Audi 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL PERFORMANCE INDICATORS

FINANCIAL PERFORMANCE

166 >>

higher marketing costs resulted in distribution costs amount-

ing to EUR 5,782 (4,895) million. Exchange rate effects also

inflated distribution costs.

Administrative expenses rose to EUR 640 (587) million as a

result of the general growth of the Audi Group.

The other operating result came to EUR −119 (1,260) million.

This decrease is primarily attributable to significantly higher

expenditure for the settlement of foreign currency hedges,

which offset the positive exchange rate effects in revenue.

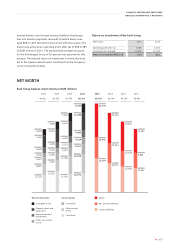

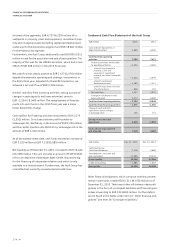

Operating profit of the Audi Group

EUR million 2015 2014

Operating profit before

special items 5,134 5,150

Special items − 298 −

Operating profit 4,836 5,150

The Audi Group achieved an operating profit of EUR 4,836

(5,150) million for the 2015 fiscal year. Before special items,

we achieved an operating profit of EUR 5,134 (5,150) million.

Special items amounting to EUR 228 million resulted from the

diesel issue concerning the V6 3.0 TDI. This includes financial

expenditure for technical measures, sales measures and legal

risks. The four-cylinder TDI engines affected do not have direct

influence on the financial performance of the Audi Group in

view of existing agreements with Volkswagen AG. The special

items also include expenditure amounting to EUR 70 million in

connection with the precautionary recall of vehicles fitted with

airbags made by the Japanese manufacturer Takata. Further

information on the diesel issue and the airbag recall is provid-

ed on pages 145 ff. under the management’s overall assess-

ment.

In the Automotive segment, we achieved an operating profit of

EUR 4,804 (5,127) million. We were able to benefit here from

an increase in deliveries to customers. Nevertheless, there were

also effects resulting from regional distribution and more

intense competition. The currency environment had a positive

effect overall on the development of operating profit for the

Automotive segment. We addressed the continued high

upfront expenditures for new models and innovative technol-

ogies as well as the ongoing expansion of our worldwide

production network by intensifying our efforts to optimize

processes and costs along the entire value chain.

In the Motorcycles segment, the higher delivery volume as well

as exchange rate effects had a beneficial impact on operating

profit. Considering mix effects and expenses for launching new

models, the operating profit reached EUR 31 (23) million.

After adjustment for the effects of subsequent measurement

in connection with the purchase price allocation, operating

profit came to EUR 54 (48) million.

The financial result of the Audi Group declined to EUR 448 (841)

million in the past fiscal year mainly due to a lower result from

the measurement of derivative financial instruments. The result

from participations including equity-accounted investments,

which contributes towards the financial result, almost matched

the previous year’s figure. It also includes a share of the in-

come of the associated company FAW-Volkswagen Automotive

Company, Ltd., Changchun (China), which was maintained at

the previous year’s level despite a challenging market situation

in China.

The profit before tax of the Audi Group for the 2015 fiscal

year totaled EUR 5,284 (5,991) million. After deduction of

income tax expense, the Company generated a profit of

EUR 4,297 (4,428) million.

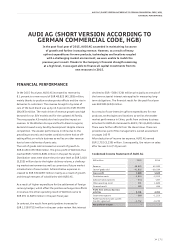

Key earnings figures of the Audi Group

in % 2015 2014

Operating return on sales before

special items 8.8 9.6

Operating return on sales 8.3 9.6

Automotive segment 8.3 9.6

Motorcycles segment 4.5 4.0

Adjusted for PPA effects 1) 7.8 8.4

Return on sales before tax 9.0 11.1

1) Effects of purchase price allocation

With investment spending remaining at a high level, the Audi

Group achieved an operating return on sales of 8.3 (9.6)

percent in the 2015 fiscal year. Before special items, the

operating return on sales came to 8.8 (9.6) percent. We

consequently again reached an operating return on sales

within our strategic target corridor of 8 to 10 percent in 2015.

To build on our strong brand position, we prepared and carried

out the gradual market introduction of numerous volume mod-

els in the past fiscal year. These make up around 40 percent of

deliveries worldwide. The return on sales before tax was

9.0 (11.1) percent.

Return on investment (ROI) reached 19.4 (23.2) percent. We

therefore clearly exceeded our minimum required rate of return

of 9 percent of invested assets. The invested assets figure is

calculated from operating assets (property, plant and equip-

ment, intangible assets, investment property, inventories and