AutoZone 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

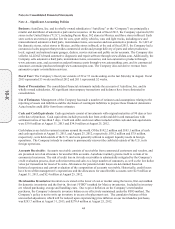

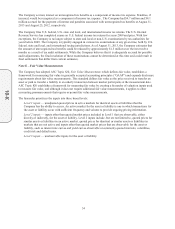

Warranty Costs: The Company or the vendors supplying its products provides the Company’s customers limited

warranties on certain products that range from 30 days to lifetime. In most cases, the Company’s vendors are

primarily responsible for warranty claims. Warranty costs relating to merchandise sold under warranty not

covered by vendors are estimated and recorded as warranty obligations at the time of sale based on each product’s

historical return rate. These obligations, which are often funded by vendor allowances, are recorded within the

Accrued expenses and other caption in the Consolidated Balance Sheets. For vendor allowances that are in excess

of the related estimated warranty expense for the vendor’s products, the excess is recorded in inventory and

recognized as a reduction to cost of sales as the related inventory is sold.

Shipping and Handling Costs: The Company does not generally charge customers separately for shipping and

handling. Substantially all the costs the Company incurs to ship products to our stores are included in cost of

sales.

Pre-opening Expenses: Pre-opening expenses, which consist primarily of payroll and occupancy costs, are

expensed as incurred.

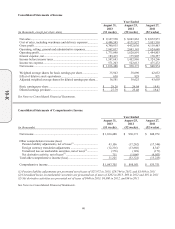

Earnings per Share: Basic earnings per share is based on the weighted average outstanding common shares.

Diluted earnings per share is based on the weighted average outstanding common shares adjusted for the effect of

common stock equivalents, which are primarily stock options. There were 8,600 stock options excluded from the

diluted earnings per share computation that would have been anti-dilutive as of August 31, 2013. There were

30,000 options excluded for the year ended August 25, 2012, and no options excluded for the year ended August

27, 2011.

Share-Based Payments: Share-based payments include stock option grants and certain other transactions under

the Company’s stock plans. The Company recognizes compensation expense for its share-based payments based

on the fair value of the awards. See “Note B – Share-Based Payments” for further discussion.

Risk and Uncertainties: In fiscal 2013, one class of similar products accounted for 10 percent of the Company’s

total revenues, and no vendor supplied more than 10 percent of the Company’s total purchases.

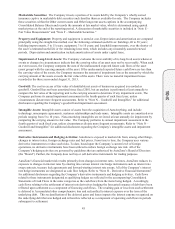

Recently Adopted Accounting Pronouncements: In August 2011, the Financial Accounting Standards Board

(“FASB”) issued Accounting Standards Update (“ASU”) 2011-08, Intangibles – Goodwill and Other, which

amends Accounting Standards Codification (“ASC”) Topic 350, Intangibles – Goodwill and Other. The purpose

of ASU 2011-08 is to simplify how an entity tests goodwill for impairment. Entities will assess qualitative factors

to determine whether it is more likely than not that a reporting unit’s fair value is less than its carrying value. In

instances where the fair value is determined to be less than the carrying value, entities will perform the two-step

quantitative goodwill impairment test. The Company adopted this standard effective August 31, 2013, and it had

no impact on the consolidated financial statements.

Recently Issued Accounting Pronouncements: In July 2012, the FASB issued ASU 2012-02, Testing Indefinite-

Lived Intangible Assets for Impairment. The purpose of ASU 2012-02 is to simplify how an entity tests for

impairment of indefinite-lived intangible assets. Entities will assess qualitative factors to determine whether it is

more likely than not that a long-lived intangible asset’s fair value is less than its carrying value. In instances

where the fair value is determined to be less than the carrying value, entities will perform the two-step quantitative

goodwill impairment test. The Company does not expect the provision of ASU 2012-02 to have a material impact

on its consolidated financial statements. This update will be effective for the Company at the beginning of its

fiscal 2014 year.

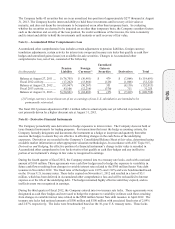

In February 2013, the FASB issued ASU 2013-02, Reporting of Amounts Reclassified Out of Accumulated Other

Comprehensive Income. Under ASU 2013-02, an entity is required to provide information about the amounts

reclassified out of accumulated other comprehensive income (“AOCI”) by component. In addition, an entity is

required to present, either on the face of the financial statements or in the notes, significant amounts reclassified

out of AOCI by the respective line items of net income, but only if the amount reclassified is required to be

reclassified in its entirety in the same reporting period. For amounts that are not required to be reclassified in their

entirety to net income, an entity is required to cross-reference to other disclosures that provide additional details

about those amounts. ASU 2013-02 does not change the current requirements for reporting net income or other

comprehensive income in the financial statements. The Company does not expect the provision of ASU 2013-02

10-K