AutoZone 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

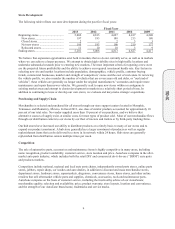

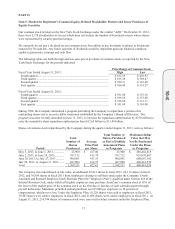

Store Development

The following table reflects our store development during the past five fiscal years:

Fiscal Year

2013 2012 2011 2010 2009

Be

g

innin

g

stores ................................. 5,006 4,813 4,627 4,417 4,240

N

ew stores ...................................... 197 193 188 213 180

Closed stores ................................... 2 - 2 3 3

N

et new stores ................................ 195 193 186 210 177

Relocated stores .............................. 11 10 10 3 9

Ending stores ...................................... 5,201 5,006 4,813 4,627 4,417

We believe that expansion opportunities exist both in markets that we do not currently serve, as well as in markets

where we can achieve a larger presence. We attempt to obtain high visibility sites in high traffic locations and

undertake substantial research prior to entering new markets. The most important criteria for opening a new store

are the projected future profitability and the ability to achieve our required investment hurdle rate. Key factors in

selecting new site and market locations include population, demographics, vehicle profile, customer buying

trends, commercial businesses, number and strength of competitors’ stores and the cost of real estate. In reviewing

the vehicle profile, we also consider the number of vehicles that are seven years old and older, or “our kind of

vehicles”; these vehicles are generally no longer under the original manufacturers’ warranties and require more

maintenance and repair than newer vehicles. We generally seek to open new stores within or contiguous to

existing market areas and attempt to cluster development in markets in a relatively short period of time. In

addition to continuing to lease or develop our own stores, we evaluate and may make strategic acquisitions.

Purchasing and Supply Chain

Merchandise is selected and purchased for all stores through our store support centers located in Memphis,

Tennessee and Monterrey, Mexico. In fiscal 2013, one class of similar products accounted for approximately 10

percent of our total sales. No vendor supplied more than 10 percent of our purchases, and we believe that

alternative sources of supply exist, at similar costs, for most types of product sold. Most of our merchandise flows

through our distribution centers to our stores by our fleet of tractors and trailers or by third-party trucking firms.

Our hub stores have increased our ability to distribute products on a timely basis to many of our stores and to

expand our product assortment. A hub store generally has a larger assortment of products as well as regular

replenishment items that can be delivered to a store in its network within 24 hours. Hub stores are generally

replenished from distribution centers multiple times per week.

Competition

The sale of automotive parts, accessories and maintenance items is highly competitive in many areas, including

name recognition, product availability, customer service, store location and price. AutoZone competes in the after-

market auto parts industry, which includes both the retail DIY and commercial do-it-for-me (“DIFM”) auto parts

and products markets.

Competitors include national, regional and local auto parts chains, independently owned parts stores, online parts

stores, jobbers, repair shops, car washes and auto dealers, in addition to discount and mass merchandise stores,

department stores, hardware stores, supermarkets, drugstores, convenience stores, home stores, and other online

retailers that sell aftermarket vehicle parts and supplies, chemicals, accessories, tools and maintenance parts.

AutoZone competes on the basis of customer service, including the trustworthy advice of our AutoZoners;

merchandise quality, selection and availability; price; product warranty; store layouts, location and convenience;

and the strength of our AutoZone brand name, trademarks and service marks.

10-K