AutoZone 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

As of August 31, 2013, the Company was in compliance with all covenants related to its borrowing arrangements.

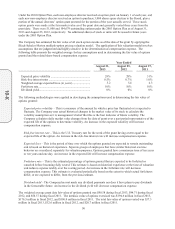

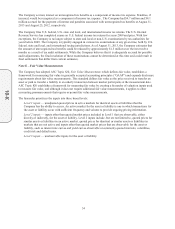

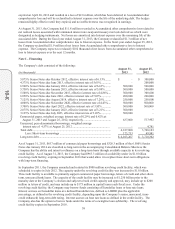

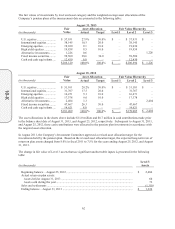

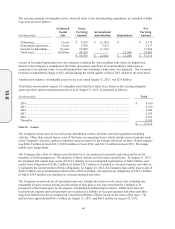

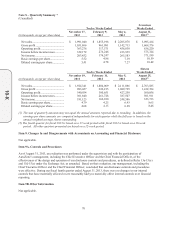

All of the Company’s debt is unsecured. Scheduled maturities of long-term debt are as follows:

(in thousands)

Scheduled

Maturities

2014 ............................................................................................................................................. $ 963,267

2015 ............................................................................................................................................. 500,000

2016 ............................................................................................................................................. 500,000

2017 ............................................................................................................................................. -

2018 ............................................................................................................................................. 250,000

Thereafte

r

..................................................................................................................................... 1,800,000

$ 4,013,267

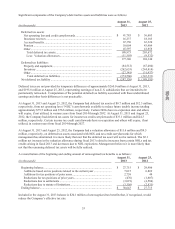

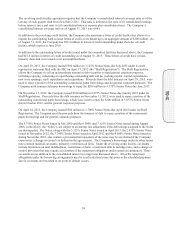

The fair value of the Company’s debt was estimated at $4.259 billion as of August 31, 2013, and $4.055 billion as

of August 25, 2012, based on the quoted market prices for the same or similar issues or on the current rates

available to the Company for debt of the same terms (Level 2). Such fair value is greater than the carrying value

of debt by $72.2 million at August 31, 2013 and $286.6 million at August 25, 2012.

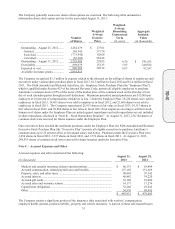

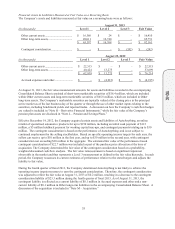

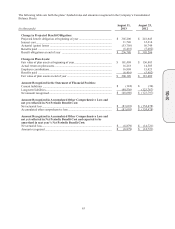

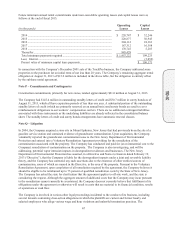

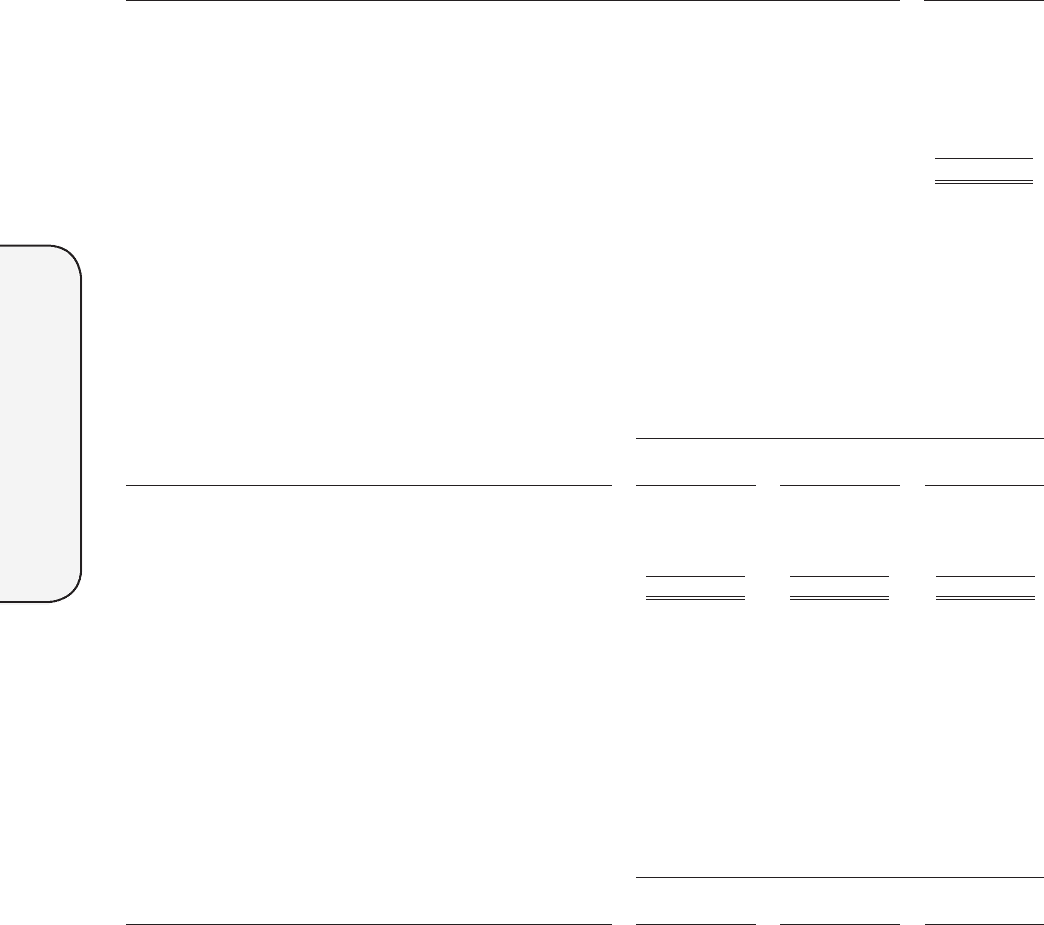

Note J – Interest Expense

Net interest expense consisted of the following:

Year Ended

(in thousands)

August 31,

2013

August 25,

2012

August 27,

2011

Interest expense ................................................................... $ 188,324 $ 178,547 $ 173,674

Interest income .................................................................... ( 1,606) (1,397) (2,058)

Capitalized interest .............................................................. (1,303 ) (1,245) (1,059)

$185,415 $175,905

$ 170,557

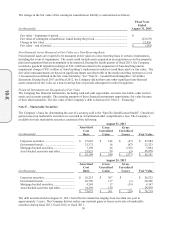

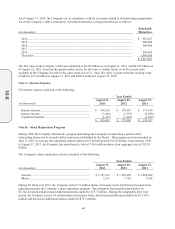

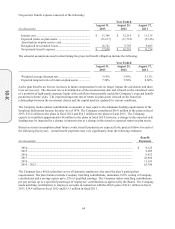

Note K – Stock Repurchase Program

During 1998, the Company announced a program permitting the Company to repurchase a portion of its

outstanding shares not to exceed a dollar maximum established by the Board. The program was last amended on

June 11, 2013 to increase the repurchase authorization to $13.40 billion from $12.65 billion. From January 1998

to August 31, 2013, the Company has repurchased a total of 134.6 million shares at an aggregate cost of $12.93

billion.

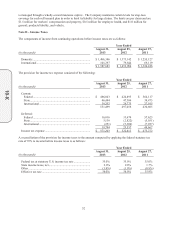

The Company’s share repurchase activity consisted of the following:

Year Ended

(in thousands)

August 31,

2013

August 25,

2012

August 27,

2011

Amount ............................................................................... $ 1,387,315 $ 1,362,869 $ 1,466,802

Shares .................................................................................. 3,511 3,795 5,598

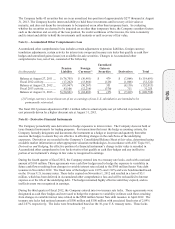

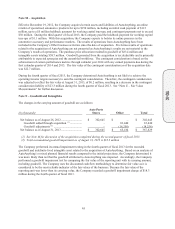

During the fiscal year 2013, the Company retired 3.9 million shares of treasury stock which had previously been

repurchased under the Company’s share repurchase program. The retirement increased Retained deficit by

$1,362.2 million and decreased Additional paid-in capital by $75.7 million. During the comparable prior year

period, the Company retired 4.9 million shares of treasury stock, which increased Retained deficit by $1,319.6

million and decreased Additional paid-in capital by $72.5 million.

10-K