AutoZone 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

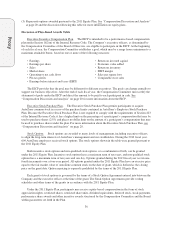

Proxy

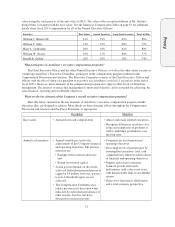

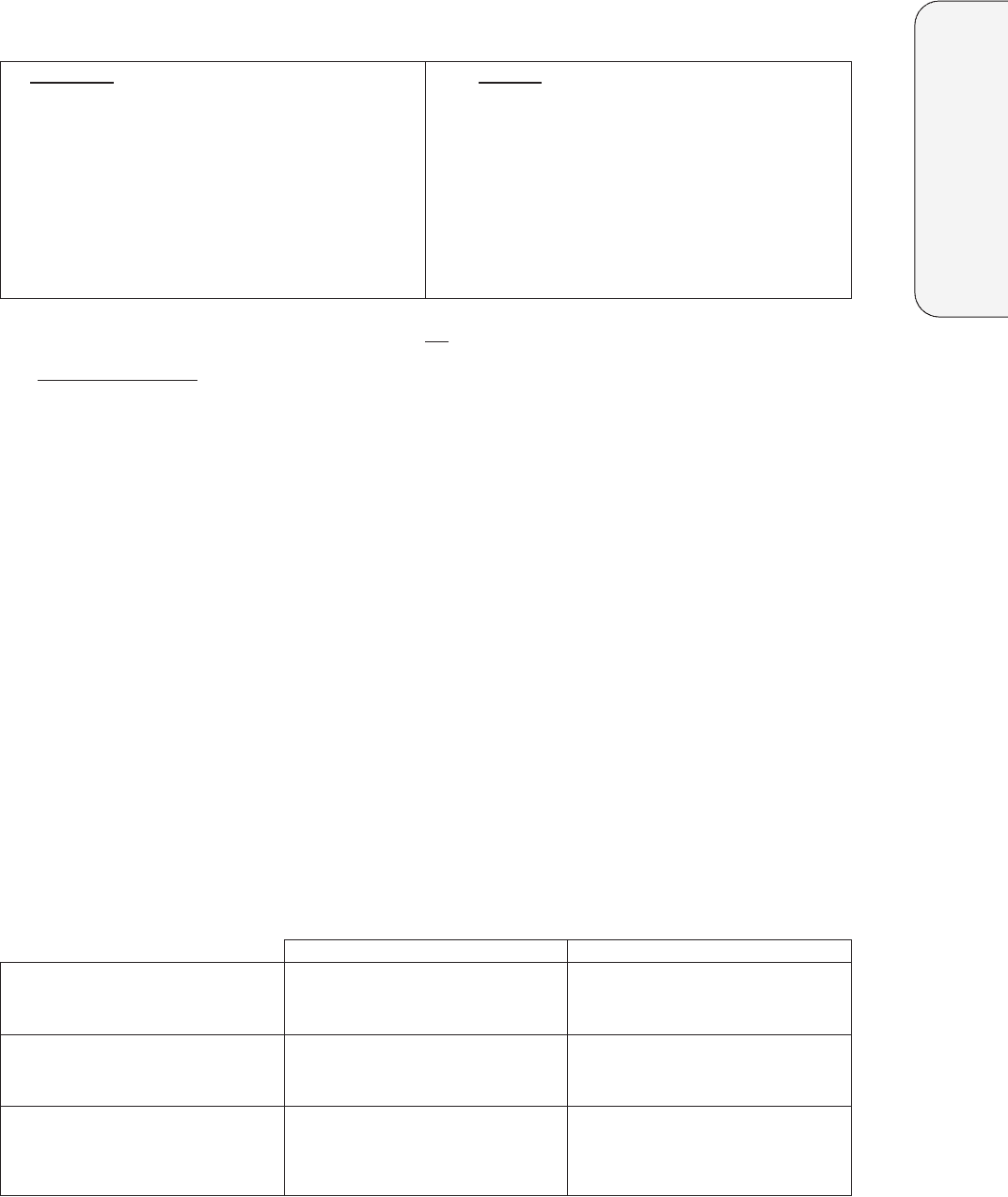

The purpose of this one-time award is to motivate continued high performance while enhancing the

retention characteristics of the compensation package applicable to the Chief Executive Officer:

Performance Retention

• The target financial measures, diluted earnings

per share and stock price, relate directly to

stockholder success.

• Achieving a payout under the award terms

requires continued and sustained high

performance.

• The potential realizable value of the award is

significant, while remaining balanced by other

elements of the compensation program to

mitigate against risk related to unintended

consequences.

• The terms of the grant require Mr. Rhodes to

remain actively employed at least through the

applicable vesting date, even if one or both of

the performance goals is reached prior to then.

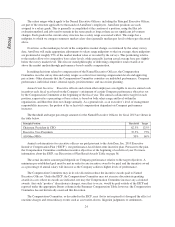

For more information about our stock-based plans, see Discussion of Plan-Based Awards Table on page 36.

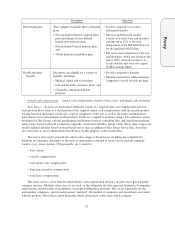

Stock purchase plans. AutoZone maintains the Employee Stock Purchase Plan which enables all

employees to purchase AutoZone common stock at a discount, subject to IRS-determined limitations. Based on

IRS rules, we limit the annual purchases in the Employee Stock Purchase Plan to no more than $15,000, and no

more than 10% of eligible compensation. To support and encourage stock ownership by our executives,

AutoZone also established a non-qualified stock purchase plan. The Fifth Amended and Restated AutoZone, Inc.

Executive Stock Purchase Plan (“Executive Stock Purchase Plan”) permits participants to acquire AutoZone

common stock in excess of the purchase limits contained in AutoZone’s Employee Stock Purchase Plan.

Because the Executive Stock Purchase Plan is not required to comply with the requirements of Section 423 of

the Internal Revenue Code, it has a higher limit on the percentage of a participant’s compensation that may be

used to purchase shares (25%) and places no dollar limit on the amount of a participant’s compensation that may

be used to purchase shares under the plan.

The Executive Stock Purchase Plan operates in a similar manner to the tax-qualified Employee Stock

Purchase Plan, in that it allows executives to contribute after-tax compensation for use in making quarterly

purchases of AutoZone common stock. Options are granted under the Executive Stock Purchase Plan each

calendar quarter and consist of two parts: a restricted share option and an unvested share option. Shares are

purchased under the restricted share option at 100% of the closing price of AutoZone stock at the end of the

calendar quarter (i.e., not at a discount), and a number of shares are issued under the unvested share option at no

cost to the executive, so that the total number of shares acquired upon exercise of both options is equivalent to

the number of shares that could have been purchased with the deferred funds at a price equal to 85% of the stock

price at the end of the quarter. The unvested shares are subject to forfeiture if the executive does not remain with

the company for one year after the grant date. After one year, the shares vest, and the executive owes taxes

based on the share price on the vesting date (unless a so-called 83(b) election was made on the date of grant).

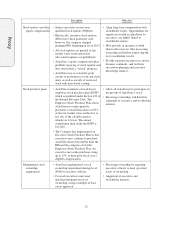

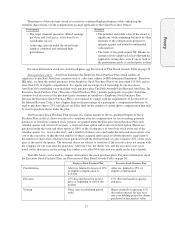

The table below can be used to compare and contrast the stock purchase plans. For more information about

the Executive Stock Purchase Plan, see Discussion of Plan-Based Awards Table on page 36.

Employee Stock Purchase Plan Executive Stock Purchase Plan

Contributions After tax, limited to lower of 10%

of eligible compensation or

$15,000

After tax, limited to 25% of

eligible compensation

Discount 15% discount based on lowest

price at beginning or end of the

quarter

15% discount based on quarter-

end price

Vesting None (one-year holding period

only)

Shares granted to represent 15%

discount restricted for one year;

one-year holding period for shares

purchased at fair market value

27