AutoZone 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

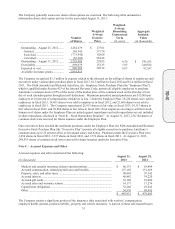

42

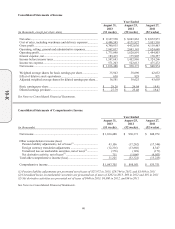

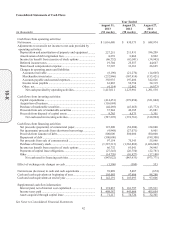

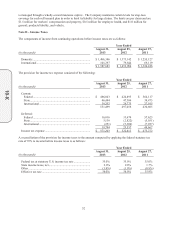

Consolidated Statements of Cash Flows

Year Ended

(in thousands)

August 31,

2013

(53 weeks)

August 25,

2012

(52 weeks)

August 27,

2011

(52 weeks)

Cash flows from operating activities:

Net income ...................................................................................... $ 1,016,480 $ 930,373 $ 848,974

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization of property and equipmen

t

.......... 227,251 211,831 196,209

Amortization of debt origination fees .......................................... 8,239 8,066 8,962

Income tax benefit from exercise of stock options ...................... (66,752) (63,041) (34,945)

Deferred income taxes ................................................................. 19,704 25,557 44,667

Share-based compensation expense ............................................. 37,307 33,363 26,625

Changes in operating assets and liabilities:

Accounts receivable ................................................................. (8,196) (21,276) (14,605)

Merchandise inventories .......................................................... (232,846) (167,914) (155,421)

Accounts payable and accrued expenses .................................. 356,935 197,406 342,826

Income taxes payable ............................................................... 61,003 56,754 34,319

Other, net .................................................................................. (4,114) 12,862 (6,073)

Net cash provided by operating activities ............................. 1,415,011 1,223,981 1,291,538

Cash flows from investing activities:

Capital expenditures .................................................................... (414,451) (378,054) (321,604)

Acquisition of business ................................................................ (116,084) – –

Purchase of marketable securities ................................................ (44,469) (45,665) (43,772)

Proceeds from sale of marketable securities ................................ 37,944 42,385 43,081

Proceeds from disposal of capital assets ...................................... 9,765 6,573 3,301

Net cash used in investing activities ..................................... (527,295) (374,761) (318,994)

Cash flows from financing activities:

Net proceeds (payments) of commercial paper ............................ 123,600 (54,200) 134,600

Net (payments) proceeds from short-term borrowings ................ (4,948) (27,071) 6,901

Proceeds from issuance of debt .................................................... 800,000 500,000 500,000

Repayment of debt ....................................................................... (500,000) – (199,300)

Net proceeds from sale of common stock .................................... 97,154 75,343 55,846

Purchase of treasury stock ........................................................... (1,387,315) (1,362,869) (1,466,802)

Income tax benefit from exercise of stock options ...................... 66,752 63,041 34,945

Payments of capital lease obligations .......................................... (27,545) (26,750) (22,781)

Other ............................................................................................ (14,720) (10,927) (17,180)

Net cash used in financing activities .................................... (847,022) (843,433) (973,771)

Effect of exchange rate changes on cash ......................................... (1,596) (300) 553

Net increase (decrease) in cash and cash equivalents ..................... 39,098 5,487 (674)

Cash and cash equivalents at beginning of year .............................. 103,093 97,606 98,280

Cash and cash equivalents at end of year ........................................ $ 142,191 $ 103,093 $ 97,606

Supplemental cash flow information:

Interest paid, net of interest cost capitalized ................................ $ 174,037 $ 161,797 $ 155,531

Income taxes paid ........................................................................ $ 498,587 $ 443,666 $ 405,654

Assets acquired through capital lease .......................................... $ 71,117 $ 74,726 $ 32,301

See Notes to Consolidated Financial Statements.

10-K