AutoZone 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

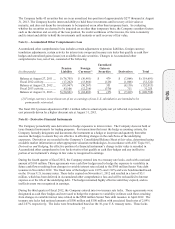

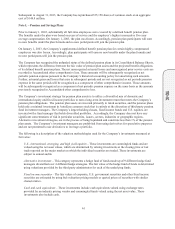

The Company accrues interest on unrecognized tax benefits as a component of income tax expense. Penalties, if

incurred, would be recognized as a component of income tax expense. The Company had $4.7 million and $4.1

million accrued for the payment of interest and penalties associated with unrecognized tax benefits at August 31,

2013 and August 25, 2012, respectively.

The Company files U.S. federal, U.S. state and local, and international income tax returns. The U.S. Internal

Revenue Service has completed exams on U.S. federal income tax returns for years 2009 and prior. With few

exceptions, the Company is no longer subject to state and local or non-U.S. examinations by tax authorities for

years before 2009. The Company is typically engaged in various tax examinations at any given time, both by U.S.

federal, state and local, and international taxing jurisdictions. As of August 31, 2013, the Company estimates that

the amount of unrecognized tax benefits could be reduced by approximately $1.5 million over the next twelve

months as a result of tax audit settlements. While the Company believes that it is adequately accrued for possible

audit adjustments, the final resolution of these examinations cannot be determined at this time and could result in

final settlements that differ from current estimates.

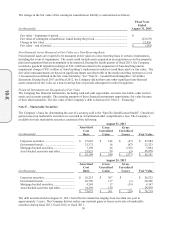

Note E – Fair Value Measurements

The Company has adopted ASC Topic 820, Fair Value Measurement, which defines fair value, establishes a

framework for measuring fair value in generally accepted accounting principles (“GAAP”) and expands disclosure

requirements about fair value measurements. This standard defines fair value as the price received to transfer an

asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

ASC Topic 820 establishes a framework for measuring fair value by creating a hierarchy of valuation inputs used

to measure fair value, and although it does not require additional fair value measurements, it applies to other

accounting pronouncements that require or permit fair value measurements.

The hierarchy prioritizes the inputs into three broad levels:

Level 1 inputs — unadjusted quoted prices in active markets for identical assets or liabilities that the

Company has the ability to access. An active market for the asset or liability is one in which transactions for

the asset or liability occur with sufficient frequency and volume to provide ongoing pricing information.

Level 2 inputs — inputs other than quoted market prices included in Level 1 that are observable, either

directly or indirectly, for the asset or liability. Level 2 inputs include, but are not limited to, quoted prices for

similar assets or liabilities in an active market, quoted prices for identical or similar assets or liabilities in

markets that are not active and inputs other than quoted market prices that are observable for the asset or

liability, such as interest rate curves and yield curves observable at commonly quoted intervals, volatilities,

credit risk and default rates.

Level 3 inputs — unobservable inputs for the asset or liability.

10-K