Berkshire Hathaway 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

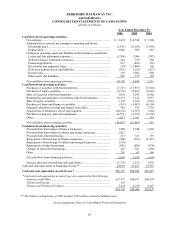

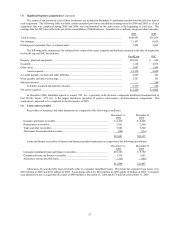

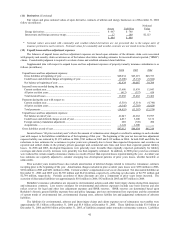

(3) Significant business acquisitions (Continued)

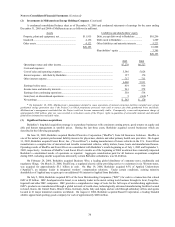

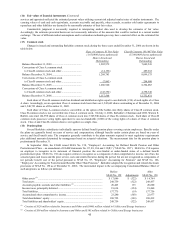

The results of operations for each of these businesses are included in Berkshire’ s consolidated results from the effective date of

each acquisition. The following table sets forth certain unaudited pro forma consolidated earnings data for 2006 and 2005, as if each

acquisition that was completed during 2005 and 2006 was consummated on the same terms at the beginning of each year. The

earnings data for 2005 also reflects the pro forma consolidation of MidAmerican. Amounts are in millions, except per share amounts.

2006 2005

Total revenues.................................................................................................................................... $100,992 $95,836

Net earnings....................................................................................................................................... 11,107 8,624

Earnings per equivalent Class A common share................................................................................ 7,204 5,601

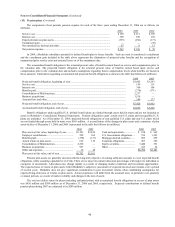

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition

for PacifiCorp and IMC (in millions).

PacifiCorp IMC

Property, plant and equipment ........................................................................................................... $10,051 $ 606

Goodwill ............................................................................................................................................ 1,118 2,072

Other assets........................................................................................................................................ 3,087 1,988

Assets acquired ........................................................................................................................ 14,256 4,666

Accounts payable, accruals and other liabilities ................................................................................ 4,969 263

Notes payable and other borrowings.................................................................................................. 4,167 153

Minority interests............................................................................................................................... — 248

Liabilities assumed and minority interests ............................................................................... 9,136 664

Net assets acquired ............................................................................................................................ $ 5,120 $ 4,002

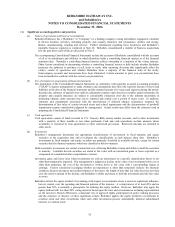

In December 2006, Berkshire agreed to acquire TTI, Inc., a privately held electronic component distributor headquartered in

Fort Worth, Texas. TTI, Inc. is the largest distributor specialist of passive, interconnect electromechanical components. The

acquisition is expected to be completed in the first quarter of 2007.

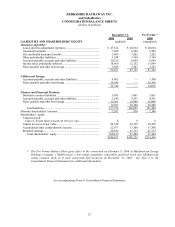

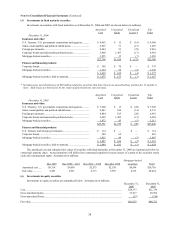

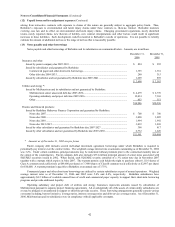

(4) Loans and receivables

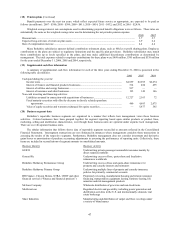

Receivables of insurance and other businesses are comprised of the following (in millions).

December 31, December 31,

2006 2005

Insurance premiums receivable...................................................................................... $ 4,418 $ 4,406

Reinsurance recoverables............................................................................................... 2,961 2,990

Trade and other receivables ........................................................................................... 5,884 5,340

Allowances for uncollectible accounts .......................................................................... (382) (339)

$12,881 $12,397

Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions).

December 31, December 31,

2006 2005

Consumer installment loans and finance receivables .................................................... $10,325 $ 9,792

Commercial loans and finance receivables.................................................................... 1,336 1,481

Allowances for uncollectible loans ................................................................................ (163) (186)

$11,498 $11,087

Allowances for uncollectible loans primarily relate to consumer installment loans. Provisions for consumer loan losses were

$210 million in 2006 and $232 million in 2005. Loan charge-offs were $243 million in 2006 and $110 million in 2005. Consumer

loan amounts are net of acquisition discounts of $484 million at December 31, 2006 and $579 million at December 31, 2005.