like to see this done more often. We sometimes encounter accounting footnotes about

important transactions that leave us baffled, and we go away suspicious that the reporting company wished

it that way. (For example, try comprehending transactions “described” in the old 10-Ks of Enron, even

after you know how the movie ended.)

So let us summarize our accounting for the Equitas transaction. The major debits will be to Cash

and Investments, Reinsurance Recoverable, and Deferred Charges for Reinsurance Assumed (“DCRA”).

The major credit will be to Reserve for Losses and Loss Adjustment Expense. No profit or loss will be

recorded at the inception of the transaction, but underwriting losses will thereafter be incurred annually as

the DCRA asset is amortized downward. The amount of the annual amortization charge will be primarily

determined by how our end-of-the-year estimates as to the timing and amount of future loss payments

compare to the estimates made at the beginning of the year. Eventually, when the last claim has been paid,

the DCRA account will be reduced to zero. That day is 50 years or more away.

What’ s important to remember is that retroactive insurance contracts always produce underwriting

losses for us. Whether these losses are worth experiencing depends on whether the cash we have received

produces investment income that exceeds the losses. Recently our DCRA charges have annually delivered

$300 million or so of underwriting losses, which have been more than offset by the income we have

realized through use of the cash we received as a premium. Absent new retroactive contracts, the amount

of the annual charge would normally decline over time. After the Equitas transaction, however, the annual

DCRA cost will initially increase to about $450 million a year. This means that our other insurance

operations must generate at least that much underwriting gain for our overall float to be cost-free. That

amount is quite a hurdle but one that I believe we will clear in many, if not most, years.

Aren’ t you glad that I promised you there would be no quiz?

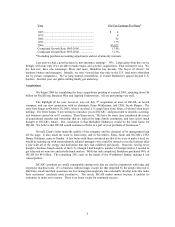

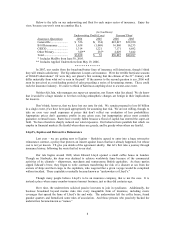

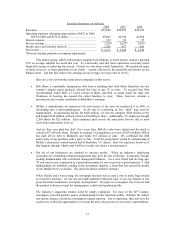

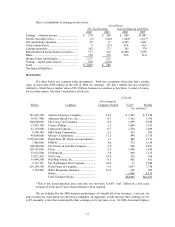

Manufacturing, Service and Retailing Operations

Our activities in this part of Berkshire cover the waterfront. Let’ s look, though, at a summary

balance sheet and earnings statement for the entire group.

Balance Sheet 12/31/06 (in millions)

Assets Liabilities and Equity

Cash and equivalents .............................. $ 1,543 Notes payable ............................ $ 1,468

Accounts and notes receivable ............... 3,793 Other current liabilities.............. 6,635

Inventory ................................................ 5,257 Total current liabilities .............. 8,103

Other current assets ................................ 363

Total current assets................................. 10,956

Goodwill and other intangibles............... 13,314 Deferred taxes............................ 540

Fixed assets............................................. 8,934 Term debt and other liabilities... 3,014

Other assets............................................. 1,168 Equity ........................................ 22,715

$34,372 $34,372

10