AutoZone 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

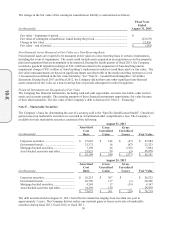

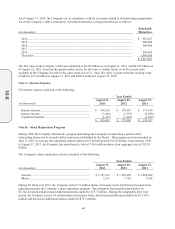

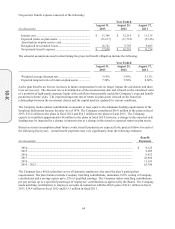

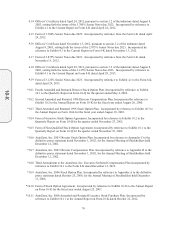

The carrying amounts of intangible assets, which all relate to the AutoAnything acquisition, are included in Other

long-term assets as follows:

(in thousands)

Estimated

Useful

Life

Gross

Carrying

Amount

Accumulated

Amortization

Impairment

Net

Carrying

Amount

Technology ....................... 5 years $ 9,700 $ (1,365) $ – $ 8,335

Noncompete agreement .... 5 years 1,300 (183) – 1,117

Customer relationships ..... 10 years 19,000 (1,336) – 17,664

Trade name ....................... Indefinite 28,700 – (4,100) 24,600

$ 58,700 $ (2,884) $ (4,100) $ 51,716

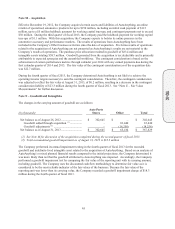

As part of its annual impairment test, the Company evaluated the AutoAnything trade name for impairment.

Based on the Company’s evaluation of the future discounted cash flows of AutoAnything’s trade name as

compared to its carrying value, it was determined that AutoAnything’s trade name was impaired. The Company

recorded an impairment charge of $4.1 million during the fourth quarter of fiscal 2013 related to the trade name.

Amortization expense of intangible assets for the year ended August 31, 2013, was $2.9 million.

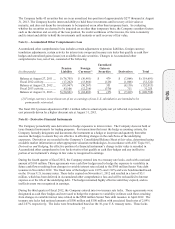

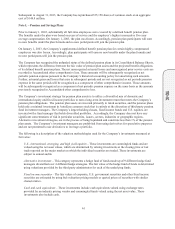

Total future amortization expense for intangible assets that have finite lives, based on the existing intangible

assets and their current estimated useful lives as of August 31, 2013, is estimated as follows:

(in thousands)

Total

2014 ........................................................................................................................................... $ 4,100

2015 ........................................................................................................................................... 4,100

2016 ........................................................................................................................................... 4,100

2017 ........................................................................................................................................... 4,100

2018 ........................................................................................................................................... 2,553

Thereafter .................................................................................................................................. 8,163

$ 27,116

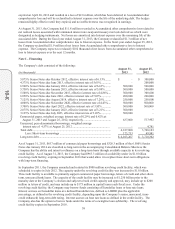

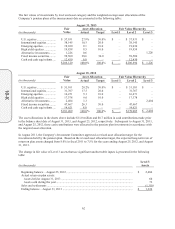

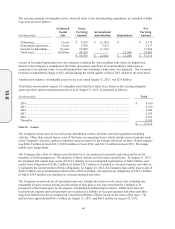

Note O – Leases

The Company leases some of its retail stores, distribution centers, facilities, land and equipment, including

vehicles. Other than vehicle leases, most of the leases are operating leases, which include renewal options made

at the Company’s election, options to purchase and provisions for percentage rent based on sales. Rental expense

was $246.3 million in fiscal 2013, $229.4 million in fiscal 2012, and $213.8 million in fiscal 2011. Percentage

rentals were insignificant.

The Company has a fleet of vehicles used for delivery to its commercial customers and stores and travel for

members of field management. The majority of these vehicles are held under capital lease. At August 31, 2013,

the Company had capital lease assets of $107.5 million, net of accumulated amortization of $44.8 million, and

capital lease obligations of $106.2 million, of which $32.2 million is classified as Accrued expenses and other as

it represents the current portion of these obligations. At August 25, 2012, the Company had capital lease assets of

$104.2 million, net of accumulated amortization of $36.4 million, and capital lease obligations of $102.3 million,

of which $29.8 million was classified as Accrued expenses and other.

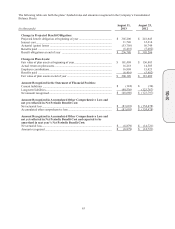

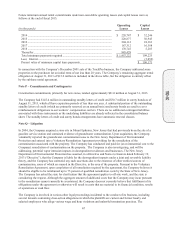

The Company records rent for all operating leases on a straight-line basis over the lease term, including any

reasonably assured renewal periods and the period of time prior to the lease term that the Company is in

possession of the leased space for the purpose of installing leasehold improvements. Differences between

recorded rent expense and cash payments are recorded as a liability in Accrued expenses and other and Other

long-term liabilities in the accompanying Consolidated Balance Sheets, based on the terms of the lease. The

deferred rent approximated $96.5 million on August 31, 2013, and $86.9 million on August 25, 2012.

10-K