Berkshire Hathaway 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2006 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities........................................................Inside Front Cover

Corporate Performance vs. the S&P 500 ................................................ 2

Chairman’ s Letter* ................................................................................. 3

Acquisition Criteria ................................................................................25

Report of Independent Registered Public Accounting Firm................... 25

Consolidated Financial Statements......................................................... 26

Selected Financial Data For The

Past Five Years .................................................................................. 53

Management’ s Discussion ...................................................................... 54

Management’ s Report on Internal Control

Over Financial Reporting ...................................................................73

Owner’ s Manual .....................................................................................74

Common Stock Data and Corporate Governance Matters......................79

Operating Companies ............................................................................. 80

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2007 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2006 ANNUAL REPORT TABLE OF CONTENTS Business Activities...Inside Front Cover Corporate Performance vs. the S&P 500 ...2 Chairman' s Letter* ...3 Acquisition Criteria ...25 Report of Independent Registered Public Accounting Firm...25 Consolidated Financial Statements ...26 ... -

Page 2

... Mountain Power; and Kern River Gas Transmission Company and Northern Natural Gas. In addition, MidAmerican owns HomeServices of America, a real estate brokerage firm. Berkshire' s finance and financial products businesses primarily engage in proprietary investing strategies (BH Finance), commercial... -

Page 3

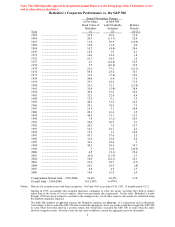

...- 1964-2006 Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which was... -

Page 4

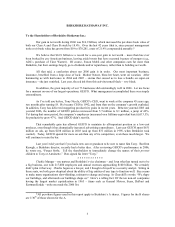

... of Berkshire Hathaway Inc.: Our gain in net worth during 2006 was $16.9 billion, which increased the per-share book value of both our Class A and Class B stock by 18.4%. Over the last 42 years (that is, since present management took over) book value has grown from $19 to $70,281, a rate of... -

Page 5

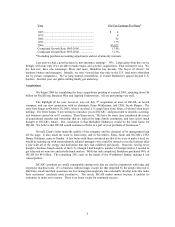

...well, our growth rate in investments was for a long time quite high. Over the years, however, we have focused more and more on the acquisition of operating businesses. Using our funds for these purchases has both slowed our growth in investments and accelerated our gains in pre-tax earnings from non... -

Page 6

... for PacifiCorp, Business Wire and Applied Underwriters. All are performing very well. The highlight of the year, however, was our July 5th acquisition of most of ISCAR, an Israeli company, and our new association with its chairman, Eitan Wertheimer, and CEO, Jacob Harpaz. The story here began... -

Page 7

... bought Justin Industries, but it has since been run exactly as we promised him it would be. Visiting me in November, John Roach brought along Paul Andrews, Jr., owner of about 80% of TTI, a Fort Worth distributor of electronic components. Over a 35-year period, Paul built TTI from $112,000 of sales... -

Page 8

... went right in insurance - really right. Our managers - Tony Nicely (GEICO), Ajit Jain (B-H Reinsurance), Joe Brandon and Tad Montross (General Re), Don Wurster (National Indemnity Primary), Tom Nerney (U.S. Liability), Tim Kenesey (Medical Protective), Rod Eldred (Homestate Companies and Cypress... -

Page 9

... Berkshire agreed to enter into a huge retroactive reinsurance contract, a policy that protects an insurer against losses that have already happened, but whose cost is not yet known. I' ll give you details of the agreement shortly. But let' s first take a journey through insurance history, following... -

Page 10

... went. But that warning came to be viewed as perfunctory. Three hundred years of retained cufflinks acted as a powerful sedative to the names poised to sign up. Then came asbestos. When its prospective costs were added to the tidal wave of environmental and product claims that surfaced in the 1980s... -

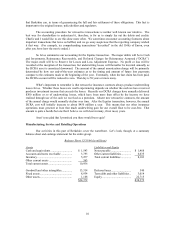

Page 11

... of Berkshire cover the waterfront. Let' s look, though, at a summary balance sheet and earnings statement for the entire group. Balance Sheet 12/31/06 (in millions) Assets Cash and equivalents ...Accounts and notes receivable ...Inventory ...Other current assets ...Total current assets ...Goodwill... -

Page 12

... bought 2,200 shares for $22 million. Each employee paid exactly the same price that we did, in most cases borrowing money to do so. And are they ever glad they did! Five years later, MiTek' s sales have tripled and the stock is valued at $71,699 per share. Despite its making 14 acquisitions... -

Page 13

... well. That' s why Peter Kiewit bought the Omaha paper more than 40 years ago. We are likely therefore to see non-economic individual buyers of newspapers emerge, just as we have seen such buyers acquire major sports franchises. Aspiring press lords should be careful, however: There' s no rule... -

Page 14

... the second largest real estate brokerage firm in the U.S., HomeServices of America. This company operates through 20 locally-branded firms with 20,300 agents. Despite HomeServices' purchase of two operations last year, the company' s overall volume fell 9% to $58 billion, and profits fell 50%. The... -

Page 15

...s well that ends." We' ve also wound up our investment in Value Capital. So earnings or losses from these two lines of business are making their final appearance in the table that annually appears in this section. Clayton Homes remains an anomaly in the manufactured-housing industry, which last year... -

Page 16

...Corp ...Wal-Mart Stores, Inc...The Washington Post Company ...Wells Fargo & Company...White Mountains Insurance...Others ...Total Common Stocks ... 12.6 4.7 8.6 1.1 0.7 6.1 17.2 1.3 4.0 3.2 2.9 1.8 19.0 0.5 18.0 6.5 16.0 *This is our actual purchase price and also our tax basis; GAAP "cost" differs... -

Page 17

... to accept our bonds, real estate, stocks and businesses. And we have a vast store of these to hand over. These transfers will have consequences, however. Already the prediction I made last year about one fall-out from our spending binge has come true: The "investment income" account of our country... -

Page 18

... CEO and that the Board knows exactly who should take over if I should die tonight. Each of the three is much younger than I. The directors believe it' s important that my successor have the prospect of a long tenure. Frankly, we are not as well-prepared on the investment side of our business. There... -

Page 19

... step down as a director at the annual meeting. I owe much to the Chaces and wish to thank Kim for his many years of service to Berkshire. In selecting a new director, we were guided by our long-standing criteria, which are that board members be owner-oriented, business-savvy, interested and truly... -

Page 20

... way up to 19 employees at World Headquarters. This crew occupies 9,708 square feet of space, and Charlie - at World Headquarters West in Los Angeles - uses another 655 square feet. Our home-office payroll, including benefits and counting both locations, totaled $3,531,978 last year. We' re careful... -

Page 21

... of deftly selecting "peer" companies to compare with their clients will only perpetuate present excesses Last year I arranged for the bulk of my Berkshire holdings to go to five charitable foundations, thus carrying out part of my lifelong plan to eventually use all of my shares for philanthropic... -

Page 22

.... At most, sales by the foundations receiving my shares will add three percentage points to annual trading volume, which will still leave Berkshire with a turnover ratio that is the lowest around. Overall, Berkshire' s business performance will determine the price of our stock, and most of... -

Page 23

... of investment instruction at most major business schools. This theory, as then most commonly taught, held that the price of any stock at any moment is not demonstrably mispriced, which means that no investor can be expected to overperform the stock market averages using only publicly-available... -

Page 24

...be hard to find, but work with Carol and you will get one. At Nebraska Furniture Mart, located on a 77-acre site on 72nd Street between Dodge and Pacific, we will again be having "Berkshire Weekend" discount pricing. We initiated this special event at NFM ten years ago, and sales during the "Weekend... -

Page 25

... by presenting your meeting credentials or a brokerage statement that shows you are a Berkshire holder. On Sunday, in a tent outside of Borsheim' s, a blindfolded Patrick Wolff, twice U.S. chess champion, will take on all comers - who will have their eyes wide open - in groups of six. Last year... -

Page 26

...." REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc. We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2006 and 2005, and the related... -

Page 27

...143 7,500 22,693 2,388 4,937 169,648 358 11,915 4,156 3,764 - 20,193 4,189 3,435 11,087 951 4,865 24,527 $214,368 * The Pro Forma Balance Sheet gives effect to the conversion on February 9, 2006 of MidAmerican Energy Holdings Company ("MidAmerican") non-voting cumulative convertible preferred stock... -

Page 28

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions) LIABILITIES AND SHAREHOLDERS' EQUITY Insurance and Other: Losses and loss adjustment expenses...Unearned premiums...Life and health insurance benefits ...Other policyholder liabilities ...Accounts payable, ... -

Page 29

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per share amounts) Year Ended December 31, 2005 2004 2006 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ... -

Page 30

... maturities ...Sales of equity securities ...Purchases of loans and finance receivables ...Principal collections on loans and finance receivables...Acquisitions of businesses, net of cash acquired...Purchases of property, plant and equipment...Other...Net cash flows from investing activities...Cash... -

Page 31

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME (dollars in millions) Year Ended December 31, 2005 2004 2006 Class A & B Common Stock Balance at beginning and end of year ...$ 8 $ 8 $ 8 Capital in Excess of Par Value ... -

Page 32

... Significant accounting policies and practices (a) Nature of operations and basis of consolidation Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in a number of diverse business activities, including property and casualty insurance and reinsurance... -

Page 33

... its claim on the investee' s book value. Loans and finance receivables Loans and finance receivables consist of commercial and consumer loans originated or purchased by Berkshire' s finance and financial products businesses. Loans and finance receivables are stated at amortized cost less allowances... -

Page 34

... fair value of net assets acquired in business acquisitions. Goodwill is tested for impairment using a variety of methods at least annually and impairments, if any, are charged to earnings. Key assumptions used in the testing include, but are not limited to, the use of an appropriate discount rate... -

Page 35

... Statements (Continued) (1) Significant accounting policies and practices (Continued) (k) Losses and loss adjustment expenses (Continued) The estimated liabilities of workers' compensation claims assumed under certain reinsurance contracts are carried in the Consolidated Balance Sheets at discounted... -

Page 36

... and international electric power projects and the second largest residential real estate brokerage firm in the United States (HomeServices). This group of businesses is referred to as "MidAmerican" or the "utilities and energy businesses." On February 9, 2006, Berkshire converted its non-voting... -

Page 37

... realizable value. (3) Significant business acquisitions Berkshire' s long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity and able and honest management at sensible prices. During the last three years, Berkshire acquired several businesses... -

Page 38

... revenues...Net earnings...Earnings per equivalent Class A common share ...2006 $100,992 11,107 7,204 2005 $95,836 8,624 5,601 The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition for PacifiCorp and IMC (in millions). IMC... -

Page 39

... rate increases. Amortized Cost December 31, 2005 Insurance and other: U.S. Treasury, U.S. government corporations and agencies ...States, municipalities and political subdivisions ...Foreign governments ...Corporate bonds and redeemable preferred stocks ...Mortgage-backed securities ...Finance... -

Page 40

...Acquisitions of businesses and other...Balance at end of year ... The MidAmerican goodwill represents the consolidation of Berkshire' s investment in MidAmerican as of January 1, 2006. The increase in goodwill from business acquisitions and other primarily relates to the acquisitions of PacifiCorp... -

Page 41

... manage certain economic risks of its businesses as well as to assume specified amounts of market risk from others. The contracts summarized in the preceding table, with limited exceptions, are not designated as hedges for financial reporting purposes. Changes in the fair values of derivative assets... -

Page 42

... determined based upon Berkshire' s historic general liability exposure base and policy language, previous environmental loss experience and the assessment of current trends of environmental law, environmental cleanup costs, asbestos liability law and judgmental settlements of asbestos liabilities... -

Page 43

...permits each holder the right to purchase either 0.1116 shares of Class A common stock (effectively at $89,606 per share) or 3.3480 shares of Class B common stock (effectively at $2,987 per share) for $10,000. A warrant premium is payable to Berkshire at an annual rate of 3.75%. Commercial paper and... -

Page 44

...Berkshire Hathaway Finance Corporation ("BHFC"), a wholly-owned subsidiary of Berkshire, issued senior notes at various times during the three years ending December 31, 2005. The proceeds were used in the financing of manufactured housing loan originations and portfolio acquisitions of Clayton Homes... -

Page 45

... reinsurance assumed, deferred policy acquisition costs, unrealized gains and losses on investments in fixed maturity securities and related deferred income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired businesses... -

Page 46

... voting rights of a share of Class A common stock. Class A and Class B common shares vote together as a single class. (18) Pension plans Several Berkshire subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits under the plans are generally based on years... -

Page 47

... is presented in the table that follows (in millions). Plan assets at fair value, beginning of year...Employer contributions ...Benefits paid...Actual return on plan assets...Consolidation of MidAmerican ...Business acquisitions...Other and expenses...Plan assets at fair value, end of year...2006... -

Page 48

... Clayton Homes, XTRA, CORT and other financial services ("Finance and financial products") McLane Company MidAmerican Business Activity Underwriting private passenger automobile insurance mainly by direct response methods Underwriting excess-of-loss, quota-share and facultative reinsurance worldwide... -

Page 49

... Manville, Justin Brands, Larson-Juhl, MiTek, Russell and Scott Fetzer Buffalo News, Business Wire, FlightSafety, International Dairy Queen, Pampered Chef and NetJets Ben Bridge Jeweler, Borsheim' s, Helzberg Diamond Shops, Jordan' s Furniture, Nebraska Furniture Mart, See' s, Star Furniture and... -

Page 50

... and service revenues included $9.6 billion of sales to Wal-Mart Stores, Inc. which were primarily related to McLane' s wholesale distribution business. Premiums written and earned by Berkshire' s property/casualty and life/health insurance businesses are summarized below. Dollars are in millions... -

Page 51

... has interviewed a number of current and former officers and employees of General Re and General Reinsurance as well as Berkshire' s Chairman and CEO, Warren E. Buffett, in connection with these investigations. In one case, a transaction initially effected with American International Group ("AIG... -

Page 52

... related to AIG General Reinsurance is a defendant in In re American International Group Securities Litigation, Case No. 04-CV-8141-(LTS), United States District Court, Southern District of New York, a putative class action asserted on behalf of investors who purchased publicly-traded securities... -

Page 53

... International Group, Inc. Derivative Litigation, Case No. 04-CV-08406, United States District Court, Southern District of New York. The complaint, brought by several alleged shareholders of AIG, seeks damages, injunctive and declaratory relief against various officers and directors of AIG as well... -

Page 54

..., Berkshire Hathaway converted its non-voting preferred stock of MidAmerican Energy Holdings Company ("MidAmerican") to common stock and upon conversion, owned approximately 83.4% (80.5% diluted) of the voting common stock interests. Accordingly, the 2006 Consolidated Financial Statements reflect... -

Page 55

..., Berkshire acquired 85% of Applied Underwriters, a provider of integrated workers' compensation solutions. Underwriting results for these businesses are included in the Berkshire Hathaway Primary Group results beginning on their respective acquisition dates. Berkshire's management views insurance... -

Page 56

...reflected higher advertising costs as well as incremental underwriting and policy issuance costs associated with new business sales. General Re General Re conducts a reinsurance business offering property and casualty and life and health coverages to clients worldwide. In North America, property and... -

Page 57

... in discount accretion and deferred charge amortization offset by $307 million of reserve reductions for prior years' property losses (primarily in World Trade Center loss exposures) and $377 million of gains from contract commutations and settlements. The International property/casualty businesses... -

Page 58

...rates in the U.S. and limited industry capacity for catastrophe reinsurance which led to more opportunities to write new business. The level of business written in future periods may vary significantly based upon market conditions and management's assessment of the adequacy of premium rates. Pre-tax... -

Page 59

... to reinsure and manage the 1992 and prior years' non-life liabilities of the Names or Underwriters at Lloyd's of London, entered into an agreement for BHRG to provide potentially up to $7 billion of new excess reinsurance to Equitas. BHRG will also employ the current staff of Equitas and manage the... -

Page 60

... $ 237* 10,528 1,478 MidAmerican Energy Company ...PacifiCorp ...Natural gas pipelines...U.K. utilities...Real estate brokerage...Other ...Earnings before corporate interest and taxes...Interest, other than to Berkshire ...Interest on Berkshire junior debt ...Income tax...Net earnings ...Earnings... -

Page 61

... Corporation, Fechheimers, Justin Brands and the H.H. Brown Shoe Group). Also included in this group are Forest River, a leading manufacturer of leisure vehicles that was acquired on August 31, 2005 and the Iscar Metalworking Companies ("IMC"), an industry leader in the metal cutting tools business... -

Page 62

... for prior periods' compensation related to a new labor contract with its pilots and flight attendants. Retailing Berkshire's retailing operations consist of several home furnishings (Nebraska Furniture Mart, R.C. Willey, Star Furniture and Jordan's) and jewelry (Borsheim's, Helzbergs and Ben Bridge... -

Page 63

..."). On October 1, 2005, The Procter & Gamble Company ("PG") completed its acquisition of Gillette and issued 0.975 shares of its common stock for each outstanding share of Gillette common stock. Berkshire recognized a non-cash pre-tax investment gain of approximately $5 billion upon the exchange of... -

Page 64

...payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a rate of 3.00%. Each warrant provides the holder the right to purchase either 0.1116 shares of Class A or 3.348 shares of Class B stock for $10,000. Short-term borrowings consist primarily of commercial paper... -

Page 65

...gross unpaid losses") are reflected in the Consolidated Balance Sheets without discounting for time value, regardless of the length of the claim-tail. Amounts are in millions. Gross unpaid losses GEICO...General Re...BHRG...Berkshire Hathaway Primary Group ...Total ...Dec. 31, 2006 $ 6,095 20,444 16... -

Page 66

.... Data is analyzed by policy coverage, rated state, reporting date and occurrence date, among other factors. A brief discussion of each component follows. Average reserve amounts are established for reported auto damage claims and new liability claims prior to the development of an individual case... -

Page 67

... individual claim basis. Loss data is provided through periodic reports and may include the amount of ceded losses paid where reimbursement is sought as well as case loss reserve estimates. Ceding companies infrequently provide IBNR estimates to reinsurers. Each of Berkshire's reinsurance businesses... -

Page 68

...millions. Type Reported case reserves ...IBNR reserves ...Gross reserves ...Ceded reserves and deferred charges...Net reserves...$11,074 9,370 20,444 (2,083) $18,361 Line of business Workers' compensation (1) ...Professional liability (2) ...Mass tort-asbestos/environmental ...Auto liability...Other... -

Page 69

... course of the year. In 2006, reported losses for North American workers' compensation risks (primarily pre-2002 occurrences) exceeded expectations. Claims data continued to show increased costs of long-term medical care and prescription drug costs and increased medical care utilization by claimants... -

Page 70

... information regarding numbers of asbestos, environmental and latent injury claims from ceding companies on a consistent basis, particularly with respect to multi-line treaty or aggregate excess of loss policies. Periodically, a ground-up analysis of the underlying loss data of the reinsured is... -

Page 71

...prefers to invest in equity securities or to acquire entire businesses based upon the principles discussed in the following section on equity price risk. When unable to do so, management may alternatively invest in bonds, loans or other interest rate sensitive instruments. Berkshire's strategy is to... -

Page 72

... business, economic and management characteristics of the investees remain favorable. Berkshire strives to maintain above average levels of shareholder capital to provide a margin of safety against short-term equity price volatility. The carrying values of investments subject to equity price... -

Page 73

... Berkshire estimates that it could incur a non-cash pre-tax loss of approximately $2 billion from the change in the estimated fair value of open contracts as of December 31, 2006. Foreign Currency Risk Market risks associated with changes in foreign currency exchange rates are currently concentrated... -

Page 74

... Public Accounting Firm To the Board of Directors and Shareholders of Berkshire Hathaway Inc. We have audited management' s assessment, included in the accompanying, Management' s Reports on Internal Control Over Financial Reporting, that Berkshire Hathaway Inc. and subsidiaries (the "Company... -

Page 75

... our ownership at an attractive price. 2. In line with Berkshire' s owner-orientation, most of our directors have a major portion of their net worth invested in the company. We eat our own cooking. Charlie' s family has 90% or more of its net worth in Berkshire shares; I have about 99%. In addition... -

Page 76

...have and don' t need. Besides, Berkshire has access to two low-cost, non-perilous sources of leverage that allow us to safely own far more assets than our equity capital alone would permit: deferred taxes and "float," the funds of others that our insurance business holds because it receives premiums... -

Page 77

... lose if their managers deliberately sell assets for 80¢ that in fact are worth $1. We didn' t commit that kind of crime in our offering of Class B shares and we never will. (We did not, however, say at the time of the sale that our stock was overvalued, though many media have reported that we did... -

Page 78

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 79

... or for taxes. Other assets of mine will take care of these requirements. All Berkshire shares will be left to foundations that will likely receive the stock in roughly equal installments over a dozen or so years. At my death, the Buffett family will not be involved in managing the business but, as... -

Page 80

... owners. Price Range of Common Stock Berkshire' s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 81

...MidAmerican Energy Company (2) MidAmerican Energy Holdings Company (2) MiTek Inc. National Indemnity Companies Nebraska Furniture Mart NetJets Northern Natural Gas (2) Northern and Yorkshire Electric (2) Northland (1) PacifiCorp (2) Pacific Power (2) The Pampered Chef Precision Steel Warehouse Rocky... -

Page 82

...and Company Incorporated, an investment banking firm. REBECCA K. AMICK, Director of Internal Auditing MARK D. MILLARD, Director of Financial Assets THOMAS S. MURPHY, Former Chairman of the Board and CEO of Capital Cities/ABC. JO ELLEN RIECK, Director of Taxes RONALD L. OLSON, Partner of the law...