AutoZone 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 AutoZone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

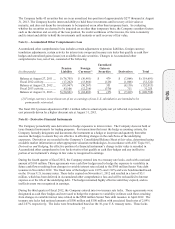

52

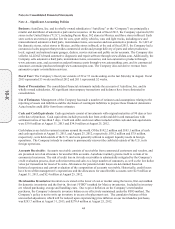

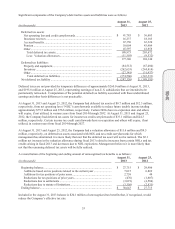

is managed through a wholly owned insurance captive. The Company maintains certain levels for stop-loss

coverage for each self-insured plan in order to limit its liability for large claims. The limits are per claim and are

$1.5 million for workers’ compensation and property, $0.5 million for employee health, and $1.0 million for

general, products liability, and vehicle.

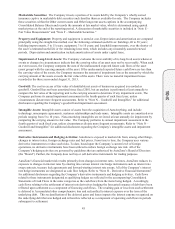

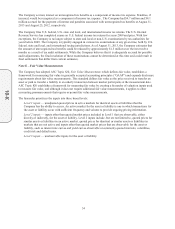

Note D – Income Taxes

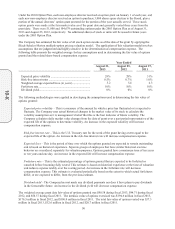

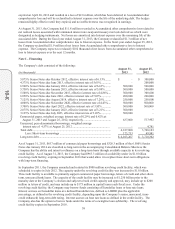

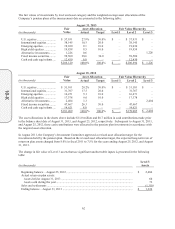

The components of income from continuing operations before income taxes are as follows:

Year Ended

(in thousands)

August 31,

2013

August 25,

2012

August 27,

2011

Domestic ............................................................................. $ 1,486,386 $ 1,373,142 $ 1,255,127

International ........................................................................ 101,297 79,844 69,119

$ 1,587,683 $ 1,452,986 $ 1,324,246

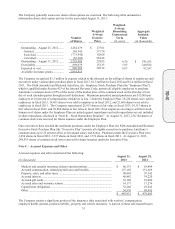

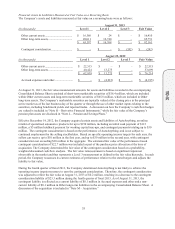

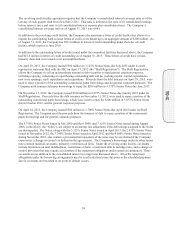

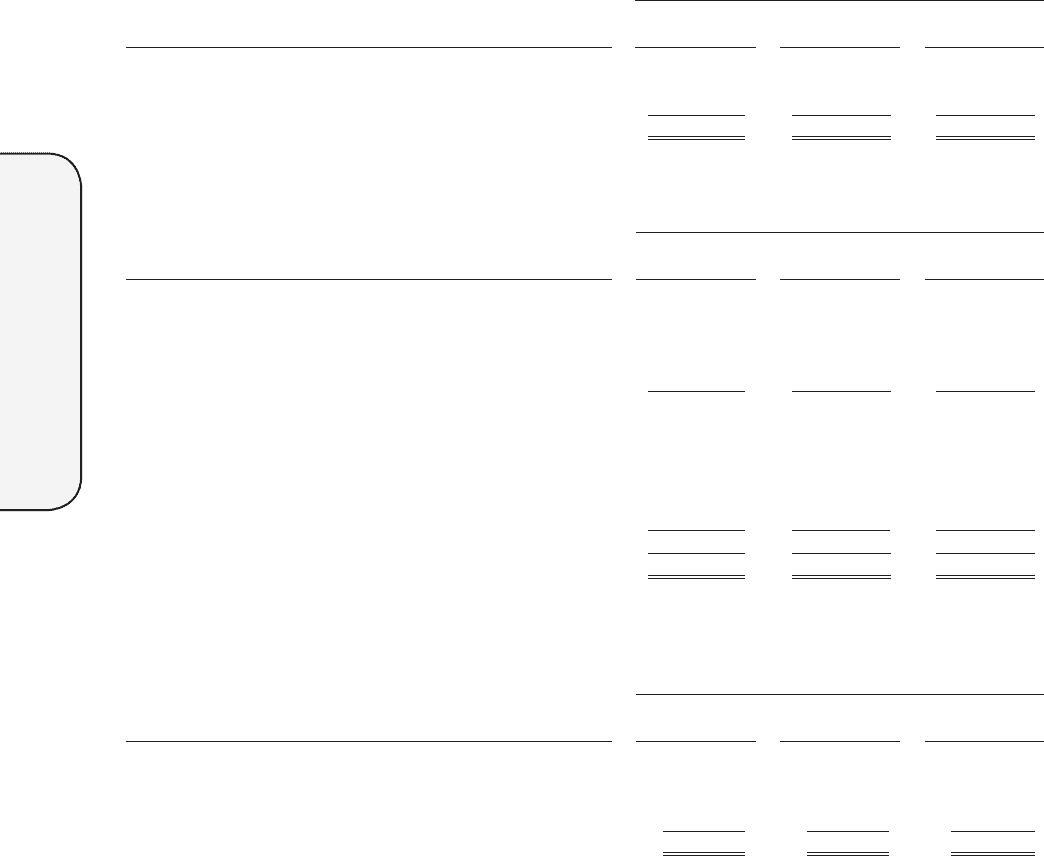

The provision for income tax expense consisted of the following:

Year Ended

(in thousands)

August 31,

2013

August 25,

2012

August 27,

2011

Current:

Federal ............................................................................. $ 466,803 $ 424,895 $ 364,117

State ................................................................................. 46,494 47,386 39,473

International ..................................................................... 38,202 24,775 27,015

551,499 497,056 430,605

Deferred:

Federal ............................................................................. 16,816 33,679 57,625

State ................................................................................. 3,139 (2,822) (5,031)

International ..................................................................... (251 ) (5,300) (7,927)

19,704 25,557 44,667

Income tax expense ............................................................. $ 571,203 $ 522,613 $ 475,272

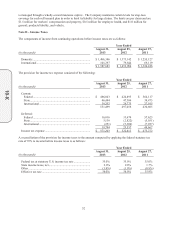

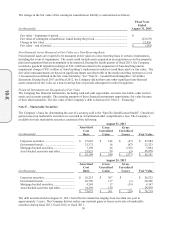

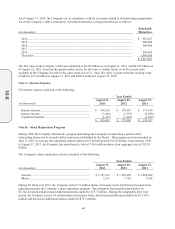

A reconciliation of the provision for income taxes to the amount computed by applying the federal statutory tax

rate of 35% to income before income taxes is as follows:

Year Ended

(in thousands)

August 31,

2013

August 25,

2012

August 27,

2011

Federal tax at statutory U.S. income tax rate ...................... 35.0% 35.0% 35.0%

State income taxes, net ........................................................ 2.0% 2.0% 1.7%

Other ................................................................................... (1.0%) (1.0%) (0.8%)

Effective tax rate ................................................................. 36.0% 36.0% 35.9%

10-K