AutoZone 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

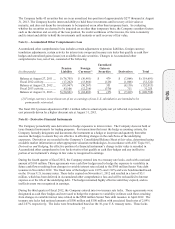

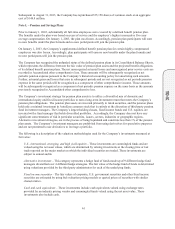

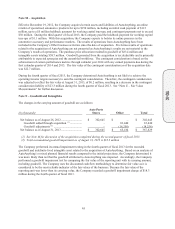

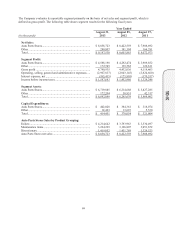

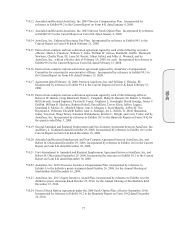

Future minimum annual rental commitments under non-cancelable operating leases and capital leases were as

follows at the end of fiscal 2013:

(in thousands)

Operating

Leases

Capital

Leases

2014 ................................................................................................................

.

$228,747

$ 32,246

2015 ................................................................................................................

.

220,877 30,943

2016 ................................................................................................................

.

204,112 24,363

2017 ................................................................................................................

.

187,312 16,388

2018 ................................................................................................................

.

170,745 5,283

Thereafte

r

........................................................................................................

.

945,429

–

Total minimum payments require

d

.................................................................

.

$ 1,957,222 109,223

Less: Interes

t

..................................................................................................

.

(3,052)

Present value of minimum capital lease payments..........................................

.

$ 106,171

In connection with the Company’s December 2001 sale of the TruckPro business, the Company subleased some

properties to the purchaser for an initial term of not less than 20 years. The Company’s remaining aggregate rental

obligation at August 31, 2013 of $15.6 million is included in the above table, but the obligation is entirely offset

by the sublease rental agreement.

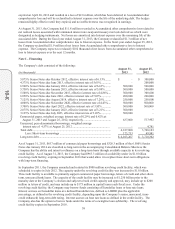

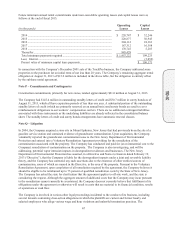

Note P – Commitments and Contingencies

Construction commitments, primarily for new stores, totaled approximately $21.0 million at August 31, 2013.

The Company had $145.4 million in outstanding standby letters of credit and $30.7 million in surety bonds as of

August 31, 2013, which all have expiration periods of less than one year. A substantial portion of the outstanding

standby letters of credit (which are primarily renewed on an annual basis) and surety bonds are used to cover

reimbursement obligations to our workers’ compensation carriers. There are no additional contingent liabilities

associated with these instruments as the underlying liabilities are already reflected in the consolidated balance

sheet. The standby letters of credit and surety bonds arrangements have automatic renewal clauses.

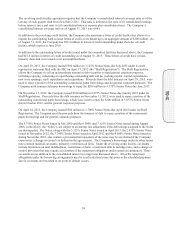

Note Q – Litigation

In 2004, the Company acquired a store site in Mount Ephraim, New Jersey that had previously been the site of a

gasoline service station and contained evidence of groundwater contamination. Upon acquisition, the Company

voluntarily reported the groundwater contamination issue to the New Jersey Department of Environmental

Protection and entered into a Voluntary Remediation Agreement providing for the remediation of the

contamination associated with the property. The Company has conducted and paid for (at an immaterial cost to the

Company) remediation of contamination on the property. The Company is also investigating, and will be

addressing, potential vapor intrusion impacts in downgradient residences and businesses. The New Jersey

Department of Environmental Protection has asserted, in a Directive and Notice to Insurers dated February 19,

2013 (“Directive”), that the Company is liable for the downgradient impacts under a joint and severable liability

theory, and the Company has contested any such assertions due to the existence of other entities/sources of

contamination, some of which are named in the Directive, in the area of the property. Pursuant to the Voluntary

Remediation Agreement, upon completion of all remediation required by the agreement, the Company believes it

should be eligible to be reimbursed up to 75 percent of qualified remediation costs by the State of New Jersey.

The Company has asked the state for clarification that the agreement applies to off-site work, and the state is

considering the request. Although the aggregate amount of additional costs that the Company may incur pursuant

to the remediation cannot currently be ascertained, the Company does not currently believe that fulfillment of its

obligations under the agreement or otherwise will result in costs that are material to its financial condition, results

of operations or cash flow.

The Company is involved in various other legal proceedings incidental to the conduct of its business, including

several lawsuits containing class-action allegations in which the plaintiffs are current and former hourly and

salaried employees who allege various wage and hour violations and unlawful termination practices. The

10-K