Berkshire Hathaway 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

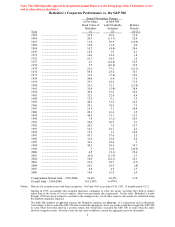

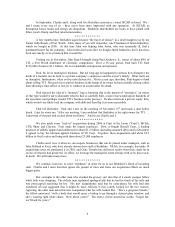

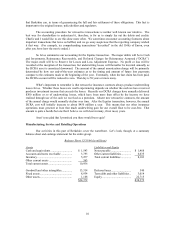

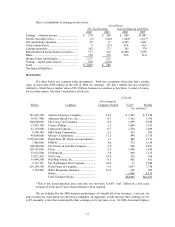

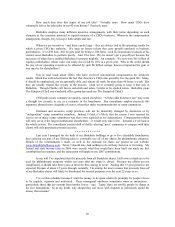

Earnings Statement (in millions)

2006 2005 2004

Revenues ................................................................................. $52,660 $46,896 $44,142

Operating expenses (including depreciation of $823 in 2006,

$699 in 2005 and $676 in 2004)....................................... 49,002 44,190 41,604

Interest expense ....................................................................... 132 83 57

Pre-tax earnings....................................................................... 3,526* 2,623* 2,481*

Income taxes and minority interests ........................................ 1,395 977 941

Net income .............................................................................. $ 2,131 $ 1,646 $ 1,540

*Does not include purchase-accounting adjustments.

This motley group, which sells products ranging from lollipops to motor homes, earned a pleasing

25% on average tangible net worth last year. It’ s noteworthy also that these operations used only minor

financial leverage in achieving that return. Clearly we own some terrific businesses. We purchased many

of them, however, at large premiums to net worth – a point reflected in the goodwill item shown on the

balance sheet – and that fact reduces the earnings on our average carrying value to 10.8%.

Here are a few newsworthy items about companies in this sector:

• Bob Shaw, a remarkable entrepreneur who from a standing start built Shaw Industries into the

country’ s largest carpet producer, elected last year, at age 75, to retire. To succeed him, Bob

recommended Vance Bell, a 31-year veteran at Shaw, and Bob, as usual, made the right call.

Weakness in housing has caused the carpet business to slow. Shaw, however, remains a

powerhouse and a major contributor to Berkshire’ s earnings.

• MiTek, a manufacturer of connectors for roof trusses at the time we purchased it in 2001, is

developing into a mini-conglomerate. At the rate it is growing, in fact, “mini” may soon be

inappropriate. In purchasing MiTek for $420 million, we lent the company $200 million at 9%

and bought $198 million of stock, priced at $10,000 per share. Additionally, 55 employees bought

2,200 shares for $22 million. Each employee paid exactly the same price that we did, in most

cases borrowing money to do so.

And are they ever glad they did! Five years later, MiTek’ s sales have tripled and the stock is

valued at $71,699 per share. Despite its making 14 acquisitions, at a cost of $291 million, MiTek

has paid off its debt to Berkshire and holds $35 million of cash. We celebrated the fifth

anniversary of our purchase with a party in July. I told the group that it would be embarrassing if

MiTek’ s stock price soared beyond that of Berkshire “A” shares. Don’ t be surprised, however, if

that happens (though Charlie and I will try to make our shares a moving target).

• Not all of our businesses are destined to increase profits. When an industry’ s underlying

economics are crumbling, talented management may slow the rate of decline. Eventually, though,

eroding fundamentals will overwhelm managerial brilliance. (As a wise friend told me long ago,

“If you want to get a reputation as a good businessman, be sure to get into a good business.”) And

fundamentals are definitely eroding in the newspaper industry, a trend that has caused the profits

of our Buffalo News to decline. The skid will almost certainly continue.

When Charlie and I were young, the newspaper business was as easy a way to make huge returns

as existed in America. As one not-too-bright publisher famously said, “I owe my fortune to two

great American institutions: monopoly and nepotism.” No paper in a one-paper city, however bad

the product or however inept the management, could avoid gushing profits.

The industry’ s staggering returns could be simply explained. For most of the 20th Century,

newspapers were the primary source of information for the American public. Whether the subject

was sports, finance, or politics, newspapers reigned supreme. Just as important, their ads were the

easiest way to find job opportunities or to learn the price of groceries at your town’ s supermarkets.

11