AutoZone 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

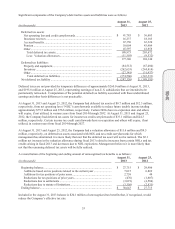

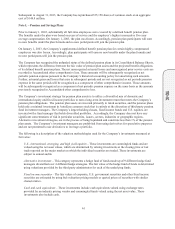

expired on April 20, 2012 and resulted in a loss of $2.8 million, which has been deferred in Accumulated other

comprehensive loss and will be reclassified to Interest expense over the life of the underlying debt. The hedges

remained highly effective until they expired, and no ineffectiveness was recognized in earnings.

At August 31, 2013, the Company had $11.8 million recorded in Accumulated other comprehensive loss related to

net realized losses associated with terminated interest rate swap and treasury rate lock derivatives which were

designated as hedging instruments. Net losses are amortized into Interest expense over the remaining life of the

associated debt. During the fiscal year ended August 31, 2013, the Company reclassified $1.3 million of net

losses from Accumulated other comprehensive loss to Interest expense. In the fiscal year ended August 25, 2012,

the Company reclassified $1.9 million of net losses from Accumulated other comprehensive loss to Interest

expense. The Company expects to reclassify $182 thousand of net losses from Accumulated other comprehensive

loss to Interest expense over the next 12 months.

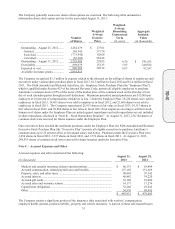

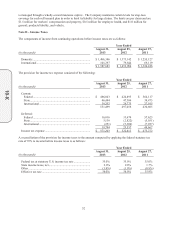

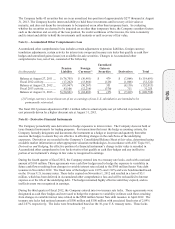

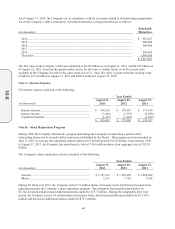

Note I – Financing

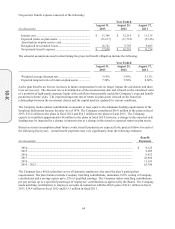

The Company’s debt consisted of the following:

(in thousands)

August 31,

2013

August 25,

2012

5.875% Senior Notes due October 2012, effective interest rate of 6.33% ........ $

–

$ 300,000

4.375% Senior Notes due June 2013, effective interest rate of 5.65% .............

–

200,000

6.500% Senior Notes due January 2014, effective interest rate of 6.63% ........ 500,000 500,000

5.750% Senior Notes due January 2015, effective interest rate of 5.89% ........ 500,000 500,000

5.500% Senior Notes due November 2015, effective interest rate of 4.86% .... 300,000 300,000

6.950% Senior Notes due June 2016, effective interest rate of 7.09% ............. 200,000 200,000

7.125% Senior Notes due August 2018, effective interest rate of 7.28% ......... 250,000 250,000

4.000% Senior Notes due November 2020, effective interest rate of 4.43% .... 500,000 500,000

3.700% Senior Notes due April 2022, effective interest rate of 3.85% ............ 500,000 500,000

2.875% Senior Notes due January 2023, effective interest rate of 3.21% ........ 300,000

–

3.125% Senior Notes due July 2023, effective interest rate of 3.26% .............. 500,000

–

Commercial paper, weighted average interest rate of 0.29% and 0.42% at

August 31, 2013 and August 25, 2012, respectively .....................................

637,000

513,402

Unsecured, peso denominated borrowings, weighted average

interest rate of 4.57% at August 25, 2012 ..................................................

–

4,781

Total debt .......................................................................................................... 4,187,000 3,768,183

Less: Short-term borrowings ..................................................................... 173,733 49,881

Long-term debt ................................................................................................. $ 4,013,267 $ 3,718,302

As of August 31, 2013, $637 million of commercial paper borrowings and $326.3 million of the 6.500% Senior

Notes due January 2014 are classified as long-term in the accompanying Consolidated Balance Sheets as the

Company has the ability and intent to refinance on a long-term basis through available capacity in its revolving

credit facility. As of August 31, 2013, the Company had $963.3 million of availability under its $1.0 billion

revolving credit facility, expiring in September 2016 that would allow it to replace these short-term obligations

with long-term financing.

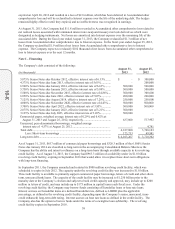

In September 2011, the Company amended and restated its $800 million revolving credit facility, which was

scheduled to expire in July 2012. The capacity under the revolving credit facility was increased to $1.0 billion.

This credit facility is available to primarily support commercial paper borrowings, letters of credit and other short-

term, unsecured bank loans. The capacity of the credit facility may be increased to $1.250 billion prior to the

maturity date at the Company’s election and subject to bank credit capacity and approval, may include up to $200

million in letters of credit, and may include up to $175 million in capital leases each fiscal year. Under the

revolving credit facility, the Company may borrow funds consisting of Eurodollar loans or base rate loans.

Interest accrues on Eurodollar loans at a defined Eurodollar rate, defined as LIBOR plus the applicable

percentage, as defined in the revolving credit facility, depending upon the Company’s senior, unsecured, (non-

credit enhanced) long-term debt rating. Interest accrues on base rate loans as defined in the credit facility. The

Company also has the option to borrow funds under the terms of a swingline loan subfacility. The revolving

credit facility expires in September 2016.

10-K