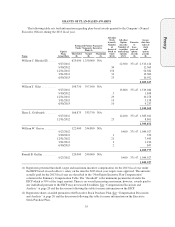

AutoZone 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

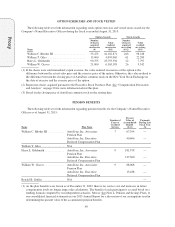

Prior to January 1, 2003, substantially all full-time AutoZone employees were covered by a defined benefit

pension plan, the AutoZone, Inc. Associates Pension Plan (the “Pension Plan”). The Pension Plan is a traditional

defined benefit pension plan which covered full-time AutoZone employees who were at least 21 years old and

had completed one year of service with the Company. The benefits under the Pension Plan were based on years

of service and the employee’s highest consecutive five-year average compensation. Compensation included total

annual earnings shown on Form W-2 plus any amounts directed on a tax-deferred basis into Company-

sponsored benefit plans, but did not include reimbursements or other expense allowances, cash or non-cash

fringe benefits, moving expenses, non-cash compensation (regardless of whether it resulted in imputed income),

long-term cash incentive payments, gain on exercise of stock options, payments under any insurance plan,

payments under any weekly-paid indemnity plan, payments under any long term disability plan, nonqualified

deferred compensation, or welfare benefits.

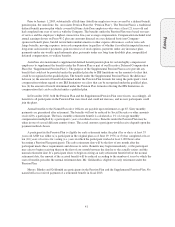

AutoZone also maintained a supplemental defined benefit pension plan for certain highly compensated

employees to supplement the benefits under the Pension Plan as part of our Executive Deferred Compensation

Plan (the “Supplemental Pension Plan”). The purpose of the Supplemental Pension Plan was to provide any

benefit that could not be provided under the qualified plan due to IRS limitations on the amount of salary that

could be recognized in the qualified plan. The benefit under the Supplemental Pension Plan is the difference

between (a) the amount of benefit determined under the Pension Plan formula but using the participant’s total

compensation without regard to any IRS limitations on salary that can be recognized under the qualified plan,

less (b) the amount of benefit determined under the Pension Plan formula reflecting the IRS limitations on

compensation that can be reflected under a qualified plan.

In December 2002, both the Pension Plan and the Supplemental Pension Plan were frozen. Accordingly, all

benefits to all participants in the Pension Plan were fixed and could not increase, and no new participants could

join the plans.

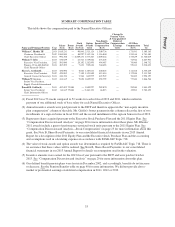

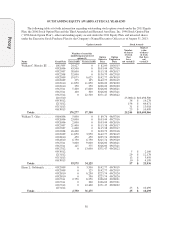

Annual benefits to the Named Executive Officers are payable upon retirement at age 65. Sixty monthly

payments are guaranteed after retirement. The benefits will not be reduced by Social Security or other amounts

received by a participant. The basic monthly retirement benefit is calculated as 1% of average monthly

compensation multiplied by a participant’s years of credited service. Benefits under the Pension Plan may be

taken in one of several different annuity forms. The actual amount a participant would receive depends upon the

payment method chosen.

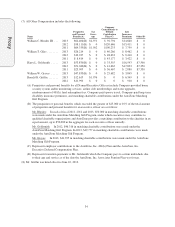

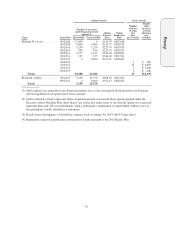

A participant in the Pension Plan is eligible for early retirement under the plan if he or she is at least 55

years old AND was either (a) a participant in the original plan as of June 19, 1976; or (b) has completed at least

ten (10) years of service for vesting (i.e. years in which the participant worked at least 1,000 hours after

becoming a Pension Plan participant). The early retirement date will be the first of any month after the

participant meets these requirements and chooses to retire. Benefits may begin immediately, or the participant

may elect to begin receiving them on the first of any month between the date he or she actually retires and the

normal retirement date. If a participant elects to begin receiving an early retirement benefit before the normal

retirement date, the amount of the accrued benefit will be reduced according to the number of years by which the

start of benefits precedes the normal retirement date. Mr. Goldsmith is eligible for early retirement under the

Pension Plan.

Messrs. Rhodes and Goldsmith are participants in the Pension Plan and the Supplemental Pension Plan. No

named officers received payment of a retirement benefit in fiscal 2013.

41