Berkshire Hathaway 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

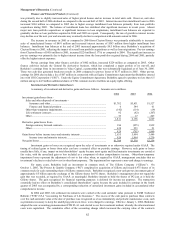

Management’s Discussion (Continued)

Finance and Financial Products (Continued)

was primarily due to slightly increased sales of higher priced homes and an increase in total units sold. However, unit sales

during the second half of 2006 declined as compared to the second half of 2005. Interest income from installment loans in 2006

increased $104 million as compared to 2005 due to higher average installment loan balances primarily from loan portfolio

acquisitions during 2005. The balance of installment loans has stabilized after significant increases in recent years. Absent

major new loan portfolio acquisitions or significant increases in loan originations, installment loan balances are expected to

gradually decline as loan portfolios acquired in 2004 and 2005 are repaid. Consequently, the rate of growth in interest income

may decline over the next year and amounts may eventually decline in comparison with amounts earned in 2006.

The increase in revenues in 2005 as compared to 2004 from Clayton Homes was primarily attributable to increased

sales of manufactured homes of $491 million and increased interest income of $583 million from higher installment loan

balances. Installment loan balances at the end of 2005 increased approximately $8.5 billion since Berkshire’s acquisition of

Clayton Homes in 2003, reflecting the impact of several loan portfolio acquisitions as well as loan originations. Pre-tax earnings

from Clayton Homes of $416 million in 2005, increased $224 million (117%) as compared to 2004. The significant increase in

pre-tax earnings was primarily due to higher interest income from the loan portfolios acquired during 2004 and 2005, partially

offset by higher interest expenses.

Pre-tax earnings from other finance activities of $462 million, increased $229 million as compared to 2005. Other

finance activities include the General Re derivatives business, which has completed a major portion of its run-off, and

Berkshire’s earnings from its investment in Value Capital, a partnership that was substantially liquidated as of June 30, 2006.

These two activities generated breakeven results in 2006 compared to pre-tax losses of $137 million in 2005. Other pre-tax

earnings for 2006 also include a fee of $67 million in connection with an Equity Commitment Agreement that Berkshire entered

into with USG Corporation (“USG”). Under the Equity Commitment Agreement, Berkshire agreed to purchase no less than 6.5

million and up to 44.9 million additional shares of USG common stock to facilitate an equity rights offering.

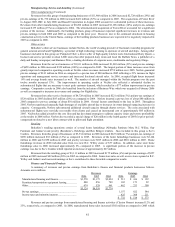

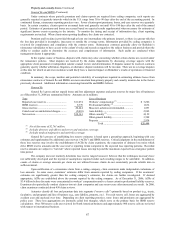

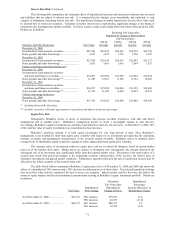

Investment and Derivative Gains/Losses

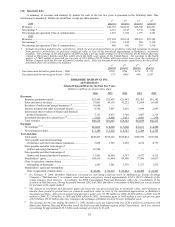

A summary of investment and derivative gains and losses follows. Amounts are in millions.

2006 2005 2004

Investment gains/losses from -

Sales and other disposals of investments -

Insurance and other...................................................................................... $1,782 $5,831 $1,527

Finance and financial products .................................................................... 6 544 61

Other-than-temporary impairments.................................................................... (142) (114) (19)

Life settlement contracts.................................................................................... 92 (82) (207)

Other .................................................................................................................. 73 17 267

1,811 6,196 1,629

Derivative gains/losses from -

Foreign currency forward contracts ................................................................... 186 (955) 1,839

Other .................................................................................................................. 638 253 21

824 (702) 1,860

Gains/losses before income taxes and minority interests ........................................ 2,635 5,494 3,489

Income taxes and minority interests............................................................. 926 1,964 1,230

Net gains/losses....................................................................................................... $1,709 $3,530 $2,259

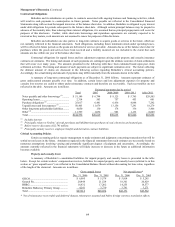

Investment gains or losses are recognized upon the sales of investments or as otherwise required under GAAP. The

timing of realized gains or losses from sales can have a material effect on periodic earnings. However, such gains or losses

usually have little, if any, impact on total shareholders’ equity because most equity and fixed maturity investments are carried at

fair value, with the unrealized gain or loss included as a component of other comprehensive income. Other-than-temporary

impairment losses represent the adjustment of cost to fair value when, as required by GAAP, management concludes that an

investment’s decline in value below cost is other than temporary. The impairment loss represents a non-cash charge to earnings.

For many years, Berkshire held an investment in common stock of The Gillette Company (“Gillette”). On

October 1, 2005, The Procter & Gamble Company (“PG”) completed its acquisition of Gillette and issued 0.975 shares of its

common stock for each outstanding share of Gillette common stock. Berkshire recognized a non-cash pre-tax investment gain of

approximately $5 billion upon the exchange of the Gillette shares for PG shares. Berkshire’s management does not regard the

gain that was recorded, as required by GAAP, as meaningful. Berkshire intends to hold the shares of PG just as it held the

Gillette shares. The gain recognized for financial reporting purposes is deferred for income tax purposes. The transaction

essentially had no effect on Berkshire’s consolidated shareholders’ equity because the gain included in earnings in the fourth

quarter of 2005 was accompanied by a corresponding reduction of unrealized investment gains included in accumulated other

comprehensive income.

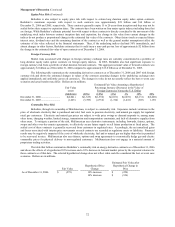

In 2004 and 2005, life settlement investments were carried at the cash surrender value pursuant to FASB Technical

Bulletin (“FTB”) 85-4 “Accounting for Purchases of Life Insurance.” The excess of the cash paid to purchase these contracts

over the cash surrender value at the date of purchase was recognized as a loss immediately and periodic maintenance costs, such

as premiums necessary to keep the underlying policies in force, were charged to earnings. Effective January 1, 2006, Berkshire

adopted the new accounting pronouncement FTB 85-4-1 and elected to use the investment method, whereby the aforementioned

costs were capitalized. The cumulative effect of the accounting change which increased the carrying value of the contracts