Berkshire Hathaway 2006 Annual Report Download - page 14

Download and view the complete annual report

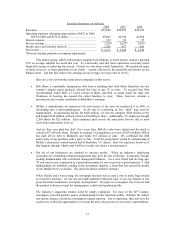

Please find page 14 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• A much improved situation is emerging at NetJets, which sells and manages fractionally-owned

aircraft. This company has never had a problem growing: Revenues from flight operations have

increased 596% since our purchase in 1998. But profits had been erratic.

Our move to Europe, which began in 1996, was particularly expensive. After five years of

operation there, we had acquired only 80 customers. And by mid-year 2006 our cumulative pre-

tax loss had risen to $212 million. But European demand has now exploded, with a net of 589

customers having been added in 2005-2006. Under Mark Booth’ s brilliant leadership, NetJets is

now operating profitably in Europe, and we expect the positive trend to continue.

Our U.S. operation also had a good year in 2006, which led to worldwide pre-tax earnings of $143

million at NetJets last year. We made this profit even though we suffered a loss of $19 million in

the first quarter.

Credit Rich Santulli, along with Mark, for this turnaround. Rich, like many of our managers, has

no financial need to work. But you’ d never know it. He’ s absolutely tireless – monitoring

operations, making sales, and traveling the globe to constantly widen the already-enormous lead

that NetJets enjoys over its competitors. Today, the value of the fleet we manage is far greater

than that managed by our three largest competitors combined.

There’ s a reason NetJets is the runaway leader: It offers the ultimate in safety and service. At

Berkshire, and at a number of our subsidiaries, NetJets aircraft are an indispensable business tool.

I also have a contract for personal use with NetJets and so do members of my family and most

Berkshire directors. (None of us, I should add, gets a discount.) Once you’ ve flown NetJets,

returning to commercial flights is like going back to holding hands.

Regulated Utility Business

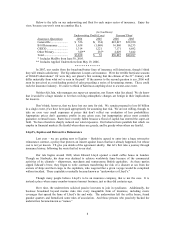

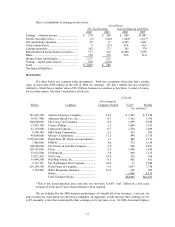

Berkshire has an 86.6% (fully diluted) interest in MidAmerican Energy Holdings, which owns a

wide variety of utility operations. The largest of these are (1) Yorkshire Electricity and Northern Electric,

whose 3.7 million electric customers make it the third largest distributor of electricity in the U.K.; (2)

MidAmerican Energy, which serves 706,000 electric customers, primarily in Iowa; (3) Pacific Power and

Rocky Mountain Power, serving about 1.7 million electric customers in six western states; and (4) Kern

River and Northern Natural pipelines, which carry about 8% of the natural gas consumed in the U.S.

Our partners in ownership of MidAmerican are Walter Scott, and its two terrific managers, Dave

Sokol and Greg Abel. It’ s unimportant how many votes each party has; we will make major moves only

when we are unanimous in thinking them wise. Six years of working with Dave, Greg and Walter have

underscored my original belief: Berkshire couldn’ t have better partners.

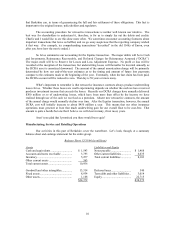

Somewhat incongruously, MidAmerican owns the second largest real estate brokerage firm in the

U.S., HomeServices of America. This company operates through 20 locally-branded firms with 20,300

agents. Despite HomeServices’ purchase of two operations last year, the company’ s overall volume fell

9% to $58 billion, and profits fell 50%.

The slowdown in residential real estate activity stems in part from the weakened lending practices

of recent years. The “optional” contracts and “teaser” rates that have been popular have allowed borrowers

to make payments in the early years of their mortgages that fall far short of covering normal interest costs.

Naturally, there are few defaults when virtually nothing is required of a borrower. As a cynic has said, “A

rolling loan gathers no loss.” But payments not made add to principal, and borrowers who can’ t afford

normal monthly payments early on are hit later with above-normal monthly obligations. This is the Scarlett

O’ Hara scenario: “I’ ll think about that tomorrow.” For many home owners, “tomorrow” has now arrived.

Consequently there is a huge overhang of offerings in several of HomeServices’ markets.

Nevertheless, we will be seeking to purchase additional brokerage operations. A decade from

now, HomeServices will almost certainly be much larger.

13