Berkshire Hathaway 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Notes to Consolidated Financial Statements (Continued)

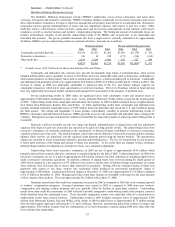

(21) Contingencies and Commitments

Berkshire and its subsidiaries are parties in a variety of legal actions arising out of the normal course of business. In particular,

such legal actions affect Berkshire’ s insurance and reinsurance businesses. Such litigation generally seeks to establish liability

directly through insurance contracts or indirectly through reinsurance contracts issued by Berkshire subsidiaries. Plaintiffs

occasionally seek punitive or exemplary damages. Berkshire does not believe that such normal and routine litigation will have a

material effect on its financial condition or results of operations. Berkshire and certain of its subsidiaries are also involved in other

kinds of legal actions, some of which assert or may assert claims or seek to impose fines and penalties in substantial amounts and are

described below.

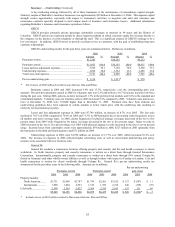

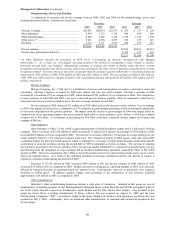

a) Governmental Investigations

Berkshire, General Re Corporation (“General Re”) and certain of Berkshire’ s insurance subsidiaries, including General

Reinsurance Corporation (“General Reinsurance”) and National Indemnity Company (“NICO”) have been continuing to cooperate

fully with the U.S. Securities and Exchange Commission (“SEC”), the U.S. Department of Justice, the U.S. Attorney for the Eastern

District of Virginia and the New York State Attorney General (“NYAG”) in their ongoing investigations of non-traditional products.

General Re originally received subpoenas from the SEC and NYAG in January 2005. Berkshire, General Re, General Reinsurance

and NICO have been providing information to the government relating to transactions between General Reinsurance or NICO (or

their respective subsidiaries or affiliates) and other insurers in response to the January 2005 subpoenas and related requests and, in

the case of General Reinsurance (or its subsidiaries or affiliates), in response to subpoenas from other U.S. Attorneys conducting

investigations relating to certain of these transactions. In particular, Berkshire and General Re have been responding to requests from

the government for information relating to certain transactions that may have been accounted for incorrectly by counterparties of

General Reinsurance (or its subsidiaries or affiliates). Berkshire understands that the government is evaluating the actions of General

Re and its subsidiaries, as well as those of their counterparties, to determine whether General Re or its subsidiaries conspired with

others to misstate counterparty financial statements or aided and abetted such misstatements by the counterparties. The government

has interviewed a number of current and former officers and employees of General Re and General Reinsurance as well as

Berkshire’ s Chairman and CEO, Warren E. Buffett, in connection with these investigations.

In one case, a transaction initially effected with American International Group (“AIG”) in late 2000 (the “AIG Transaction”),

AIG has corrected its prior accounting for the transaction on the grounds, as stated in AIG’ s 2004 10-K, that the transaction was done

to accomplish a desired accounting result and did not entail sufficient qualifying risk transfer to support reinsurance accounting.

General Reinsurance has been named in related civil actions brought against AIG, as described below. As part of their ongoing

investigations, governmental authorities have also inquired about the accounting by certain of Berkshire’ s insurance subsidiaries for

certain assumed and ceded finite reinsurance transactions.

In June 2005, John Houldsworth, the former Chief Executive Officer of Cologne Reinsurance Company (Dublin) Limited

(“CRD”), a subsidiary of General Re, and Richard Napier, a former Senior Vice President of General Re who had served as an

account representative for the AIG account, each pleaded guilty to a federal criminal charge of conspiring with others to misstate

certain AIG financial statements in connection with the AIG Transaction and entered into a partial settlement agreement with the

SEC with respect to such matters. In addition, Ronald Ferguson, General Re’ s former Chief Executive Officer, Elizabeth Monrad,

General Re’ s former Chief Financial Officer, Christopher Garand, a former General Reinsurance Senior Vice President and Robert

Graham, a former General Reinsurance Senior Vice President and Assistant General Counsel -- are awaiting trial in the U.S. District

Court for the District of Connecticut on charges of conspiracy to violate securities laws and to commit mail fraud, securities fraud,

making false statements to the SEC and mail fraud in connection with the AIG Transaction. The trial is currently set for December

2007. Each has pleaded not guilty to all charges. Each of these individuals, who had previously received a “Wells” notice in 2005

from the SEC, is also the subject of an SEC enforcement action for allegedly aiding and abetting AIG’ s violations of the antifraud

provisions and other provisions of the federal securities laws in connection with the AIG Transaction. The SEC case is presently

stayed. Joseph Brandon, the Chief Executive Officer of General Re, also received a “Wells” notice from the SEC in 2005.

Various state insurance departments have issued subpoenas or otherwise requested that General Reinsurance, NICO and their

affiliates provide documents and information relating to non-traditional products. The Office of the Connecticut Attorney General has

also issued a subpoena to General Reinsurance for information relating to non-traditional products. General Reinsurance, NICO and

their affiliates have been cooperating fully with these subpoenas and requests.

In November 2006, two subsidiaries of General Re, General Reinsurance UK Limited (“Gen Re UK”) and Kolnische

Ruckversicherungs-Gesellschaft AG (“Cologne Re”), entered into a settlement agreement with the Financial Services Authority

(“FSA”) with respect to the FSA’ s previously disclosed investigation of the role of these entities in certain transactions that were

alleged to involve no or insufficient risk transfer to be treated for accounting and regulatory purposes as reinsurance. Pursuant to the

settlement agreement, Gen Re UK paid the FSA a penalty of $2.3 million.

Cologne Re is also cooperating fully with requests for information and orders to produce documents from the German Federal

Financial Supervisory Authority (the “BaFin”) regarding the activities of Cologne Re relating to “finite reinsurance” and regarding

transactions between Cologne Re or its subsidiaries, including CRD, and certain counterparties. In particular, Cologne Re is

cooperating fully with a BaFin order to produce documents received on October 24, 2006. The order stated that it is part of the

BaFin’ s continuing investigation into financial reinsurance agreements and that Cologne Re, and possibly one or more of its senior

executives, is suspected of violating legal provisions in regard to such agreements.