Berkshire Hathaway 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Notes to Consolidated Financial Statements (Continued)

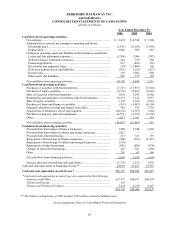

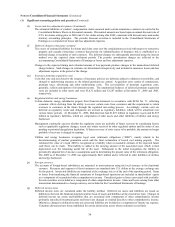

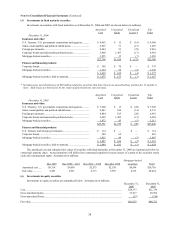

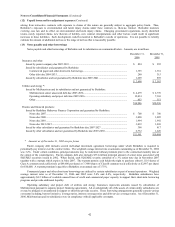

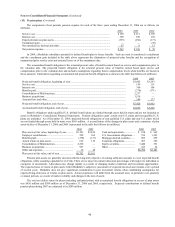

(5) Investments in fixed maturity securities

Investments in securities with fixed maturities as of December 31, 2006 and 2005 are shown below (in millions).

A

mortized Unrealized Unrealized Fai

r

Cost Gains

L

osse

s

* Value

December 31, 2006

Insurance and other:

U.S. Treasury, U.S. government corporations and agencies ........... $ 4,962 $ 12 $ (14) $ 4,960

States, municipalities and political subdivisions ............................. 2,967 71 (15) 3,023

Foreign governments ....................................................................... 8,444 51 (79) 8,416

Corporate bonds and redeemable preferred stocks.......................... 5,468 1,467 (17) 6,918

Mortgage-backed securities ............................................................. 1,955 35 (7) 1,983

$23,796 $1,636 $ (132) $25,300

Finance and financial products:

Corporate bonds............................................................................... $ 305 $ 70 $ — $ 375

Mortgage-backed securities ............................................................. 1,134 32 (4) 1,162

$ 1,439 $ 102 $ (4) $ 1,537

Mortgage-backed securities, held-to-maturity................................. $ 1,475 $ 153 $ (1) $ 1,627

* Includes gross unrealized losses of $69 million related to securities that have been in an unrealized loss position for 12 months or

more. Such losses are believed to be the result of general interest rate increases.

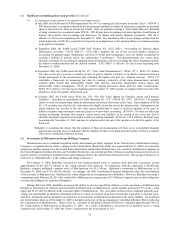

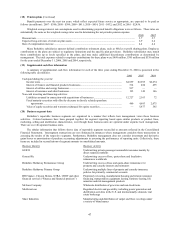

A

mortized Unrealized Unrealized Fai

r

Cost Gains

L

osses Value

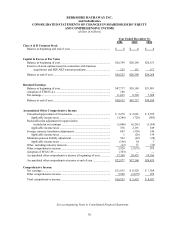

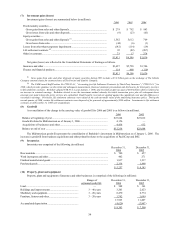

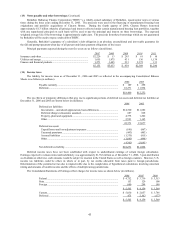

December 31, 20

0

5

Insurance and other:

U.S. Treasury, U.S. government corporations and agencies ........... $ 7,660 $ 13 $ (28) $ 7,645

States, municipalities and political subdivisions ............................. 4,243 104 (14) 4,333

Foreign governments ....................................................................... 6,884 105 (28) 6,961

Corporate bonds and redeemable preferred stocks.......................... 5,492 1,492 (15) 6,969

Mortgage-backed securities ............................................................. 1,472 45 (5) 1,512

$25,751 $1,759 $ (90) $27,420

Finance and financial products:

U.S. Treasury and foreign governments .......................................... $ 114 $ — $ — $ 114

Corporate bonds............................................................................... 348 62 — 410

Mortgage-backed securities ............................................................. 1,425 44 (2) 1,467

$ 1,887 $ 106 $ (2) $ 1,991

Mortgage-backed securities, held-to-maturity................................. $ 1,444 $ 181 $ (1) $ 1,624

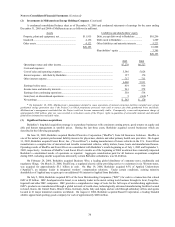

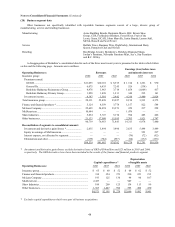

The amortized cost and estimated fair values of securities with fixed maturities at December 31, 2006 are summarized below by

contractual maturity dates. Actual maturities will differ from contractual maturities because issuers of certain of the securities retain

early call or prepayment rights. Amounts are in millions.

Mortgage-backed

Due 2007 Due 2008 – 2011 Due 2012 – 2016 Due after 2016 securities Total

Amortized cost ...... $8,314 $9,099 $2,575 $2,158 $4,564 $26,710

Fair value............... 8,493 9,531 2,713 2,955 4,772 28,464

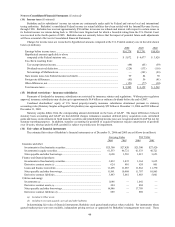

(6) Investments in equity securities

Investments in equity securities are summarized below. Amounts are in millions.

December 31, December 31,

2006 2005

Cost............................................................................................................................................................ $28,353 $21,339

Gross unrealized gains .............................................................................................................................. 33,217 25,892

Gross unrealized losses ............................................................................................................................. (37) (510)

Fair value................................................................................................................................................... $61,533 $46,721