AutoZone 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

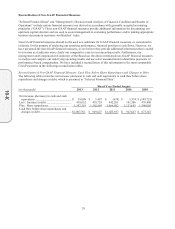

contingencies are influenced by items such as tax audits, changes in tax laws, litigation, appeals and prior

experience with similar tax positions. We regularly review our tax reserves for these items and assess the

adequacy of the amount we have recorded. As of August 31, 2013, we had approximately $35.4 million reserved

for uncertain tax positions.

We evaluate potential exposures associated with our various tax filings by estimating a liability for uncertain tax

positions based on a two-step process. The first step is to evaluate the tax position for recognition by determining

if the weight of available evidence indicates that it is more likely than not that the position will be sustained on

audit, including resolution of related appeals or litigation processes, if any. The second step requires us to estimate

and measure the tax benefit as the largest amount that is more than 50% likely to be realized upon ultimate

settlement.

We believe our estimates to be reasonable and have not experienced material adjustments to our reserves in the

previous three years; however, actual results could differ from our estimates, and we may be exposed to gains or

losses that could be material. Specifically, management has used judgment and made assumptions to estimate the

likely outcome of uncertain tax positions. Additionally, to the extent we prevail in matters for which a liability

has been established, or must pay in excess of recognized reserves, our effective tax rate in any particular period

could be materially affected.

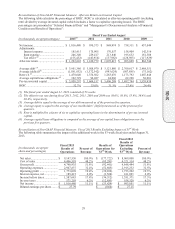

Pension Obligation

Prior to January 1, 2003, substantially all full-time employees were covered by a qualified defined benefit pension

plan. The benefits under the plan were based on years of service and the employee’s highest consecutive five-year

average compensation. On January 1, 2003, the plan was frozen. Accordingly, pension plan participants will earn

no new benefits under the plan formula and no new participants will join the pension plan. On January 1, 2003,

our supplemental, unqualified defined benefit pension plan for certain highly compensated employees was also

frozen. Accordingly, plan participants will earn no new benefits under the plan formula and no new participants

will join the pension plan. As the plan benefits are frozen, the annual pension expense and recorded liabilities are

not impacted by increases in future compensation levels, but are impacted by the use of two key assumptions in

the calculation of these balances:

Expected long-term rate of return on plan assets: For the fiscal year ended August 31, 2013, we have

assumed a 7.5% long-term rate of return on our plan assets. This estimate is a judgmental matter in which

management considers the composition of our asset portfolio, our historical long-term investment

performance and current market conditions. We review the expected long-term rate of return on an annual

basis, and revise it accordingly. Additionally, we monitor the mix of investments in our portfolio to ensure

alignment with our long-term strategy to manage pension cost and reduce volatility in our assets. At August

31, 2013, our plan assets totaled $208 million in our qualified plan. Our assets are generally valued using the

net asset values, which are determined by valuing investments at the closing price or last trade reported on the

major market on which the individual securities are traded. We have no assets in our nonqualified plan. A 50

basis point change in our expected long term rate of return would impact annual pension expense by

approximately $1 million for the qualified plan.

Discount rate used to determine benefit obligations: This rate is highly sensitive and is adjusted annually

based on the interest rate for long-term, high-quality, corporate bonds as of the measurement date using yields

for maturities that are in line with the duration of our pension liabilities. This same discount rate is also used

to determine pension expense for the following plan year. For fiscal 2013, we assumed a discount rate of

5.2%. A decrease in the discount rate increases our projected benefit obligation and pension expense. A 50

basis point change in the discount rate at August 31, 2013 would impact annual pension expense/income by

approximately $2 million for the qualified plan and $30 thousand for the nonqualified plan.

10-K