AutoZone 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

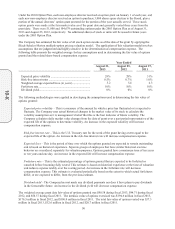

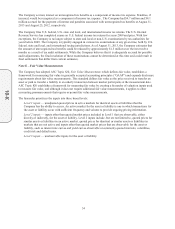

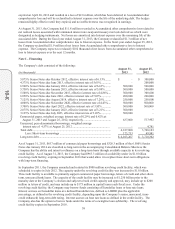

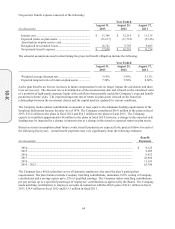

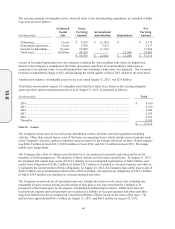

The change in the fair value of the contingent consideration liability is summarized as follows:

(in thousands)

Fiscal Year

Ended

August 31, 2013

Fair value – beginning of period ............................................................................................. $ –

Fair value of contingent consideration issued during the period ............................................ (22,678)

Change in fair value................................................................................................................ 22,436

Fair value – end of period ....................................................................................................... $ (242)

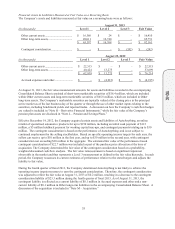

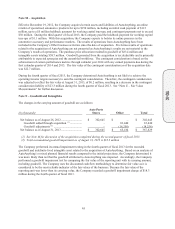

Non-Financial Assets Measured at Fair Value on a Non-Recurring Basis

Non-financial assets are required to be measured at fair value on a non-recurring basis in certain circumstances,

including the event of impairment. The assets could include assets acquired in an acquisition as well as property,

plant and equipment that are determined to be impaired. During the fourth quarter of fiscal 2013, the Company

recorded a goodwill impairment charge of $18.3 million related to the acquisition of AutoAnything and an

impairment charge of $4.1 million of AutoAnything’s trade name in order to record these assets at fair value. The

fair value remeasurements are based on significant inputs not observable in the market and thus represent a Level

3 measurement as defined in the fair value hierarchy. See “Note N – Goodwill and Intangibles” for further

discussion. During fiscal 2013 and fiscal 2012, the Company did not have any other significant non-financial

assets measured at fair value on a non-recurring basis in periods subsequent to initial recognition.

Financial Instruments not Recognized at Fair Value

The Company has financial instruments, including cash and cash equivalents, accounts receivable, other current

assets and accounts payable. The carrying amounts of these financial instruments approximate fair value because

of their short maturities. The fair value of the Company’s debt is disclosed in “Note I – Financing.”

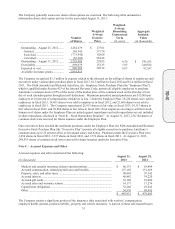

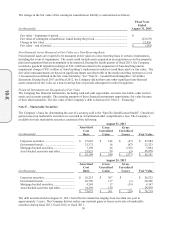

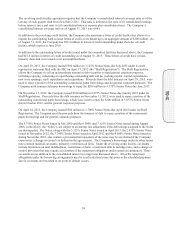

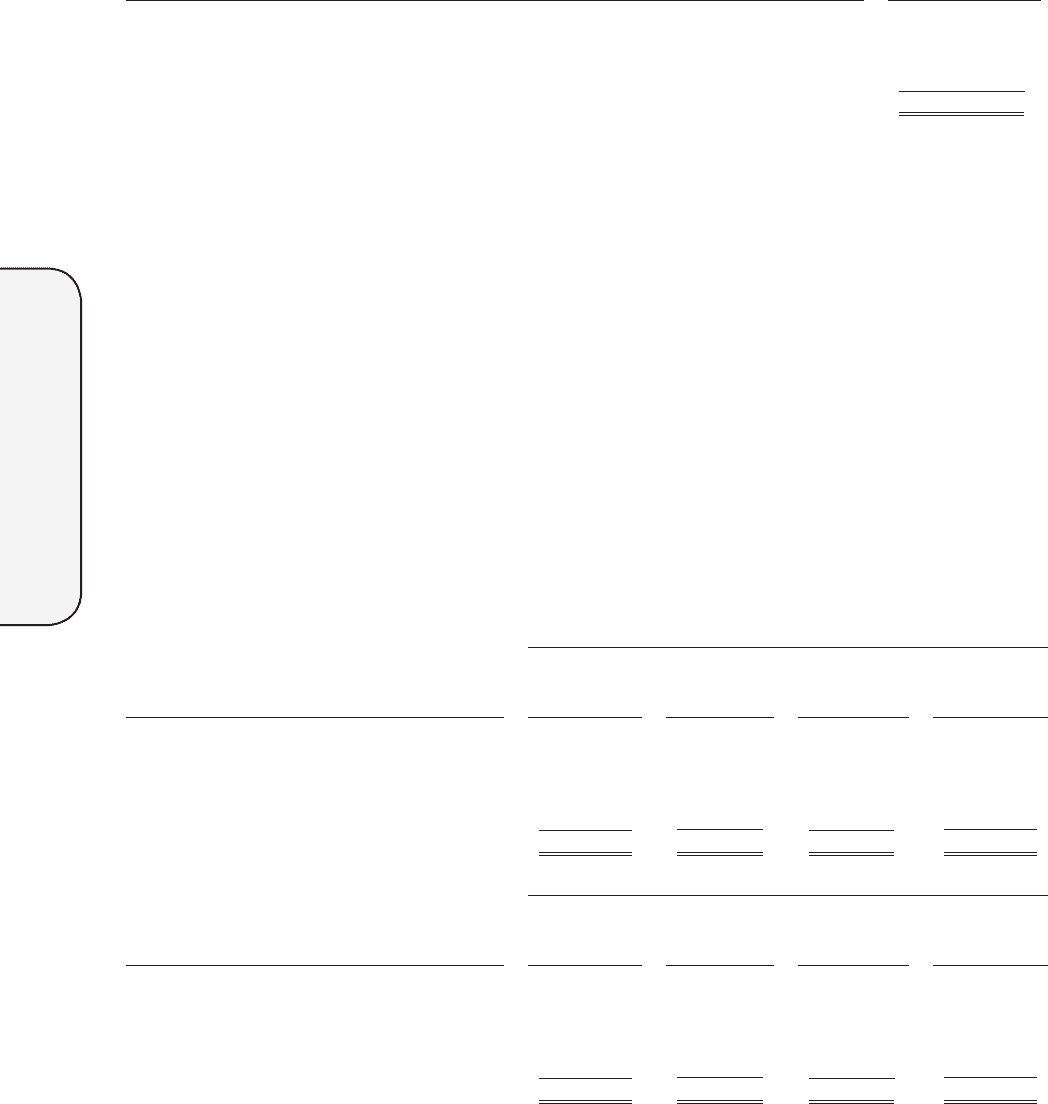

Note F – Marketable Securities

The Company’s basis for determining the cost of a security sold is the “Specific Identification Model”. Unrealized

gains (losses) on marketable securities are recorded in Accumulated other comprehensive loss. The Company’s

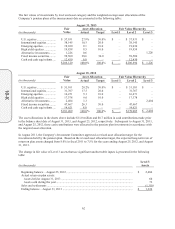

available-for-sale marketable securities consisted of the following:

August 31, 2013

(in thousands)

Amortized

Cost

Basis

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair Value

Corporate securities ........................................

.

$ 27,803 $ 148 $ (67) $ 27,884

Government bonds .........................................

.

21,372 18 (67) 21,323

Mortgage-backed securities ............................

.

7,198 24 (138) 7,084

Asset-backed securities and other ...................

.

25,825 50 (5) 25,870

$ 82,198 $ 240 $ (277) $ 82,161

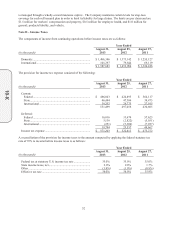

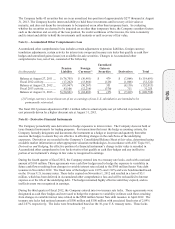

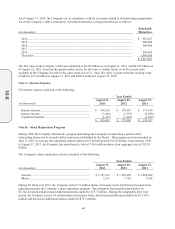

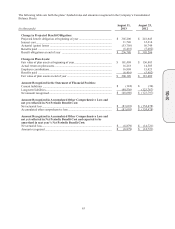

August 25, 2012

(in thousands)

Amortized

Cost

Basis

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair Value

Corporate securities ........................................

.

$ 26,215 $ 307 $ – $ 26,522

Government bonds .........................................

.

20,790 117 (1) 20,906

Mortgage-backed securities ............................

.

4,369 17 (19) 4,367

Asset-backed securities and other ...................

.

24,299 120 – 24,419

$ 75,673 $ 561 $ (20) $ 76,214

The debt securities held at August 31, 2013, had effective maturities ranging from less than one year to

approximately 3 years. The Company did not realize any material gains or losses on its sale of marketable

securities during fiscal 2013, fiscal 2012, or fiscal 2011.

10-K