AutoZone 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

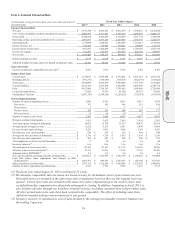

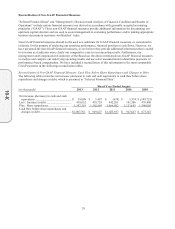

Operating, selling, general and administrative expenses for fiscal 2013 increased to $2.968 billion, or 32.4% of net

sales, from $2.803 billion, or 32.6% of net sales for fiscal 2012. Operating expenses, as a percentage of sales,

improved due to lower incentive compensation (19 basis points), partially offset by lower sales growth rates.

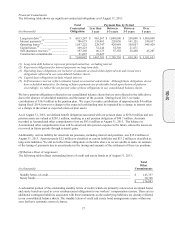

Interest expense, net for fiscal 2013 was $185.4 million compared with $175.9 million during fiscal 2012. This

increase was primarily due to higher average borrowing levels over the comparable prior year period; partially

offset by a decline in borrowing rates. Average borrowings for fiscal 2013 were $3.927 billion, compared with

$3.507 billion for fiscal 2012 and weighted average borrowing rates were 4.5% for fiscal 2013, compared to 4.7%

for fiscal 2012.

Our effective income tax rate was 36.0% of pre-tax income for fiscal 2013 compared to 36.0% for fiscal 2012.

Net income for fiscal 2013 increased by 9.3% to $1.016 billion, and diluted earnings per share increased 18.3% to

$27.79 from $23.48 in fiscal 2012. The impact of the fiscal 2013 stock repurchases on diluted earnings per share

in fiscal 2013 was an increase of approximately $1.09.

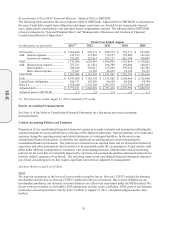

Effective December 2012, we acquired certain assets and liabilities of AutoAnything, an online retailer of

specialized automotive products for up to $150 million, including an initial cash payment of $115 million, up to a

$5 million holdback payment for working capital true-ups, and contingent payments not to exceed $30 million.

During the third quarter of fiscal 2013, we paid the holdback payment for working capital true-ups of $1.1

million. With this acquisition, we expect to bolster our online presence in the automotive accessory and

performance markets. The results of operations from AutoAnything have been included in our Other business

activities since the date of acquisition. The purchase price allocation resulted in goodwill of $83.4 million and

intangible assets totaling $58.7 million. Goodwill generated from the acquisition is tax deductible and is primarily

attributable to expected synergies and the assembled workforce. The contingent consideration is based on the

achievement of certain performance metrics through calendar year 2014 with any earned payments due during the

first calendar quarter of 2014 and 2015. The fair value of the contingent consideration as of the acquisition date

was $22.7 million.

We performed our annual impairment testing in the fourth quarter of fiscal 2013 for the goodwill and indefinite-

lived intangible asset related to the acquisition of AutoAnything. Based on an analysis of AutoAnything’s revised

planned financial results compared to the initial projections, we determined it was more likely than not the

goodwill attributed to AutoAnything was impaired. Accordingly, we performed a goodwill impairment test by

comparing the fair value of the reporting unit with its carrying amount, including goodwill. Because the fair value

of the reporting unit was lower than its carrying value, we recorded a goodwill impairment charge of $18.3

million during the fourth quarter of fiscal 2013. Based on our evaluation of the future discounted cash flows of

AutoAnything’s trade name as compared to its carrying value, it was determined that AutoAnything’s trade name

was also impaired. We recorded an impairment charge of $4.1 million during the fourth quarter of fiscal 2013

related to the trade name.

Based on the revised plan financial results, we also determined AutoAnything is not likely to achieve the

operating income targets necessary to earn the contingent consideration. Therefore, we adjusted the fair value of

the contingent consideration at August 31, 2013 to $0.2 million, resulting in a decrease to the contingent

consideration liability of $23.3 million during the fourth quarter of fiscal 2013. The net impact of the impairment

charges and the contingent consideration adjustment is a gain of $0.9 million. The net impact is included in

Operating, selling, general and administrative expenses in our Other business activities.

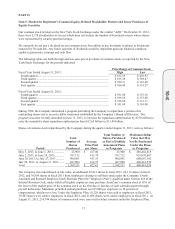

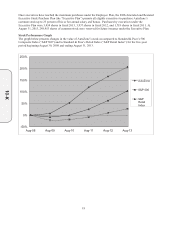

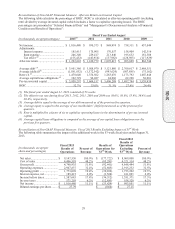

Fiscal 2012 Compared with Fiscal 2011

For the fiscal year ended August 25, 2012, we reported net sales of $8.604 billion compared with $8.073 billion

for the year ended August 27, 2011, a 6.6% increase from fiscal 2011. This growth was driven primarily by an

increase in domestic same store sales of 3.9% and sales from new stores of $214.2 million. The improvement in

domestic same store sales was driven by higher transaction value, partially offset by decreased transaction counts.

At August 25, 2012, we operated 4,685 domestic stores and 321 stores in Mexico, compared with 4,534 domestic

stores and 279 stores in Mexico at August 27, 2011. We reported a total auto parts (domestic and Mexico

operations) sales increase of 6.5% for fiscal 2012.

10-K