Berkshire Hathaway 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 75

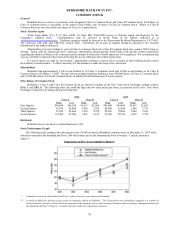

In recent years we have made a number of acquisitions. Though there will be dry years, we expect to make many more

in the decades to come, and our hope is that they will be large. If these purchases approach the quality of those we

have made in the past, Berkshire will be well served.

The challenge for us is to generate ideas as rapidly as we generate cash. In this respect, a depressed stock market is

likely to present us with significant advantages. For one thing, it tends to reduce the prices at which entire companies

become available for purchase. Second, a depressed market makes it easier for our insurance companies to buy small

pieces of wonderful businesses — including additional pieces of businesses we already own — at attractive prices.

And third, some of those same wonderful businesses, such as Coca-Cola, are consistent buyers of their own shares,

which means that they, and we, gain from the cheaper prices at which they can buy.

Overall, Berkshire and its long-term shareholders benefit from a sinking stock market much as a regular purchaser of

food benefits from declining food prices. So when the market plummets — as it will from time to time — neither

panic nor mourn. It’ s good news for Berkshire.

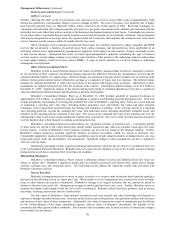

5. Because of our two-pronged approach to business ownership and because of the limitations of conventional

accounting, consolidated reported earnings may reveal relatively little about our true economic performance. Charlie

and I, both as owners and managers, virtually ignore such consolidated numbers. However, we will also report to you

the earnings of each major business we control, numbers we consider of great importance. These figures, along with

other information we will supply about the individual businesses, should generally aid you in making judgments about

them.

To state things simply, we try to give you in the annual report the numbers and other information that really matter.

Charlie and I pay a great deal of attention to how well our businesses are doing, and we also work to understand the

environment in which each business is operating. For example, is one of our businesses enjoying an industry tailwind

or is it facing a headwind? Charlie and I need to know exactly which situation prevails and to adjust our expectations

accordingly. We will also pass along our conclusions to you.

Over time, the large majority of our businesses have exceeded our expectations. But sometimes we have

disappointments, and we will try to be as candid in informing you about those as we are in describing the happier

experiences. When we use unconventional measures to chart our progress — for instance, you will be reading in our

annual reports about insurance “float” — we will try to explain these concepts and why we regard them as important.

In other words, we believe in telling you how we think so that you can evaluate not only Berkshire’ s businesses but

also assess our approach to management and capital allocation.

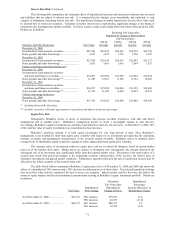

6. Accounting consequences do not influence our operating or capital-allocation decisions. When acquisition costs are

similar, we much prefer to purchase $2 of earnings that is not reportable by us under standard accounting principles

than to purchase $1 of earnings that is reportable. This is precisely the choice that often faces us since entire

businesses (whose earnings will be fully reportable) frequently sell for double the pro-rata price of small portions

(whose earnings will be largely unreportable). In aggregate and over time, we expect the unreported earnings to be

fully reflected in our intrinsic business value through capital gains.

We have found over time that the undistributed earnings of our investees, in aggregate, have been fully as beneficial to

Berkshire as if they had been distributed to us (and therefore had been included in the earnings we officially report).

This pleasant result has occurred because most of our investees are engaged in truly outstanding businesses that can

often employ incremental capital to great advantage, either by putting it to work in their businesses or by repurchasing

their shares. Obviously, every capital decision that our investees have made has not benefitted us as shareholders, but

overall we have garnered far more than a dollar of value for each dollar they have retained. We consequently regard

look-through earnings as realistically portraying our yearly gain from operations.

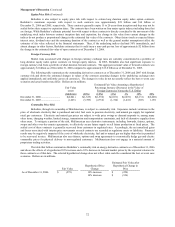

7. We use debt sparingly and, when we do borrow, we attempt to structure our loans on a long-term fixed-rate basis. We

will reject interesting opportunities rather than over-leverage our balance sheet. This conservatism has penalized our

results but it is the only behavior that leaves us comfortable, considering our fiduciary obligations to policyholders,

lenders and the many equity holders who have committed unusually large portions of their net worth to our care. (As

one of the Indianapolis “500” winners said: “To finish first, you must first finish.”)

The financial calculus that Charlie and I employ would never permit our trading a good night’ s sleep for a shot at a few

extra percentage points of return. I’ ve never believed in risking what my family and friends have and need in order to

pursue what they don’ t have and don’ t need.

Besides, Berkshire has access to two low-cost, non-perilous sources of leverage that allow us to safely own far more

assets than our equity capital alone would permit: deferred taxes and “float,” the funds of others that our insurance

business holds because it receives premiums before needing to pay out losses. Both of these funding sources have

grown rapidly and now total about $69 billion.