AutoZone 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

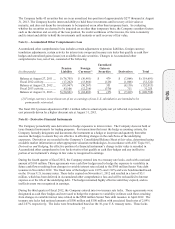

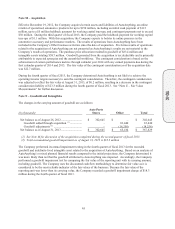

Note M – Acquisition

Effective December 19, 2012, the Company acquired certain assets and liabilities of AutoAnything, an online

retailer of specialized automotive products for up to $150 million, including an initial cash payment of $115

million, up to a $5 million holdback payment for working capital true-ups, and contingent payments not to exceed

$30 million. During the third quarter of fiscal 2013, the Company paid the holdback payment for working capital

true-ups of $1.1 million. With this acquisition, the Company expects to bolster its online presence in the

automotive accessory and performance markets. The results of operations from AutoAnything have been

included in the Company’s Other business activities since the date of acquisition. Pro forma results of operations

related to the acquisition of AutoAnything are not presented as AutoAnything’s results are not material to the

Company’s results of operations. The purchase price allocation resulted in goodwill of $83.4 million and

intangible assets totaling $58.7 million. Goodwill generated from the acquisition is tax deductible and is primarily

attributable to expected synergies and the assembled workforce. The contingent consideration is based on the

achievement of certain performance metrics through calendar year 2014 with any earned payments due during the

first calendar quarter of 2014 and 2015. The fair value of the contingent consideration as of the acquisition date

was $22.7 million.

During the fourth quarter of fiscal 2013, the Company determined AutoAnything is not likely to achieve the

operating income targets necessary to earn the contingent consideration. Therefore, the contingent consideration

was adjusted to reflect the fair value at August 31, 2013, of $0.2 million, resulting in a decrease in the contingent

consideration liability of $23.3 million during the fourth quarter of fiscal 2013. See “Note E – Fair Value

Measurements” for further discussion.

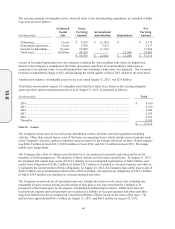

Note N – Goodwill and Intangibles

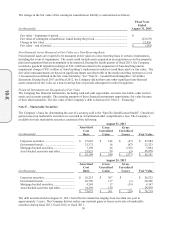

The changes in the carrying amount of goodwill are as follows:

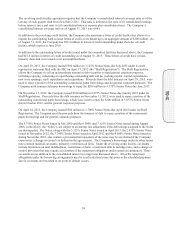

(in thousands)

Auto Parts

Stores

Other

Total

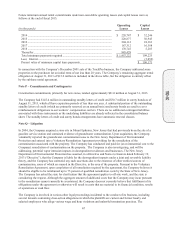

Net balance as of August 26, 2012 ............................ $ 302,645 $ – $ 302,645

Goodwill added through acquisition (1) ................ – 83,440 83,440

Goodwill adjustments (2) ...................................... – (18,256) (18,256)

Net balance as of August 31, 2013 ............................ $ 302,645 $ 65,184 $ 367,829

(1) See Note M for discussion of the acquisition completed during the second quarter of fiscal 2013

(2) Total accumulated goodwill impairment as of August 31, 2013 is $18.3 million

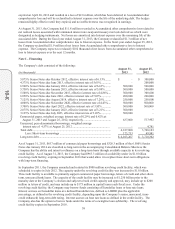

The Company performed its annual impairment testing in the fourth quarter of fiscal 2013 for the recorded

goodwill and indefinite-lived intangible asset related to the acquisition of AutoAnything. Based on an analysis of

AutoAnything’s revised planned financial results compared to the initial projections, the Company determined it

was more likely than not that the goodwill attributed to AutoAnything was impaired. Accordingly, the Company

performed a goodwill impairment test by comparing the fair value of the reporting unit with its carrying amount,

including goodwill. The Company uses the discounted cash flow methodology to determine fair value as it is

considered to be the most reliable indicator of the fair values of the business. Because the fair value of the

reporting unit was lower than its carrying value, the Company recorded a goodwill impairment charge of $18.3

million during the fourth quarter of fiscal 2013.

10-K