Audi 2015 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT ON EXPECTED DEVELOPMENTS, RISKS AND OPPORTUNITIES

REPORT ON EXPECTED DEVELOPMENTS

>> 187

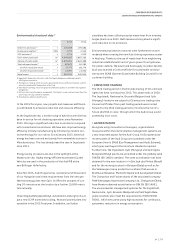

Sales of passenger cars and light commercial vehicles in the

United States will grow more slowly than in the previous year

as the market shows signs of saturation, with only slight

growth. For South America, we expect there to be a slight drop

in demand for passenger cars and light commercial vehicles.

Falling demand in Brazil is expected to be a major factor in this

development.

The Asia-Pacific region should again be a major driver of the

rise in worldwide demand for cars in 2016. With China’s vehi-

cle density still comparatively low, the growth trend for new

registrations there should continue, but less dynamically than

in the previous year. On the other hand, we expect demand for

passenger cars in Japan to fall.

// MOTORCYCLE MARKET

Demand in the motorcycle markets above 500 cc that are of

relevance for the Ducati brand should again rise moderately in

2016. The slight revival in economic development as a whole

should benefit new registrations of motorcycles in the estab-

lished markets. In emerging markets, we expect weaker growth

overall than in recent years primarily due to the economic

development in China, Brazil, Russia and South Africa. However,

rising demand for high-displacement motorcycles should have

a positive impact there.

/OVERALL ASSESSMENT OF THE ANTICIPATED

DEVELOPMENT OF THE AUDI GROUP

Our assessments for the 2016 fiscal year are based on our

expectations with regard to how the economy as a whole and

the car market will develop. We assume that the upward trend

will continue, while acknowledging that the individual regions

will present a mixed picture. In addition, numerous geopoliti-

cal trouble spots and the high volatility of financial markets

complicate the task of forecasting economic developments.

In addition to these areas of uncertainty, various develop-

ments are making a lasting impact on the automotive industry.

For example, competition is becoming increasingly intense,

especially in major sales markets. Tougher CO2 requirements

worldwide will accelerate the trend toward alternative drive

concepts. The growing prominence of connectivity and digitali-

zation in our society is opening up new, far-reaching potential

for the automotive industry. This calls for the cross-industry

development of existing business models and new, innovative

mobility concepts. In this context, we need to be mindful of the

entry of new competitors into the mobility business and related

services, some of them crossing over from other industries.

Bearing in mind our strategic objectives, value-oriented corpo-

rate management is of key importance for the Audi Group.

To safeguard and build on our strong competitive position

worldwide, we are constantly developing and implementing a

succession of targeted measures. For instance, the Audi Group

continues to invest heavily in strategic future topics, in the

broadening of its product portfolio and in the expansion of the

international manufacturing network. All in all, the Board of

Management considers the Company to be well-placed to

continue successfully addressing upcoming challenges and to

maintain its course of qualitative growth.

The following forecasts for the key performance indicators are

subject to various risks and opportunities which could result in

the actual development in the key performance indicators

deviating from the forecast. We present the principal risks and

opportunities in the Report on risks and opportunities.

The effects from the diesel issue are reflected and presented in

the 2015 Annual Financial Statements under our forecast for

the 2016 fiscal year, as well as in the Report on risks and op-

portunities based on current assessments.

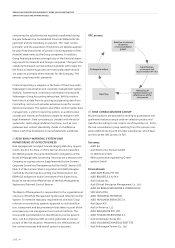

// ANTICIPATED DEVELOPMENT OF DELIVERIES

In the 2015 fiscal year, the Audi Group delivered over 1.8 million

vehicles of the Audi brand to customers worldwide, again

establishing record new registrations for the brand with the

Four Rings in a large number of individual markets. In 2016,

we want to continue our worldwide growth and, assuming a

stable environment, expect to see a moderate rise in deliveries

to customers by the Audi brand. We should therefore also suc-

ceed in outperforming the market as a whole.

Especially in key markets, we are planning to increase our market

shares or consolidate our competitive position.

Our objective for Western Europe in 2016 therefore is to develop

better than the market overall and increase customer deliveries

of our core brand.

In the Central and Eastern Europe region, vehicle sales of the

Audi brand are also expected to be up on the prior-year level.

We also aim to maintain our course of growth in North America,

and especially in the U.S. car market. We believe we will be

able to outperform the market overall in the United States in

2016.