Berkshire Hathaway 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

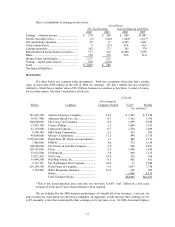

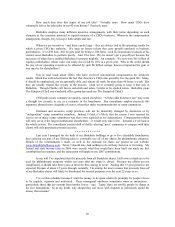

Coca-Cola, Procter & Gamble and Wells Fargo, our largest holdings, increased per-share earnings by 18%,

9%, 8% and 11%. These are stellar results, and we thank their CEOs.

* * * * * * * * * * * *

We’ ve come close to eliminating our direct foreign-exchange position, from which we realized

about $186 million in pre-tax profits in 2006 (earnings that were included in the Finance and Financial

Products table shown earlier). That brought our total gain since inception of this position in 2002 to $2.2

billion. Here’ s a breakdown by currency:

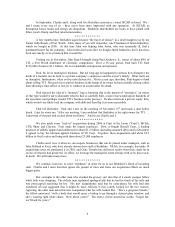

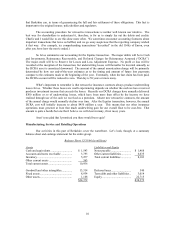

Total Gain (Loss) in Millions

Australian dollar $247.1 Mexican peso $106.1

British pound 287.2 New Zealand dollar 102.6

Canadian dollar 398.3 Singapore dollar (2.6)

Chinese yuan (12.7) South Korean won 261.3

Euro 839.2 Swiss franc 9.6

Hong Kong dollar (2.5) Taiwan dollar (45.3)

Japanese yen 1.9 Miscellaneous options 22.9

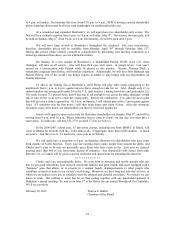

We’ ve made large indirect currency profits as well, though I’ ve never tallied the precise amount.

For example, in 2002-2003 we spent about $82 million buying – of all things – Enron bonds, some of

which were denominated in Euros. Already we’ ve received distributions of $179 million from these bonds,

and our remaining stake is worth $173 million. That means our overall gain is $270 million, part of which

came from the appreciation of the Euro that took place after our bond purchase.

When we first began making foreign exchange purchases, interest-rate differentials between the

U.S. and most foreign countries favored a direct currency position. But that spread turned negative in

2005. We therefore looked for other ways to gain foreign-currency exposure, such as the ownership of

foreign equities or of U.S. stocks with major earnings abroad. The currency factor, we should emphasize,

is not dominant in our selection of equities, but is merely one of many considerations.

As our U.S. trade problems worsen, the probability that the dollar will weaken over time continues

to be high. I fervently believe in real trade – the more the better for both us and the world. We had about

$1.44 trillion of this honest-to-God trade in 2006. But the U.S. also had $.76 trillion of pseudo-trade last

year – imports for which we exchanged no goods or services. (Ponder, for a moment, how commentators

would describe the situation if our imports were $.76 trillion – a full 6% of GDP – and we had no exports.)

Making these purchases that weren’ t reciprocated by sales, the U.S. necessarily transferred ownership of its

assets or IOUs to the rest of the world. Like a very wealthy but self-indulgent family, we peeled off a bit of

what we owned in order to consume more than we produced.

The U.S. can do a lot of this because we are an extraordinarily rich country that has behaved

responsibly in the past. The world is therefore willing to accept our bonds, real estate, stocks and

businesses. And we have a vast store of these to hand over.

These transfers will have consequences, however. Already the prediction I made last year about

one fall-out from our spending binge has come true: The “investment income” account of our country –

positive in every previous year since 1915 – turned negative in 2006. Foreigners now earn more on their

U.S. investments than we do on our investments abroad. In effect, we’ ve used up our bank account and

turned to our credit card. And, like everyone who gets in hock, the U.S. will now experience “reverse

compounding” as we pay ever-increasing amounts of interest on interest.

I want to emphasize that even though our course is unwise, Americans will live better ten or

twenty years from now than they do today. Per-capita wealth will increase. But our citizens will also be

forced every year to ship a significant portion of their current production abroad merely to service the cost

of our huge debtor position. It won’ t be pleasant to work part of each day to pay for the over-consumption

16