Audi 2015 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT ON EXPECTED DEVELOPMENTS, RISKS AND OPPORTUNITIES

REPORT ON EXPECTED DEVELOPMENTS // REPORT ON RISKS AND OPPORTUNITIES

>> 189

// CAPITAL INVESTMENTS

The Audi Group will continue to invest in the future and in addi-

tional growth in 2016. The Company plans capital investments

of more than EUR 3 billion in property, plant and equipment.

The German locations Ingolstadt and Neckarsulm are to account

for around half of the investment volume. The ratio of capex

(investments in property, plant and equipment, investment

property and other intangible assets, without capitalized de-

velopment costs) should lie within the strategic target corridor

of 5.0 to 5.5 percent of revenue.

The focus is mainly on investment in new models and future

technologies – in the areas of digitalization and alternative

drive technologies, for example – and the expansion of the

worldwide production network. From 2016, for instance, we

will be building the successor version of the Audi Q5 at the new

plant in Mexico, and the additional car line of the Audi Q2 in

Ingolstadt. The volume production of our first all-electric-drive

SUV will commence at the Brussels site in 2018. The overall

product portfolio of the Audi brand will grow to 60 different

models by 2020. The overriding aim of the measures in our

investment program is to further consolidate and steadily

improve the strong position of the Audi brand.

We will continue to optimize costs and processes to give our-

selves the necessary leeway for future investment projects.

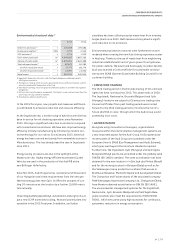

Anticipated development in the key performance indicators of the Audi Group

Forecast for 2016

Deliveries of cars of the Audi brand to customers moderate increase

Revenue moderate increase

Operating profit/operating return on sales within the strategic target corridor of 8 to 10 percent

Return on investment (ROI) between 16 and 18 percent and therefore significantly

above the minimum rate of return of 9 percent

Net cash flow between EUR 2.0 and 2.5 billion

Ratio of capex within the strategic target corridor of 5.0 to 5.5 percent

REPORT ON RISKS AND

OPPORTUNITIES

/THE RISK MANAGEMENT SYSTEM IN

THE AUDI GROUP

// OPERATING PRINCIPLE OF THE RISK

MANAGEMENT SYSTEM

The Audi Group bears economic, ecological and social respon-

sibility towards its stakeholders. This principle is enshrined in

its corporate guidelines and corporate culture. In our under-

standing, the objective is the value-oriented, sustained devel-

opment of our Company. As an automotive group with global

operations, we are exposed to a dynamic environment and as

such are continually confronted with a wide variety of oppor-

tunities and risks. The Audi Group seeks to maintain construc-

tive dialogue when addressing opportunities and risks in order

to ensure the continuing success of its entrepreneurial activities.

Apart from meeting statutory requirements, the particular

purpose of an effective Risk Management System and Internal

Control System (RMS/ICS) is to validate the entrepreneurial

goals and long-term viability and competitiveness of our Com-

pany. Hand in hand with refining our risk management organi-

zation, we seek to steadily improve the risk culture in particular.

In that way, we want to create transparency regarding poten-

tial risks and optimize the controllability of risks.

The Audi Group formulates and pursues ambitious corporate

goals based on conscientious risk/return analyses. These are

synchronized both Company-wide and with the Volkswagen

Group. They express the risk propensity of the Audi Group.

The Risk Management System of the Audi Group is based on

the internationally recognized standard of the Committee of

Sponsoring Organizations of the Treadway Commission (COSO).