AutoZone 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

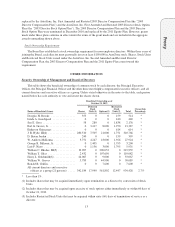

(4) Includes 213,010 shares pledged as security by Mr. Hyde. Includes 67,500 shares held by a charitable

foundation for which Mr. Hyde is an officer and a director and for which he shares investment and voting

power. Does not include 2,000 shares owned by Mr. Hyde’s wife.

(5) Includes 1,574 shares held as custodian for Mr. Rhodes’s children.

(6) Includes 1,200 shares held by trusts for which Mr. Goldsmith is a co-trustee and beneficiary and 200 shares

held by trusts for Mr. Goldsmith’s daughters. Does not include 1,000 shares owned by Mr. Goldsmith’s

mother.

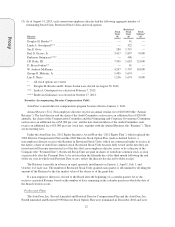

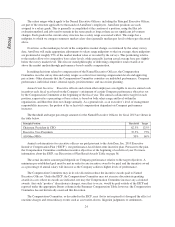

Security Ownership of Certain Beneficial Owners

The following entities are known by us to own more than five percent of our outstanding common stock:

Name and Address

of Beneficial Owner Shares

Ownership

Percentage(1)

T. Rowe Price Associates, Inc.(2) ................................

100 East Pratt Street

Baltimore, MD 21202

3,008,169 8.8%

JPMorgan Chase & Co.(3) .....................................

270 Park Avenue, 38th Floor

New York, NY 10017

2,686,574 7.9%

Wellington Management Co., LLP(4) ............................

280 Congress Street

Boston, MA 02210

1,982,668 5.8%

(1) The ownership percentages are calculated based on the number of shares of AutoZone common stock

outstanding as of October 21, 2013.

(2) The source of this information is the Form 13F filed by T. Rowe Price Associates, Inc. on August 15, 2013

for the quarter ending June 30, 2013.

(3) The source of this information is the Form 13F filed by JPMorgan Chase & Co. on August 13, 2013 for the

quarter ending June 30, 2013. The shares are beneficially owned by a group consisting of JP Morgan Asset

Management (2,017,342 shares); JPMorgan Asset Management (UK) Ltd., (324,968); JPMorgan Private

Bank (297,666 shares) and J.P. Morgan Securities, Inc. (46,598 shares).

(4) The source of this information is the Form 13F filed by Wellington Management Company, LLP on

August 14, 2013 for the quarter ending June 30, 2013.

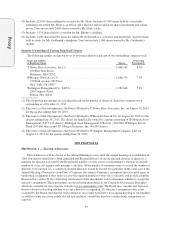

THE PROPOSALS

PROPOSAL 1 — Election of Directors

Eleven directors will be elected at the Annual Meeting to serve until the annual meeting of stockholders in

2014. Pursuant to AutoZone’s Fifth Amended and Restated Bylaws, in an uncontested election of directors, a

nominee for director is elected to the Board if the number of votes cast for such nominee’s election exceed the

number of votes cast against such nominee’s election. (If the number of nominees were to exceed the number of

directors to be elected, i.e., a contested election, directors would be elected by a plurality of the votes cast at the

Annual Meeting.) Pursuant to AutoZone’s Corporate Governance Principles, incumbent directors must agree to

tender their resignation if they fail to receive the required number of votes for re-election, and in such event the

Board will act within 90 days following certification of the shareholder vote to determine whether to accept the

director’s resignation. These procedures are described in more detail in our Corporate Governance Principles,

which are available on our corporate website at www.autozoneinc.com. The Board may consider any factors it

deems relevant in deciding whether to accept a director’s resignation. If a director’s resignation offer is not

accepted by the Board, that director will continue to serve until AutoZone’s next annual meeting of stockholders

or until his or her successor is duly elected and qualified, or until the director’s earlier death, resignation, or

removal.

14