Audi 2015 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT ON EXPECTED DEVELOPMENTS, RISKS AND OPPORTUNITIES

REPORT ON RISKS AND OPPORTUNITIES

190 >>

Within each scope of responsibilities, risks are to be identified,

evaluated, appropriately managed and monitored. Furthermore,

transparent, accurate, timely communication up the chain of

command to the appropriate internal business units and Group

functionalities is required. All organizational levels are to be

integrated into the Risk Management System. The inclusion of

Group, brand, corporate and divisional levels also meets statu-

tory requirements. Changes in the legal framework with respect

to risk management are continually observed and are acted on

promptly where relevant for the Company. The integration of all

principal subsidiaries is currently already ensured. New compa-

nies are integrated promptly.

The Risk Management System and Internal Control System is

closely interlocked with the compliance functionality (central

governance, risk & compliance organization/central GRC organ-

ization) as part of an integrated and inclusive management ap-

proach. The Board of Management and the Audit Committee of

the Supervisory Board are kept regularly informed about the

Risk Management System and Internal Control System as well

as the Compliance Management System in a combined report.

The central task of risk management is to identify and analyze

risks, then systematically render them transparent and improve

their controllability using suitable risk management tools. This

process also creates scope for generating and exploiting oppor-

tunities. Using the COSO framework, risk-appropriate internal

controls are defined and performed along the entire value chain

(Internal Control System). So that suitable measures and

controls can be implemented early on, cross-disciplinary topics

and activities in particular are examined for risk potential both

continually and ad hoc.

The Audi Group promotes the ongoing development of the Risk

Management System through cross-divisional and cross-company

projects. One of the priorities here is to interlink the system

closely with financial corporate planning and management,

accounting and insurance management. In view of its high

strategic relevance, the regulatory framework for the Risk

Management System and Internal Control System is firmly

established both in an internal Board Directive of AUDI AG and

at the subsidiaries.

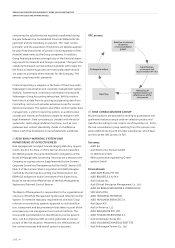

For the systemic design of its risk management architecture,

the Audi Group adopts the “Three Lines of Defense” model – a

recommendation of the European Confederation of Institutes

of Internal Auditing (ECIIA). The Risk Management System

and Internal Control System of the Audi Group consequently

features three lines of defense that are intended to protect the

Company against the occurrence of material risks.

The “Three Lines of Defense” model

The individual risk owners of the AUDI AG divisions and subsid-

iaries are responsible for the operational management of risks

and their control, as well as for reporting on them. They repre-

sent the first line of defense. Controlling maintains a constant

dialogue with the individual departments of the Company

throughout. This ensures that the financial impacts are

continuously taken into account in corporate planning and

management.

In the second line of defense, the central GRC organization

takes charge of the fundamental functionality of the Risk

Management System and Internal Control System as well as

the compliance management system. The core activities of

Central Risk Management involve monitoring system perfor-

mance and submitting an aggregated report on the risk situa-

tion to the Board of Management and the Audit Committee of

the Supervisory Board (GRC Annual Report). This ensures that

the statutory requirements for the early identification of risks

and the effectiveness of the Risk Management System and

Internal Control System are met. In addition, Central Risk

Management handles the Group-wide ongoing development of

risk management governance and tools. These include direc-

tives and standards, as well as methods and processes that are

adapted to the scale of the individual company. In addition,

consultancy on operational risk management is available for

the divisions and subsidiaries. Regular training courses and

fact-finding events are held to lastingly reinforce awareness of

risk management and compliance as well as promote a posi-

tive risk culture in the Audi Group. AUDI AG also has risk com-

Supervisory Board

Board of Management

First

line of defense

Third

line of defense

Second

line of defense

Operational risk

management

Coordination

of GRC control

process, risk and

compliance program

Audit of

RMS/ICS

Reports on risk

management Reporting through

GRC Annual Report Audit reports

on RMS/ICS

Divisions Central GRC

organization Internal Audit