Berkshire Hathaway 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

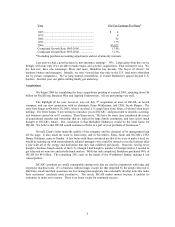

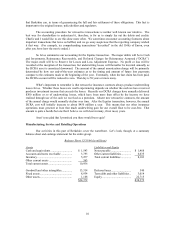

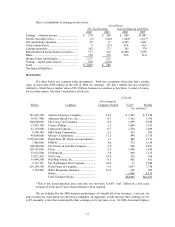

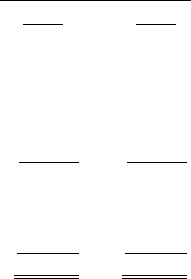

Here are some key figures on MidAmerican’ s operations:

Earnings (in $ millions)

2006 2005

U.K. utilities ....................................................................................................... $ 338 $ 308

Iowa utility ......................................................................................................... 348 288

Western utilities (acquired March 21, 2006) ..................................................... 356 N/A

Pipelines ............................................................................................................. 376 309

HomeServices..................................................................................................... 74 148

Other (net) .......................................................................................................... 226 115

Earnings before corporate interest and taxes...................................................... 1,718 1,168

Interest, other than to Berkshire ......................................................................... (261) (200)

Interest on Berkshire junior debt ........................................................................ (134) (157)

Income tax .......................................................................................................... (407) (248)

Net earnings........................................................................................................ $ 916 $ 563

Earnings applicable to Berkshire*...................................................................... $ 885 $ 523

Debt owed to others............................................................................................ 16,946 10,296

Debt owed to Berkshire...................................................................................... 1,055 1,289

*Includes interest earned by Berkshire (net of related income taxes) of $87 in 2006 and $102 in 2005.

Finance and Financial Products

You will be happy to hear – and I’ m even happier – that this will be my last discussion of the

losses at Gen Re’ s derivative operation. When we started to wind this business down early in 2002, we had

23,218 contracts outstanding. Now we have 197. Our cumulative pre-tax loss from this operation totals

$409 million, but only $5 million occurred in 2006. Charlie says that if we had properly classified the $409

million on our 2001 balance sheet, it would have been labeled “Good Until Reached For.” In any event, a

Shakespearean thought – slightly modified – seems appropriate for the tombstone of this derivative

business: “All’ s well that ends.”

We’ ve also wound up our investment in Value Capital. So earnings or losses from these two lines

of business are making their final appearance in the table that annually appears in this section.

Clayton Homes remains an anomaly in the manufactured-housing industry, which last year

recorded its lowest unit sales since 1962. Indeed, the industry’ s volume last year was only about one-third

that of 1999. Outside of Clayton, I doubt if the industry, overall, made any money in 2006.

Yet Clayton earned $513 million pre-tax and paid Berkshire an additional $86 million as a fee for

our obtaining the funds to finance Clayton’ s $10 billion portfolio of installment receivables. Berkshire’ s

financial strength has clearly been of huge help to Clayton. But the driving force behind the company’ s

success is Kevin Clayton. Kevin knows the business forward and backward, is a rational decision-maker

and a joy to work with. Because of acquisitions, Clayton now employs 14,787 people, compared to 6,661

at the time of our purchase.

We have two leasing operations: CORT (furniture), run by Paul Arnold, and XTRA (truck

trailers), run by Bill Franz. CORT’ s earnings improved significantly last year, and XTRA’ s remained at

the high level attained in 2005. We continue to look for tuck-in acquisitions to be run by Paul or Bill, and

also are open to ideas for new leasing opportunities.

14