AutoZone 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

operations. We intend to continue to permanently reinvest the cash held outside of the U.S. in our foreign

operations.

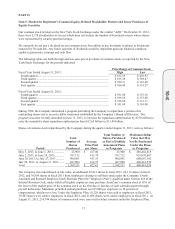

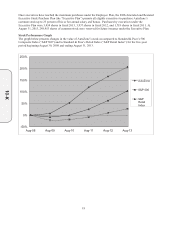

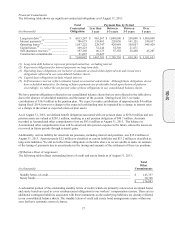

For the fiscal year ended August 31, 2013, our after-tax return on invested capital (“ROIC”) was 32.7% as

compared to 33.0% for the comparable prior year period. ROIC is calculated as after-tax operating profit

(excluding rent charges) divided by average invested capital (which includes a factor to capitalize operating

leases). The decrease in ROIC is primarily due to the acquisition of AutoAnything. We use ROIC to evaluate

whether we are effectively using our capital resources and believe it is an important indicator of our overall

operating performance.

Debt Facilities

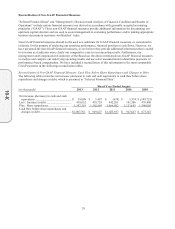

In September 2011, we amended and restated our $800 million revolving credit facility, which was scheduled to

expire in July 2012. The capacity under the revolving credit facility was increased to $1.0 billion. This credit

facility is available to primarily support commercial paper borrowings, letters of credit and other short-term,

unsecured bank loans. The capacity of the credit facility may be increased to $1.250 billion prior to the maturity

date at our election and subject to bank credit capacity and approval, may include up to $200 million in letters of

credit, and may include up to $175 million in capital leases each fiscal year. Under the revolving credit facility,

we may borrow funds consisting of Eurodollar loans or base rate loans. Interest accrues on Eurodollar loans at a

defined Eurodollar rate, defined as the London InterBank Offered Rate (“LIBOR”) plus the applicable percentage,

as defined in the revolving credit facility, depending upon our senior, unsecured, (non-credit enhanced) long-term

debt rating. Interest accrues on base rate loans as defined in the revolving credit facility. We also have the option

to borrow funds under the terms of a swingline loan subfacility. The revolving credit facility expires in

September 2016.

The revolving credit facility agreement requires that our consolidated interest coverage ratio as of the last day of

each quarter shall be no less than 2.50:1. This ratio is defined as the ratio of (i) consolidated earnings before

interest, taxes and rents to (ii) consolidated interest expense plus consolidated rents. Our consolidated interest

coverage ratio as of August 31, 2013 was 4.68:1.

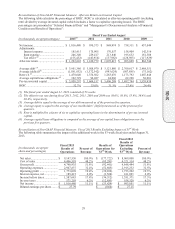

As of August 31, 2013, $637 million of commercial paper borrowings and $326.3 million of the 6.500% Senior

Notes due January 2014 are classified as long-term in the Consolidated Balance Sheets as we have the ability and

intent to refinance on a long-term basis through available capacity in our revolving credit facility. As of August

31, 2013, we had $963.3 million of availability under our $1.0 billion revolving credit facility, expiring in

September 2016 that would allow us to replace these short-term obligations with long-term financing.

In addition to the revolving credit facility, we also maintain a letter of credit facility that allows us to request the

participating bank to issue letters of credit on our behalf up to an aggregate amount of $100 million. As of August

31, 2013, we have $99.4 million in letters of credit outstanding under the letter of credit facility, which expires in

June 2016.

In addition to the outstanding letters of credit issued under the committed facilities discussed above, we had $41.8

million in letters of credit outstanding as of August 31, 2013. These letters of credit have various maturity dates

and were issued on an uncommitted basis.

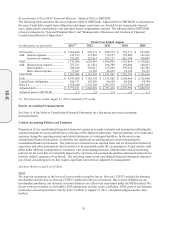

On April 29, 2013, we issued $500 million in 3.125% Senior Notes due July 2023 under our shelf registration

statement filed with the SEC on April 17, 2012 (the “Shelf Registration”). The Shelf Registration allows us to sell

an indeterminate amount in debt securities to fund general corporate purposes, including repaying, redeeming or

repurchasing outstanding debt and for working capital, capital expenditures, new store openings, stock

repurchases and acquisitions. Proceeds from the debt issuance on April 29, 2013, were used to repay a portion of

the outstanding commercial paper borrowings and for general corporate purposes. We used commercial paper

borrowings to repay the $200 million in 4.375% Senior Notes due June 2013.

On November 13, 2012, we issued $300 million in 2.875% Senior Notes due January 2023 under the Shelf

Registration. Proceeds from the debt issuance on November 13, 2012, were used to repay a portion of the

outstanding commercial paper borrowings, which were used to repay the $300 million in 5.875% Senior Notes

due in October 2012, and for general corporate purposes.

10-K