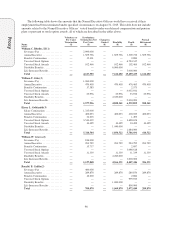

AutoZone 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

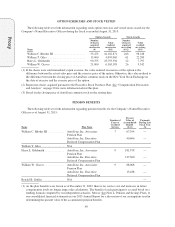

Proxy

Company’s most recent fiscal year in which the Company (including any of its subsidiaries) was, is or will be a

participant and the amount involved exceeds $120,000 and in which any Related Person had, has or will have a

direct or indirect material interest. “Related Persons” include a director or executive officer of the Company, a

nominee to become a director of the Company, any person known to be the beneficial owner of more than 5% of

any class of the Company’s voting securities, any immediate family member of any of the foregoing persons,

and any firm, corporation or other entity in which any of the foregoing persons is employed or is a partner or

principal or in a similar position or in which such person has a 5% or greater beneficial ownership interest.

Our Board has adopted a Code of Business Conduct (the “Code of Conduct”) that applies to the Company’s

directors, officers and employees. The Code of Conduct prohibits directors and executive officers from engaging

in activities that create conflicts of interest, taking corporate opportunities for personal use or competing with

the Company, among other things. Our Board has also adopted a Code of Ethical Conduct for Financial

Executives (the “Financial Code of Conduct”) that applies to the Company’s officers and employees who hold

the position of principal executive officer, principal financial officer, principal accounting officer or controller

as well as to the Company’s officers and employees who perform similar functions (“Financial Executives”).

The Financial Code of Conduct requires the Financial Executives to, among other things, report any actual or

apparent conflicts of interest between personal or professional relationships involving the Company’s

management or any other Company employee with a role in financial reporting disclosures or internal controls.

Additionally, our Corporate Governance Principles require each director who is faced with an issue that

presents, or may give the appearance of presenting, a conflict of interest to disclose that fact to the Chairman of

the Board and the Secretary, and to refrain from participating in discussions or votes on such issue unless a

majority of the Board determines, after consultation with counsel, that no conflict of interest exists as to such

matter.

We have concluded there are no material related party transactions or agreements that were entered into

during the fiscal year ended August 31, 2013 and through the date of this proxy statement requiring disclosure

under these policies.

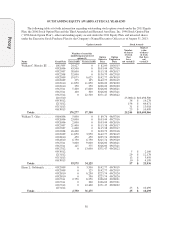

Equity Compensation Plans

Equity Compensation Plans Approved by Stockholders

Our stockholders have approved the 2011 Equity Plan, 2006 Stock Option Plan, 1996 Stock Option Plan,

the Employee Stock Purchase Plan, the Executive Stock Purchase Plan, the 2003 Director Compensation Plan

and the 2003 Director Stock Option Plan.

Equity Compensation Plans Not Approved by Stockholders

The AutoZone, Inc. Second Amended and Restated Director Compensation Plan and the AutoZone, Inc.

Fourth Amended and Restated 1998 Director Stock Option Plan were approved by the Board, but were not

submitted for approval by the stockholders as then permitted under the rules of the New York Stock Exchange.

Both of these plans were terminated in December 2002 and were replaced by the 2003 Director Compensation

Plan and the 2003 Director Stock Option Plan, respectively, after the stockholders approved them. No further

grants can be made under the terminated plans. However, any grants made under these plans will continue under

the terms of the grant made. Only treasury shares are issued under the terminated plans.

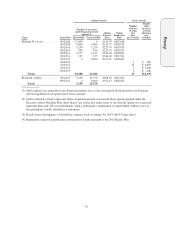

Under the Second Amended and Restated Director Compensation Plan, a non-employee director could

receive no more than one-half of the annual retainer and meeting fees immediately in cash, and the remainder of

the fees were taken in common stock or deferred in stock appreciation rights.

Under the Fourth Amended and Restated 1998 Director Stock Option Plan, on January 1 of each year, each

non-employee director received an option to purchase 1,500 shares of common stock, and each non-employee

director who owned common stock worth at least five times the annual fee paid to each non-employee director

on an annual basis received an additional option to purchase 1,500 shares of common stock. In addition, each

new director received an option to purchase 3,000 shares upon election to the Board, plus a portion of the annual

48