AutoZone 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

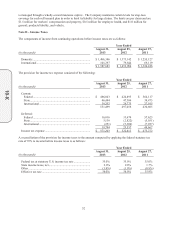

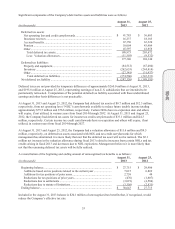

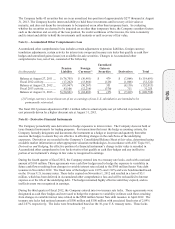

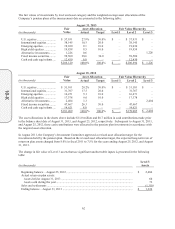

Financial Assets & Liabilities Measured at Fair Value on a Recurring Basis

The Company’s assets and liabilities measured at fair value on a recurring basis were as follows:

August 31, 2013

(in thousands) Level 1 Level 2 Level 3 Fair Value

Other current assets ..................................... $ 16,386 $ 24 $ – $ 16,410

Other long-term assets ................................ 49,011 16,740 – 65,751

$ 65,397 $ 16,764 $ – $ 82,161

Contingent consideration ............................ $ – $ – $ (242) $ (242)

August 25, 2012

(in thousands) Level 1 Level 2 Level 3 Fair Value

Other current assets ...................................... $ 22,515 $ – $ – $ 22,515

Other long-term assets ................................. 40,424 13,275 – 53,699

$ 62,939 $ 13,275 $ – $ 76,214

Accrued expenses and other ......................... $ – $ (4,915) $ – $ (4,915)

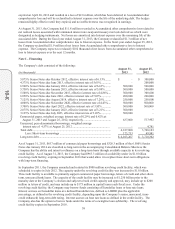

At August 31, 2013, the fair value measurement amounts for assets and liabilities recorded in the accompanying

Consolidated Balance Sheet consisted of short-term marketable securities of $16.4 million, which are included

within Other current assets and long-term marketable securities of $65.8 million, which are included in Other

long-term assets. The Company’s marketable securities are typically valued at the closing price in the principal

active market as of the last business day of the quarter or through the use of other market inputs relating to the

securities, including benchmark yields and reported trades. A discussion on how the Company’s cash flow hedges

are valued is included in “Note H – Derivative Financial Instruments,” while the fair value of the Company’s

pension plan assets are disclosed in “Note L – Pension and Savings Plans.”

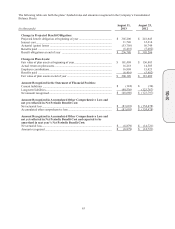

Effective December 19, 2012, the Company acquired certain assets and liabilities of AutoAnything, an online

retailer of specialized automotive products for up to $150 million, including an initial cash payment of $115

million, a $5 million holdback payment for working capital true-ups, and contingent payments totaling up to $30

million. The contingent consideration is based on the performance of AutoAnything, and is not subject to

continued employment by the selling stockholders. Based on specific operating income targets for each year, the

sellers can receive up to $10 million in the first year, and up to $30 million in the second year, with contingent

consideration not exceeding $30 million in the aggregate. The estimated fair value of the performance-based

contingent consideration of $22.7 million was included as part of the purchase price allocation at the time of

acquisition. The Company determined the fair value of the contingent consideration based on a probability-

weighted discounted cash flow analysis. The fair value remeasurement is based on significant inputs not

observable in the market and thus represents a Level 3 measurement as defined in the fair value hierarchy. In each

period, the Company reassesses its current estimates of performance relative to the stated targets and adjusts the

liability to fair value.

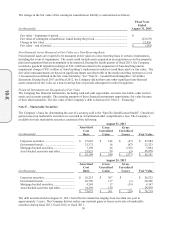

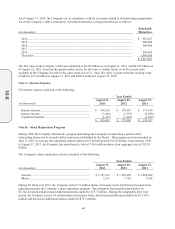

During the fourth quarter of fiscal 2013, the Company determined AutoAnything is not likely to achieve the

operating income targets necessary to earn the contingent consideration. Therefore, the contingent consideration

was adjusted to reflect the fair value at August 31, 2013 of $0.2 million, resulting in a decrease to the contingent

consideration liability of $23.3 million during the fourth quarter of fiscal 2013. As of August 31, 2013, the

contingent liability is reflected as a current liability of $0.1 million in Accrued expenses and other and a non-

current liability of $0.1 million in Other long-term liabilities in the accompanying Consolidated Balance Sheet. A

discussion of the acquisition is included in “Note M – Acquisition.”

10-K