Audi 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

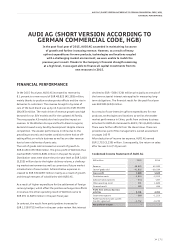

FINANCIAL PERFORMANCE INDICATORS

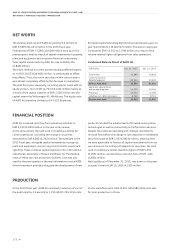

FINANCIAL POSITION

>> 169

FINANCIAL POSITION

/PRINCIPLES AND GOALS OF

FINANCIAL MANAGEMENT

The Audi Group is integrated into the financial management

of the Volkswagen Group, which concerns itself with such

matters as liquidity management and the management of

exchange rate and commodity price risks. The management of

financial risks within the Audi Group is organizationally a mat-

ter for the Treasury area, which handles these centrally for all

Audi Group companies on the basis of internal guidelines and

risk parameters.

The overriding financial goal is to ensure the solvency and

financing of the Audi Group at all times, while at the same

time achieving a suitable return on the investment of surplus

liquidity. To that end, payment streams are identified in a multi-

stage liquidity planning process and consolidated at Audi Group

level. The main companies of the Audi Group are included in

the cash pooling of the Volkswagen Group. This permits the

efficient handling of intragroup and external transactions,

and also reduces transaction costs for the Audi Group.

As a globally active company, the Audi Group also manages

exchange rate and commodity price risks. Exchange rate risks

are minimized by natural hedging, along with foreign currency

hedging transactions with matching currencies and maturities.

The goal here is to hedge planned payment streams in particu-

lar from investment, production and sales planning. In the

area of commodity price risks, the Audi Group pursues the goal

of achieving price stability for product costing purposes by

concluding long-term agreements and hedging transactions

that involve derivative financial instruments, as well as by

making use of synergies with the Volkswagen Group.

Credit and country risks are managed centrally by Volkswagen

Group Treasury. A diversification strategy is applied and con-

tracting partners are evaluated to counter the risk of losses or

defaults.

Through its partnership with Volkswagen Financial Services AG,

Braunschweig, the Audi Group enables its customers to make

use of borrowing and leasing arrangements. The Audi Group

consequently sets up hedging arrangements with the retailer

or partner company to guard against fluctuations in residual

values.

Further information can be found in the “Report on

risks and opportunities” on pages 189 ff. as well as

in the Notes under item 36 “Management of finan-

cial risks” on pages 267 ff.

/FINANCIAL SITUATION

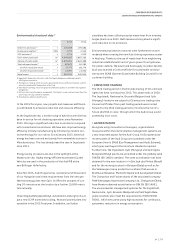

Cash flow from operating activities of the Audi Group amounted

to EUR 7,203 (7,421) million in the past fiscal year.

The cash outflow for investing activities attributable to operat-

ing activities came to EUR 5,576 (4,450) million for the 2015

fiscal year.

The greater part of this amount, or EUR 3,534 (2,979) million,

was for investments in property, plant and equipment, invest-

ment property and other intangible assets (excluding capital-

ized development costs). This investment spending was in

particular for the expansion of our manufacturing structures

and the product range. The investment priorities for the 2015

fiscal year were the new model versions of the Audi A4 and

Audi Q7 as well as the construction of the new production sites

in Brazil and Mexico. The ratio of capex (investments in proper-

ty, plant and equipment, investment property and other intan-

gible assets, without capitalized development costs) in the

2015 fiscal year was 6.0 (5.5) percent.

In addition, investing activities in the past fiscal year included

capitalized development costs of EUR 1,262 (1,311) million.