AutoZone 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

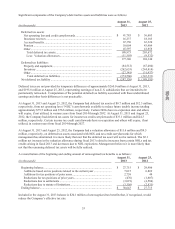

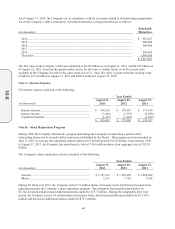

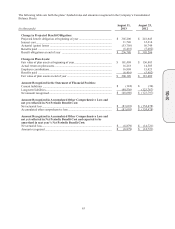

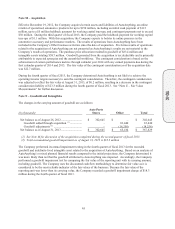

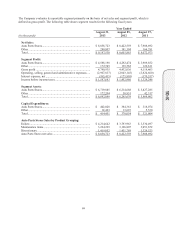

The following table sets forth the plans’ funded status and amounts recognized in the Company’s Consolidated

Balance Sheets:

(in thousands)

August 31,

2013

August 25,

2012

Chan

g

e in Pro

j

ected Benefit Obli

g

ation:

Projected benefit obligation at beginning of year ...........................................

.

$305,206

$ 241,645

Interest cost .....................................................................................................

.

11,746 12,214

Actuarial (gains) losses ..................................................................................

.

(53,756) 56,749

Benefits paid ..................................................................................................

.

(6,416) (5,402)

Benefit obligations at end of year ..................................................................

.

$256,780 $ 305,206

Chan

g

e in Plan Assets:

Fair value of plan assets at beginning of yea

r

.................................................

.

$181,409

$ 156,883

Actual return on plan assets ............................................................................

.

16,218 14,505

Employer contributions ...................................................................................

.

16,909 15,423

Benefits paid ..................................................................................................

.

(6,416) (5,402)

Fair value of plan assets at end of yea

r

...........................................................

.

$208,120 $ 181,409

Amount Reco

g

nized in the Statement of Financial Position:

Current liabilities ............................................................................................

.

$ (124) $ (30)

Long-term liabilities ........................................................................................

.

(48,536) (123,767)

Net amount recognized ...................................................................................

.

$(48,660) $ (123,797)

Amount Reco

g

nized in Accumulated Other Comprehensive Loss and

not

y

et reflected in Net Periodic Benefit Cost:

Net actuarial loss .............................................................................................

.

$(83,601) $ (154,678)

Accumulated other comprehensive loss ..........................................................

.

$(83,601) $ (154,678)

Amount Reco

g

nized in Accumulated Other Comprehensive Loss and

not yet reflected in Net Periodic Benefit Cost and expected to be

amortized in next

y

ear’s Net Periodic Benefit Cost:

Net actuarial loss .............................................................................................

.

$ (6,879) $ (14,721)

Amount recognized .........................................................................................

.

$ (6,879) $ (14,721)

10-K