Audi 2015 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

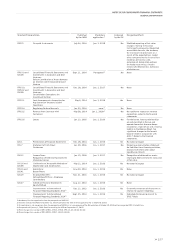

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

RECOGNITION AND MEASUREMENT PRINCIPLES

232 >>

RECOGNITION AND

MEASUREMENT PRINCIPLES

/RECOGNITION OF INCOME AND EXPENSES

Revenue, interest income and other operating income are

always recorded when the services are rendered or the goods

or products are delivered, i.e. when the risk and reward is

transferred to the customer. Revenue is reported after the

deduction of any discounts.

No revenue is initially realized from the sale of vehicles subject

to buy-back agreements. The difference between the selling

price and the expected buy-back price is recognized on a

straight-line basis over the period between sale and buy-back.

Vehicles that are still included in the accounts are reported

under inventories.

Where additional services have been contractually agreed with

the customer in addition to the sale of a vehicle, such as warranty

extensions, mobile services or the completion of maintenance

work over a fixed period, the related revenues and expenses

are recorded in the Income Statement in accordance with the

provisions of IAS 18 governing arrangements with multiple

deliverables based on the economic content of the individual

contractual components (partial services).

Operating expenses are recognized in profit or loss when the

service is used or at the time they are economically incurred.

/INTANGIBLE ASSETS

Intangible assets acquired for consideration are recognized at

their cost of purchase, taking into account ancillary costs and

cost reductions, and are amortized on a scheduled straight-line

basis over their useful life.

Concessions, rights and licenses relate to purchased software,

rights of use and subsidies paid.

Goodwill from a business combination has an indefinite useful

life and is subject to regular impairment testing.

Brand names from business combinations generally have an

indefinite useful life and are therefore not amortized. An in-

definite useful life frequently arises from the continued use

and maintenance of a brand. Brand names are tested regularly

for impairment.

Research costs are treated as current expenses in accordance

with IAS 38. The development expenditure for products going

into series production is recognized as an intangible asset,

provided that the sale of these products is likely to bring eco-

nomic benefit to the Audi Group. If the conditions stated in

IAS 38 for capitalization are not met, the costs are expensed in

the Income Statement in the year in which they occur.

Capitalized development costs encompass all direct and indirect

costs that can be directly allocated to the development process.

Capitalized development costs are amortized on a straight-line

basis from the start of production over the anticipated model

life of the developed products.

Depreciation, allocated to the corresponding functional areas,

is primarily based on the following useful lives, which are

reassessed yearly:

Useful life

Concessions, industrial property rights and similar

rights and assets 3–15 years

of which software 3 years

of which customer base 2–8 years

Capitalized development costs 4-9 years

/PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are measured at cost of pur-

chase or construction, with straight-line depreciation applied

pro rata temporis over the expected useful life.

The costs of purchase include the purchase price, ancillary

costs and cost reductions.

In the case of self-constructed fixed assets, the cost of con-

struction includes both the directly attributable material and

labor costs as well as indirect material and indirect labor costs

that must be capitalized, including pro rata depreciation.