AutoZone 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

We are exposed to market risk from, among other things, changes in interest rates, foreign exchange rates and fuel

prices. From time to time, we use various derivative instruments to reduce interest rate and fuel price risks. To

date, based upon our current level of foreign operations, no derivative instruments have been utilized to reduce

foreign exchange rate risk. All of our hedging activities are governed by guidelines that are authorized by the

Board. Further, we do not buy or sell derivative instruments for trading purposes.

Interest Rate Risk

Our financial market risk results primarily from changes in interest rates. At times, we reduce our exposure to

changes in interest rates by entering into various interest rate hedge instruments such as interest rate swap

contracts, treasury lock agreements and forward-starting interest rate swaps.

We have historically utilized interest rate swaps to convert variable rate debt to fixed rate debt and to lock in fixed

rates on future debt issuances. We reflect the current fair value of all interest rate hedge instruments as a

component of either other current assets or accrued expenses and other. Our interest rate hedge instruments are

designated as cash flow hedges.

Unrealized gains and losses on interest rate hedges are deferred in stockholders’ deficit as a component of

Accumulated other comprehensive loss. These deferred gains and losses are recognized in income as a decrease or

increase to interest expense in the period in which the related cash flows being hedged are recognized in expense.

However, to the extent that the change in value of an interest rate hedge instrument does not perfectly offset the

change in the value of the cash flow being hedged, that ineffective portion is immediately recognized in earnings.

During the fourth quarter of fiscal 2012, we entered into two treasury rate locks, each with a notional amount of

$100 million. These agreements were cash flow hedges used to hedge the exposure to variability in future cash

flows resulting from changes in variable interest rates related to the $300 million Senior Note debt issuance in

November 2012. The fixed rates of the hedges were 2.07% and 1.92% and were benchmarked based on the 10-

year U.S. treasury notes. These locks expired on November 1, 2012 and resulted in a loss of $5.1 million, which

has been deferred in Accumulated other comprehensive loss and will be reclassified to Interest expense over the

life of the underlying debt. The hedges remained highly effective until they expired, and no ineffectiveness was

recognized in earnings.

During the third quarter of fiscal 2012, we entered into two treasury rate locks. These agreements were

designated as cash flow hedges and were used to hedge the exposure to variability in future cash flows resulting

from changes in variable interest rates related to the $500 million Senior Note debt issuance in April 2012. The

treasury rate locks had notional amounts of $300 million and $100 million with associated fixed rates of 2.09%

and 2.07% respectively. The locks were benchmarked based on the 10-year U.S. treasury notes. These locks

expired on April 20, 2012 and resulted in a loss of $2.8 million, which has been deferred in Accumulated other

comprehensive loss and will be reclassified to Interest expense over the life of the underlying debt. The hedges

remained highly effective until they expired, and no ineffectiveness was recognized in earnings.

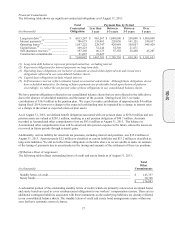

The fair value of our debt was estimated at $4.259 billion as of August 31, 2013, and $4.055 billion as of August

25, 2012, based on the quoted market prices for the same or similar debt issues or on the current rates available to

us for debt having the same remaining maturities. Such fair value is greater than the carrying value of debt by

$72.2 million and $286.6 million at August 31, 2013 and August 25, 2012, respectively. We had $637.0 million of

variable rate debt outstanding at August 31, 2013, and $518.2 million of variable rate debt outstanding at August

25, 2012. In fiscal 2013, at this borrowing level for variable rate debt, a one percentage point increase in interest

rates would have had an unfavorable impact on our pre-tax earnings and cash flows of approximately $6 million.

The primary interest rate exposure on variable rate debt is based on LIBOR. We had outstanding fixed rate debt of

$3.550 billion at August 31, 2013, and $3.250 billion at August 25, 2012. A one percentage point increase in

interest rates would reduce the fair value of our fixed rate debt by approximately $128.4 million at August 31,

2013.

Fuel Price Risk

From time to time, we utilize fuel swap contracts in order to lower fuel cost volatility in our operating results.

Historically, the instruments were executed to economically hedge a portion of our diesel and unleaded fuel

10-K