Audi 2015 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

GENERAL INFORMATION

>> 229

The risk provisioning takes account of the accountabilities as

clarified within the Volkswagen Group. In connection with the

four-cylinder TDI engine issue, Volkswagen AG has confirmed

to AUDI AG that, on the basis of existing agreements, AUDI AG

has a corresponding entitlement to compensation and that

Volkswagen AG will release AUDI AG in particular from the

direct and indirect expenses arising in this connection, includ-

ing those for legal risks. In addition, AUDI AG has concluded

an agreement with Volkswagen AG on the V6 3.0 TDI engine

issue in the event that the U.S. authorities, U.S. courts and

potential out-of-court settlements do not differentiate between

the four-cylinder TDI engine issue for which Volkswagen AG is

accountable and the V6 3.0 TDI engine issue of AUDI AG, and

that joint and several liability thus arises. In that eventuality,

costs for legal risks will be passed on to AUDI AG according to

a causation-based cost allocation. In view of this arrangement

with Volkswagen AG and the relatively low costs of the tech-

nical measures planned by AUDI AG to rectify the AECD issue for

the V6 3.0 TDI, in all probability the share of costs allocable to

AUDI AG will have no material effect on the present and future

net worth, financial position and financial performance of the

Audi Group.

Nor are any facts currently known to the incumbent Board of

Management which would imply that the Consolidated Finan-

cial Statements for 2014 were materially incorrect if individual

Board of Management members responsible for them pos-

sessed knowledge of the matter earlier, or that the compara-

tive figures for 2014 would correspondingly need to be

changed. However if, in the course of further investigations,

new findings should come to light that indicate that individual

members of the Board of Management at that time were

aware of the diesel issue earlier, this could potentially have an

effect on the Consolidated Financial Statements for the 2015

fiscal year and the comparative figures for 2014.

/NOTES ON THE AIRBAG RECALL

Audi, along with other automotive manufacturers, has been

informed by the U.S. National Highway Traffic Safety Admin-

istration (NHTSA) that certain front airbags (driver’s side) made

by the Japanese airbag manufacturer Takata might be faulty.

On the advice of NHTSA, the Audi Group will recall 170,000

vehicles of the model years 2005 to 2013 as a precaution.

A provision was created for this in the 2015 fiscal year.

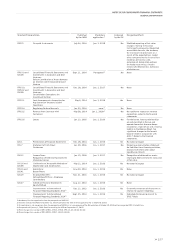

/CONSOLIDATED COMPANIES

In addition to AUDI AG, all of the material domestic and foreign

subsidiaries are included in the Consolidated Financial Statements

in cases where AUDI AG has direct or indirect decision-making

power over the relevant activities, thereby influencing its own

variable returns. The inclusion in the group of consolidated

companies begins or ends on the date on which the control is

acquired or lost.

Special securities funds are also included in the Audi Group’s

Consolidated Financial Statements. These structured entities

pursuant to IFRS 12 do not present any special risks or result

in any particular obligations for Audi.

Companies in which AUDI AG does not hold any interests,

either directly or indirectly, are included in the Consolidated

Financial Statements. As a result of contractual agreements,

however, AUDI AG exerts control. Non-controlling interests in

equity and in profit are allocated to the following companies

on a 100 percent basis in each case.

Company Non-controlling interests

Audi Canada Inc., Ajax (Canada) Volkswagen Group Canada, Inc.,

Ajax (Canada)

Audi of America, LLC, Herndon (USA) VOLKSWAGEN GROUP OF

AMERICA, INC., Herndon (USA)

Automobili Lamborghini America,

LLC, Herndon (USA)

VOLKSWAGEN GROUP OF

AMERICA, INC., Herndon (USA)

Further information on non-controlling interests is provided in

Note 25.

Subsidiaries with limited business operations that are of sub-

ordinate importance, both individually and in total, with regard

to providing a true and fair view of the net worth, financial

position and financial performance and cash flow are not con-

solidated. Before consolidation, these subsidiaries account for

0.6 (0.8) percent of consolidated equity, 0.4 (0.4) percent of

profit after tax, and 0.5 (0.6) percent of the Audi Group’s total

assets. Associated companies and joint ventures with only

limited business operations are also not consolidated using

the equity method for reasons of materiality.

Subsidiaries, associated companies and joint ventures that are

not fully consolidated or consolidated using the equity method,

as well as financial participations, are as a general rule reported

at amortized cost. Where there is evidence that the fair value

is lower, this fair value is recognized.

The group of consolidated companies was extended on Decem-

ber 31, 2014 to include the established Audi Luxembourg S.A.

(Luxembourg). Also during the fiscal year, A-K Projekt Éplog Kft.,

Győr (Hungary), Audi Akademie Hungaria Kft., Győr (Hungary),

and Audi Real Estate S.L., El Prat de Llobregat (Spain), were

merged into the Group. These integrated companies are imma-

terial subsidiaries.

The Audi Group does not wholly own PSW automotive engi-

neering GmbH, Gaimersheim. However, given that in business

terms Audi also bears the risks and has access to the economic