AutoZone 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

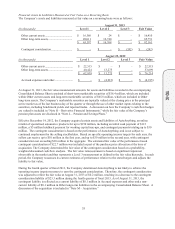

Marketable Securities: The Company invests a portion of its assets held by the Company’s wholly owned

insurance captive in marketable debt securities and classifies them as available-for-sale. The Company includes

these securities within the Other current assets and Other long-term assets captions in the accompanying

Consolidated Balance Sheets and records the amounts at fair market value, which is determined using quoted

market prices at the end of the reporting period. A discussion of marketable securities is included in “Note E –

Fair Value Measurements” and “Note F – Marketable Securities.”

Property and Equipment: Property and equipment is stated at cost. Depreciation and amortization are computed

principally using the straight-line method over the following estimated useful lives: buildings, 40 to 50 years;

building improvements, 5 to 15 years; equipment, 3 to 10 years; and leasehold improvements, over the shorter of

the asset’s estimated useful life or the remaining lease term, which includes any reasonably assured renewal

periods. Depreciation and amortization include amortization of assets under capital lease.

Impairment of Long-Lived Assets: The Company evaluates the recoverability of its long-lived assets whenever

events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. When such

an event occurs, the Company compares the sum of the undiscounted expected future cash flows of the asset

(asset group) with the carrying amounts of the asset. If the undiscounted expected future cash flows are less than

the carrying value of the assets, the Company measures the amount of impairment loss as the amount by which the

carrying amount of the assets exceeds the fair value of the assets. There were no material impairment losses

recorded in the three years ended August 31, 2013.

Goodwill: The cost in excess of fair value of identifiable net assets of businesses acquired is recorded as

goodwill. Goodwill has not been amortized since fiscal 2001, but an analysis is performed at least annually to

compare the fair value of the reporting unit to the carrying amount to determine if any impairment exists. The

Company performs its annual impairment assessment in the fourth quarter of each fiscal year, unless

circumstances dictate more frequent assessments. Refer to “Note N – Goodwill and Intangibles” for additional

disclosures regarding the Company’s goodwill and impairment assessment.

Intangible Assets: Intangible assets consist of assets from the acquisition of AutoAnything, and include

technology, noncompete agreements, customer relationships and trade name. Intangible assets are amortized over

periods ranging from 5 to 10 years. Non-amortizing intangibles are reviewed at least annually for impairment by

comparing the carrying amount to fair value. The Company performs its annual impairment assessment in the

fourth quarter of each fiscal year, unless circumstances dictate more frequent assessments. Refer to “Note N –

Goodwill and Intangibles” for additional disclosures regarding the Company’s intangible assets and impairment

assessment.

Derivative Instruments and Hedging Activities: AutoZone is exposed to market risk from, among other things,

changes in interest rates, foreign exchange rates and fuel prices. From time to time, the Company uses various

derivative instruments to reduce such risks. To date, based upon the Company’s current level of foreign

operations, no derivative instruments have been utilized to reduce foreign exchange rate risk. All of the

Company’s hedging activities are governed by guidelines that are authorized by AutoZone’s Board of Directors

(the “Board”). Further, the Company does not buy or sell derivative instruments for trading purposes.

AutoZone’s financial market risk results primarily from changes in interest rates. At times, AutoZone reduces its

exposure to changes in interest rates by entering into various interest rate hedge instruments such as interest rate

swap contracts, treasury lock agreements and forward-starting interest rate swaps. All of the Company’s interest

rate hedge instruments are designated as cash flow hedges. Refer to “Note H – Derivative Financial Instruments”

for additional disclosures regarding the Company’s derivative instruments and hedging activities. Cash flows

related to these instruments designated as qualifying hedges are reflected in the accompanying Consolidated

Statements of Cash Flows in the same categories as the cash flows from the items being hedged. Accordingly,

cash flows relating to the settlement of interest rate derivatives hedging the forecasted issuance of debt have been

reflected upon settlement as a component of financing cash flows. The resulting gain or loss from such settlement

is deferred to Accumulated other comprehensive loss and reclassified to interest expense over the term of the

underlying debt. This reclassification of the deferred gains and losses impacts the interest expense recognized on

the underlying debt that was hedged and is therefore reflected as a component of operating cash flows in periods

subsequent to settlement.

10-K