AutoZone 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

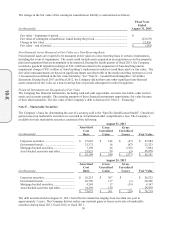

Foreign Currency: The Company accounts for its Mexican and Brazilian operations using the Mexican peso and

the Brazilian real as the functional currencies and converts its financial statements from these currencies to U.S.

dollars. The cumulative loss on currency translation is recorded as a component of Accumulated other

comprehensive loss and approximated $62.5 million at August 31, 2013, and $50.3 million at August 25, 2012.

Self-Insurance Reserves: The Company retains a significant portion of the risks associated with workers’

compensation, employee health, general, products liability, property and vehicle insurance. Through various

methods, which include analyses of historical trends and utilization of actuaries, the Company estimates the costs

of these risks. The costs are accrued based upon the aggregate of the liability for reported claims and an estimated

liability for claims incurred but not reported. Estimates are based on calculations that consider historical lag and

claim development factors. The long-term portions of these liabilities are recorded at the Company’s estimate of

their net present value.

Deferred Rent: The Company recognizes rent expense on a straight-line basis over the course of the lease term,

which includes any reasonably assured renewal periods, beginning on the date the Company takes physical

possession of the property (see “Note O – Leases”). Differences between this calculated expense and cash

payments are recorded as a liability within the Accrued expenses and other and Other long-term liabilities

captions in the accompanying Consolidated Balance Sheets, based on the terms of the lease. Deferred rent

approximated $96.5 million as of August 31, 2013, and $86.9 million as of August 25, 2012.

Financial Instruments: The Company has financial instruments, including cash and cash equivalents, accounts

receivable, other current assets and accounts payable. The carrying amounts of these financial instruments

approximate fair value because of their short maturities. A discussion of the carrying values and fair values of the

Company’s debt is included in “Note I – Financing,” marketable securities is included in “Note F – Marketable

Securities,” and derivatives is included in “Note H – Derivative Financial Instruments.”

Income Taxes: The Company accounts for income taxes under the liability method. Deferred tax assets and

liabilities are determined based on differences between financial reporting and tax bases of assets and liabilities

and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to

reverse. Our effective tax rate is based on income by tax jurisdiction, statutory rates, and tax saving initiatives

available to the Company in the various jurisdictions in which we operate.

The Company recognizes liabilities for uncertain income tax positions based on a two-step process. The first step

is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is

more likely than not that the position will be sustained on audit, including resolution of related appeals or

litigation processes, if any. The second step requires the Company to estimate and measure the tax benefit as the

largest amount that is more than 50% likely to be realized upon ultimate settlement. It is inherently difficult and

subjective to estimate such amounts, as the Company must determine the probability of various possible

outcomes. The Company reevaluates these uncertain tax positions on a quarterly basis or when new information

becomes available to management. These reevaluations are based on factors including, but not limited to, changes

in facts or circumstances, changes in tax law, successfully settled issues under audit, expirations due to statutes,

and new audit activity. Such a change in recognition or measurement could result in the recognition of a tax

benefit or an increase to the tax accrual.

The Company classifies interest related to income tax liabilities, and if applicable, penalties, as a component of

Income tax expense. The income tax liabilities and accrued interest and penalties that are expected to be payable

within one year of the balance sheet date are presented within the Accrued expenses and other caption in the

accompanying Consolidated Balance Sheets. The remaining portion of the income tax liabilities and accrued

interest and penalties are presented within the Other long-term liabilities caption in the accompanying

Consolidated Balance Sheets because payment of cash is not anticipated within one year of the balance sheet date.

Refer to “Note D – Income Taxes” for additional disclosures regarding the Company’s income taxes.

Sales and Use Taxes: Governmental authorities assess sales and use taxes on the sale of goods and services. The

Company excludes taxes collected from customers in its reported sales results; such amounts are included within

the Accrued expenses and other caption until remitted to the taxing authorities.

10-K